India's Automotive Market Is Reaching an Inflection Point

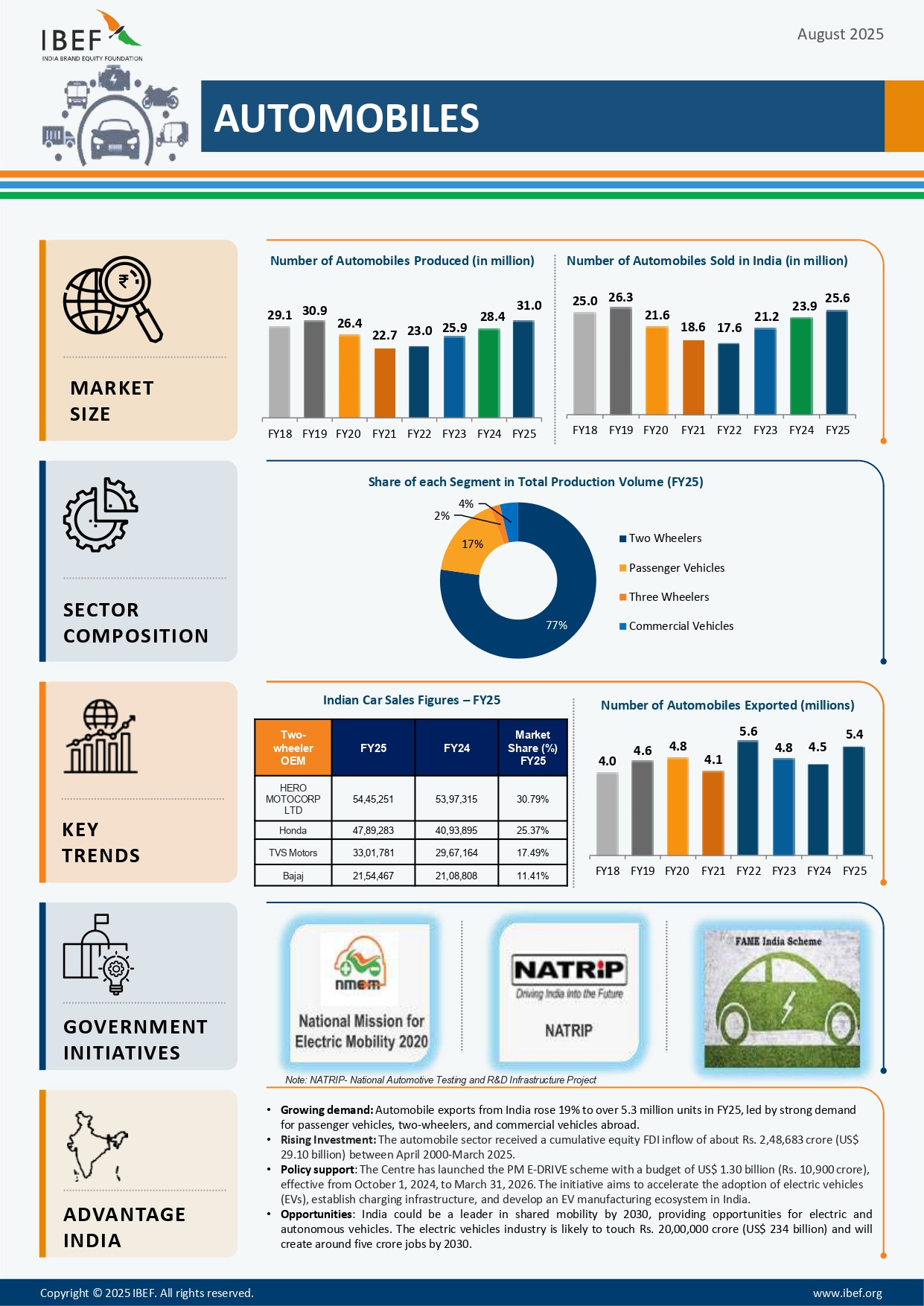

India's automotive sector is in the middle of a transformation that few industries experience. The used-car market isn't just growing—it's fundamentally reshaping how Indians buy, sell, service, and finance vehicles. And right now, one company is making a bold bet that vertical integration is the only way forward.

Spinny, the Gurugram-based online marketplace that's built itself into the dominant force in India's used-car space, just confirmed it's raising approximately

On the surface, this looks like a straightforward consolidation play. But dig deeper, and you're looking at the future blueprint for how Indian startups are building defensible, profitable businesses in a market that's finally maturing. We're talking about control across the entire value chain—from buying a used car, to reconditioning it, to servicing it years after the initial purchase. That's not a marketplace anymore. That's an ecosystem.

The funding round values Spinny at approximately $1.8 billion post-money, marking a holding pattern from its previous valuation. However, the composition of this round tells a fascinating story about investor appetite in India's startup ecosystem, the shifting dynamics between primary and secondary transactions, and why even well-funded startups are increasingly turning to acqui-hires and vertical integration to unlock growth.

Let's break down what's actually happening here, why it matters for the broader Indian economy, and what this consolidation means for competitors and consumers alike.

The Capital Structure: Who's Putting Money In (and Who's Taking It Out)

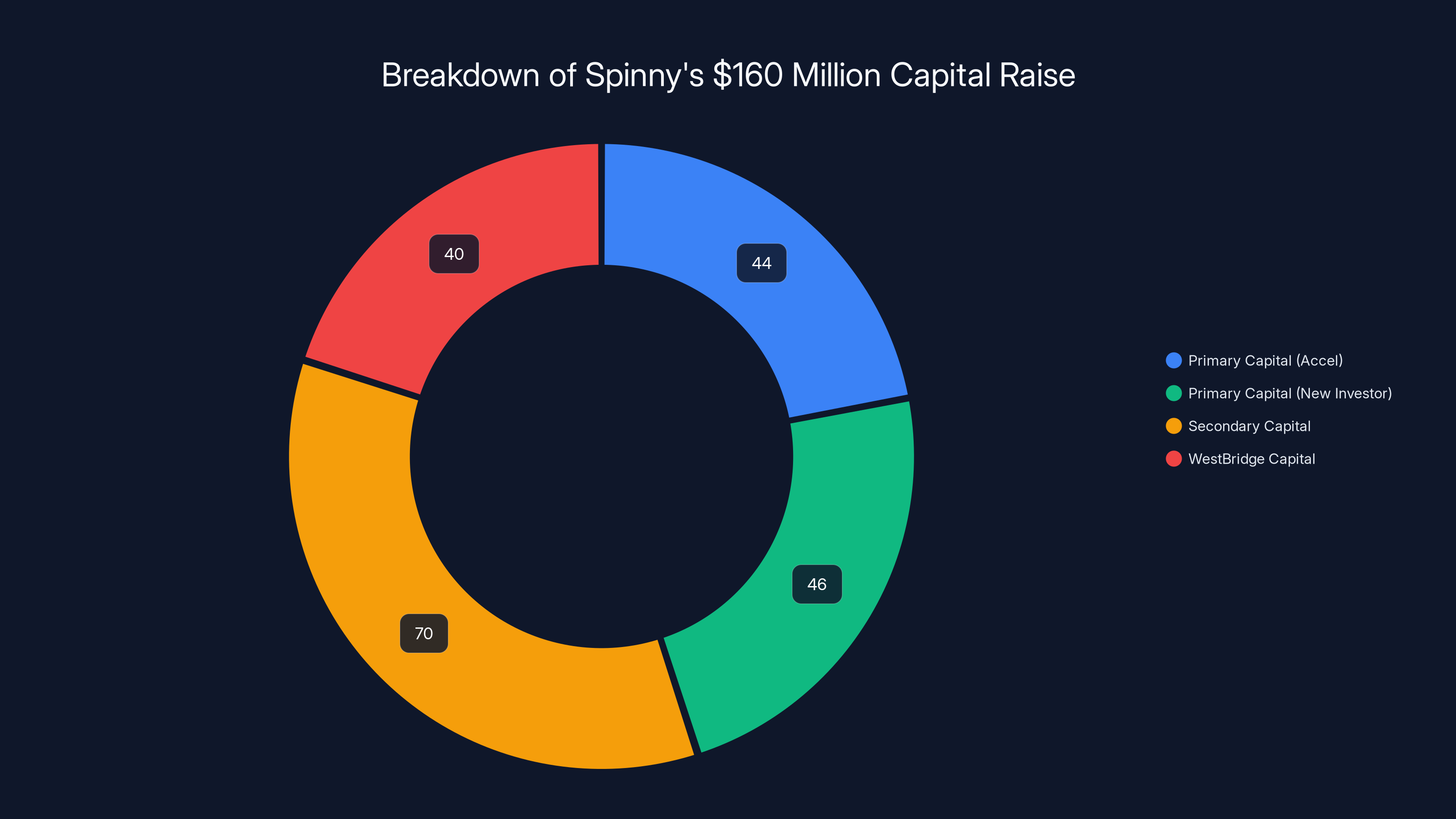

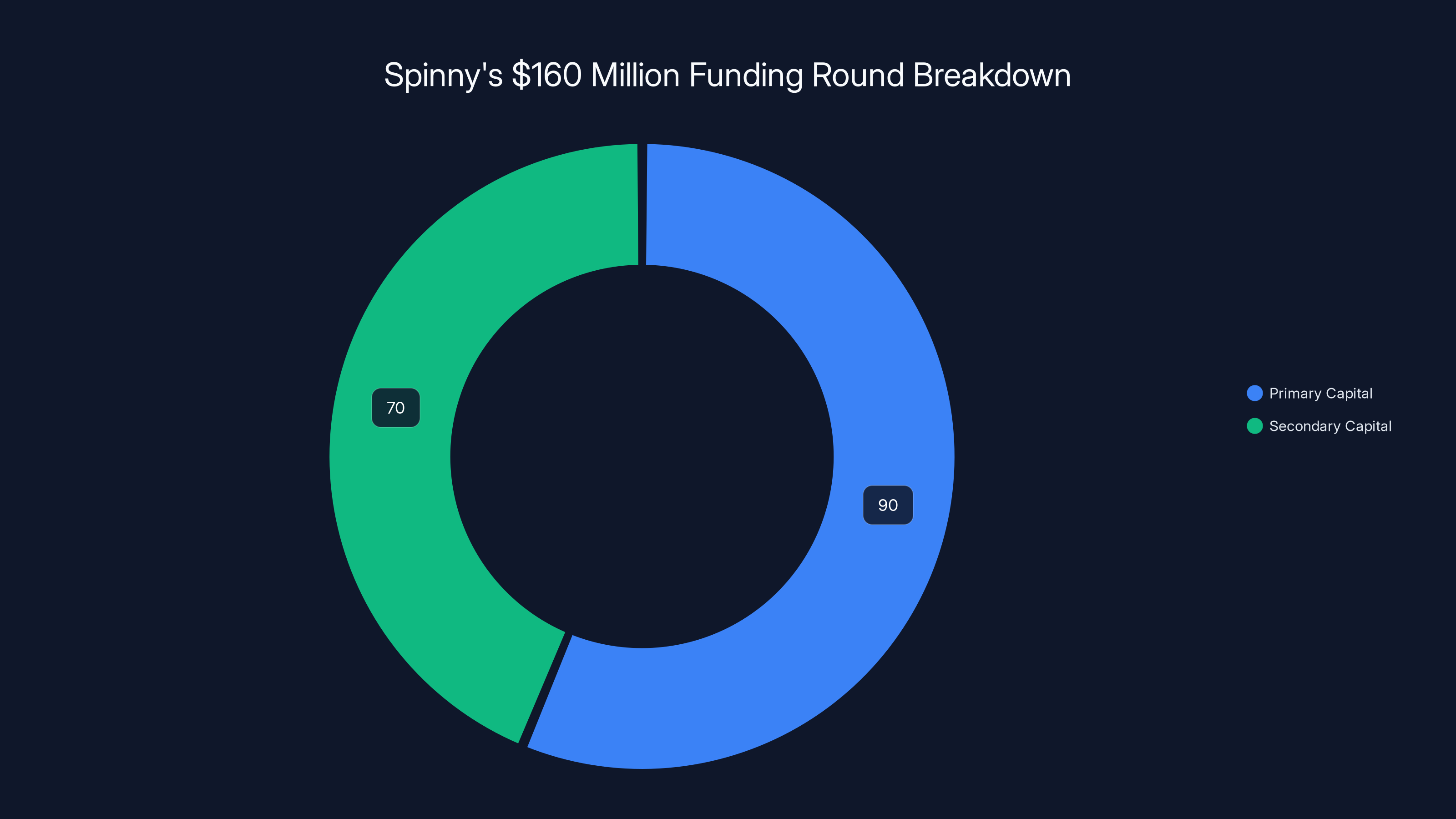

Breaking down the $160 million raise reveals a sophisticated, multi-layered transaction that's become increasingly common in India's late-stage startup ecosystem. This isn't a simple primary round where fresh capital flows into the company. Instead, it's a hybrid structure with important implications for how valuations and ownership stakes actually work.

Of the

The remaining approximately $46 million of the primary portion is coming from a new institutional investor whose identity hasn't been publicly disclosed yet. In India's startup ecosystem, mystery money usually means either a strategic corporate investor with specific business synergies, or an international fund making a calculated bet on the India thesis without announcing it immediately for competitive reasons.

Then there's West Bridge Capital, which doubled down with a check roughly similar in size to its Series F investment—somewhere in the $35-40 million range. For context, West Bridge first participated in Spinny's Series F round earlier in 2025, which itself was a phased deployment across multiple months. The fact that West Bridge is returning in Series G signals strong conviction about Spinny's Go Mechanic integration strategy and the used-car market's structural growth.

But here's where the transaction gets really interesting: the remaining $70 million consists of secondary transactions. This is where existing stakeholders are selling portions of their stakes to new or continuing investors. Fundamentum, an early institutional venture firm that's been holding Spinny shares, is reportedly selling a substantial portion of its stake. Blume Ventures, another major early investor, is also expected to pare back its holdings.

Secondary transactions often get overlooked, but they're incredibly important signals. When a VC firm like Fundamentum or Blume Ventures—which made these investments when Spinny was much earlier in its growth curve—decides to sell, it usually means one of three things: portfolio rebalancing, liquidity preferences as the fund itself faces redemption pressures, or a conviction shift about the company's near-term prospects.

In Spinny's case, the secondary activity is likely a combination of factors. Fundamentum and Blume may want to reinvest capital into earlier-stage opportunities where returns are typically higher. But they're also taking advantage of a market where later-stage investors like Accel and West Bridge are willing to pay for proven unit economics and market dominance.

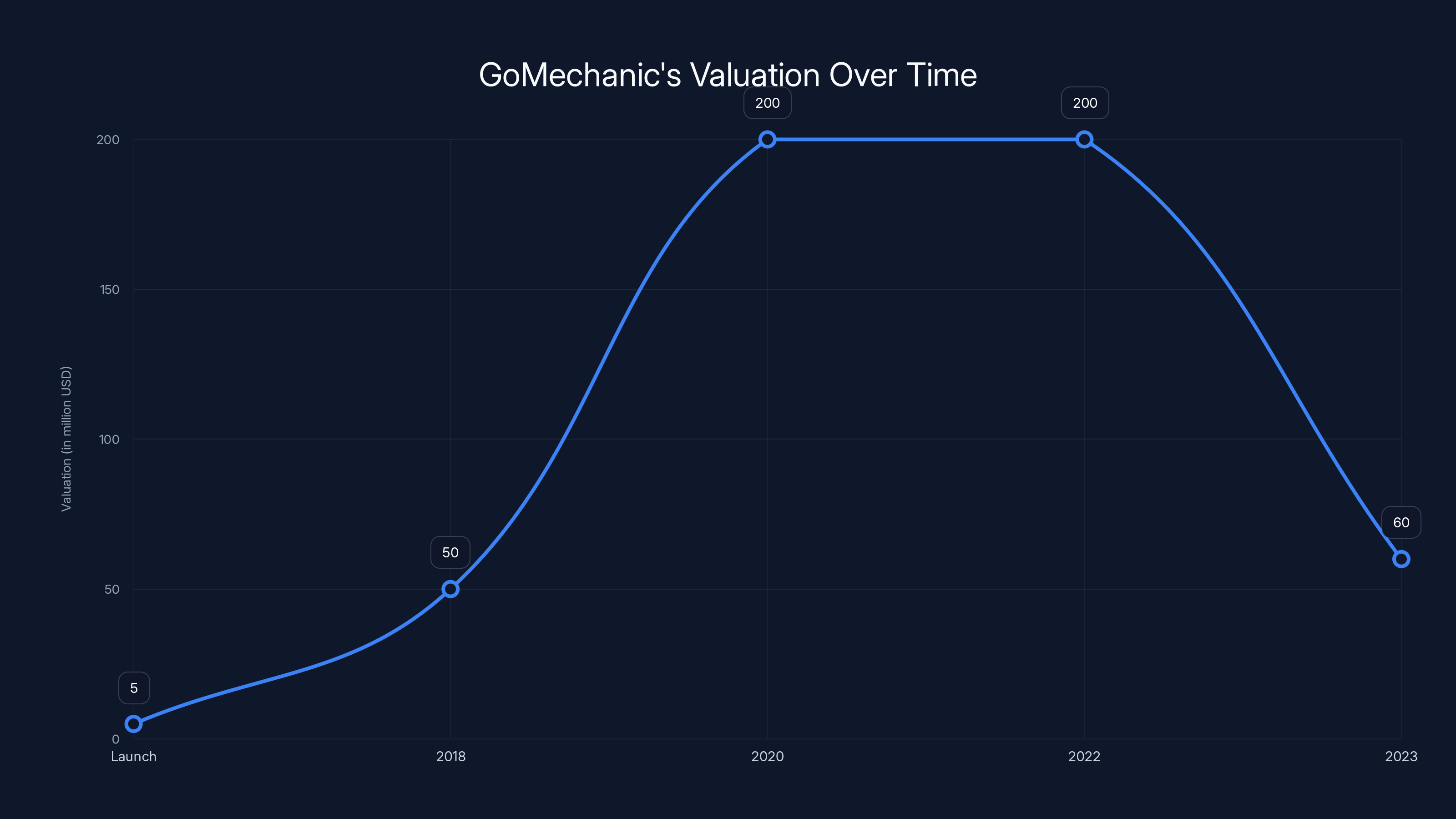

GoMechanic's valuation peaked at

Go Mechanic: From Unicorn Darling to Rescue Acquisition

To understand why this acquisition matters, you need to understand Go Mechanic's dramatic fall from grace. This is a founder story that became a cautionary tale, then evolved into an acquisition opportunity.

Go Mechanic launched as India's answer to the fragmented, unorganized car repair market. The founding team recognized something fundamental: most Indian car owners deal with sketchy local mechanics, inflated pricing, poor quality assurance, and zero digital transparency. Go Mechanic pitched a unified platform connecting customers with certified mechanics, transparent pricing, and quality guarantees through a network model.

The pitch worked. Sequoia Capital invested. Tiger Global jumped in. Soft Bank backed the company. Within a few years, Go Mechanic was valued at approximately $200 million and became part of India's elite group of well-funded automotive startups. The company was scaling rapidly, operating across major Indian cities, building brand recognition, and seemingly executing well on its market opportunity.

Then came the reckoning. In late 2023, Go Mechanic admitted to "grave errors" in its financial reporting. Specifically, the company had massively overstated metrics that investors use to evaluate business health—customer acquisition numbers, retention rates, revenue growth. The revelations triggered a collapse in the company's valuation. Investors who had poured capital into what they believed was a unicorn-in-the-making suddenly faced massive paper losses.

Sequoia, Tiger Global, and Soft Bank didn't take control of the company immediately. Instead, a consortium led by Lifelong Group, a healthcare and services company, acquired Go Mechanic in 2023 for a price that was never publicly disclosed but was reported in local media as being in the range of ₹4.5 billion to ₹6 billion (roughly $50-70 million at then-prevailing exchange rates). This was a fire sale compared to the company's peak valuation.

Lifelong Group's acquisition of Go Mechanic was a strategic one. The company saw value in Go Mechanic's brand, its network of partner mechanics, and its customer base—even if the accounting was broken and the unit economics were worse than anyone had believed. Lifelong operated in the healthcare space and saw car services as a natural extension of its broader services ecosystem.

But Lifelong is not a pure-play automotive company. It lacks the operational expertise to fix Go Mechanic's fundamental challenges: the fact that the car services market in India is extremely fragmented, margin-heavy with high customer acquisition costs, and deeply dependent on local network effects. A centralized player solving the "finding a good mechanic" problem requires both brand authority and significant operational scale to make the unit economics work.

Enter Spinny. The used-car marketplace has something Go Mechanic desperately needs: a captive customer base. Spinny sells approximately 13,000 used cars per month. Every single one of those customers needs post-sale servicing. Every single one of those cars will eventually need maintenance, repairs, and upkeep. These are customers that Spinny has already identified, acquired, and has a direct relationship with.

The Strategic Rationale: Vertical Integration as Competitive Moat

From Spinny's perspective, acquiring Go Mechanic makes mathematical sense, even if Go Mechanic's current profitability is questionable. It comes down to something called "vertical integration"—when a company expands to control multiple parts of the value chain rather than relying on external partners.

Let's walk through Spinny's current customer journey. A customer visits Spinny's website or app, browses used cars, finds one they like, completes the purchase, and drives away in a reconditioned vehicle. The recondition happens in Spinny's own facilities—Spinny has built large, modern reconditioning centers across major Indian cities where vehicles are inspected, repaired, cosmetically restored, and prepared for delivery.

But post-sale servicing? That's currently outsourced. Spinny directs customers to third-party service shops and independent mechanics for maintenance, repairs, and warranty work. This creates several problems for Spinny's business model:

First, the customer experience fractures. A customer buys a car from Spinny, then has to find a mechanic elsewhere. That mechanic is not trained on Spinny's standards. They don't have visibility into the car's history or Spinny's reconditioning process. If something goes wrong, it's unclear whether Spinny or the third-party shop is responsible.

Second, Spinny loses data and customer touchpoints. Every service visit is an opportunity to understand customer needs, collect feedback, and build loyalty. If a third party handles servicing, Spinny never sees this information.

Third, the unit economics are suboptimal. Spinny has to find customers, sell them cars, but then hand off the after-sale relationship to someone else. That's leaving money on the table. If Spinny owned the servicing relationship, it could upsell additional services, capture higher margins, and increase customer lifetime value.

With Go Mechanic, Spinny gains immediate operational capabilities in the services space. Yes, Go Mechanic's network will need to be cleaned up—removing underperforming or unprofitable service centers, consolidating duplicate locations, and aligning compensation to Spinny's quality standards. But the fundamental network exists.

More importantly, Go Mechanic becomes a "two-way funnel" as someone close to the deal explained. Spinny customers who buy cars get directed to Go Mechanic for services, creating a natural, low-CAC (customer acquisition cost) channel for Go Mechanic. But in the opposite direction, Go Mechanic becomes a discovery channel for potential Spinny customers. A person who uses Go Mechanic repeatedly and sees the quality of Spinny's reconditioned vehicles, combined with the convenience of buying and servicing in one ecosystem, may decide to sell their current car to Spinny and buy a newer used car through the platform.

This is particularly powerful because car owners who use services platforms are a qualified audience. They care about vehicle maintenance. They have disposal income. They're willing to pay for convenience and quality. In traditional marketing terms, these are hot leads with high conversion probability.

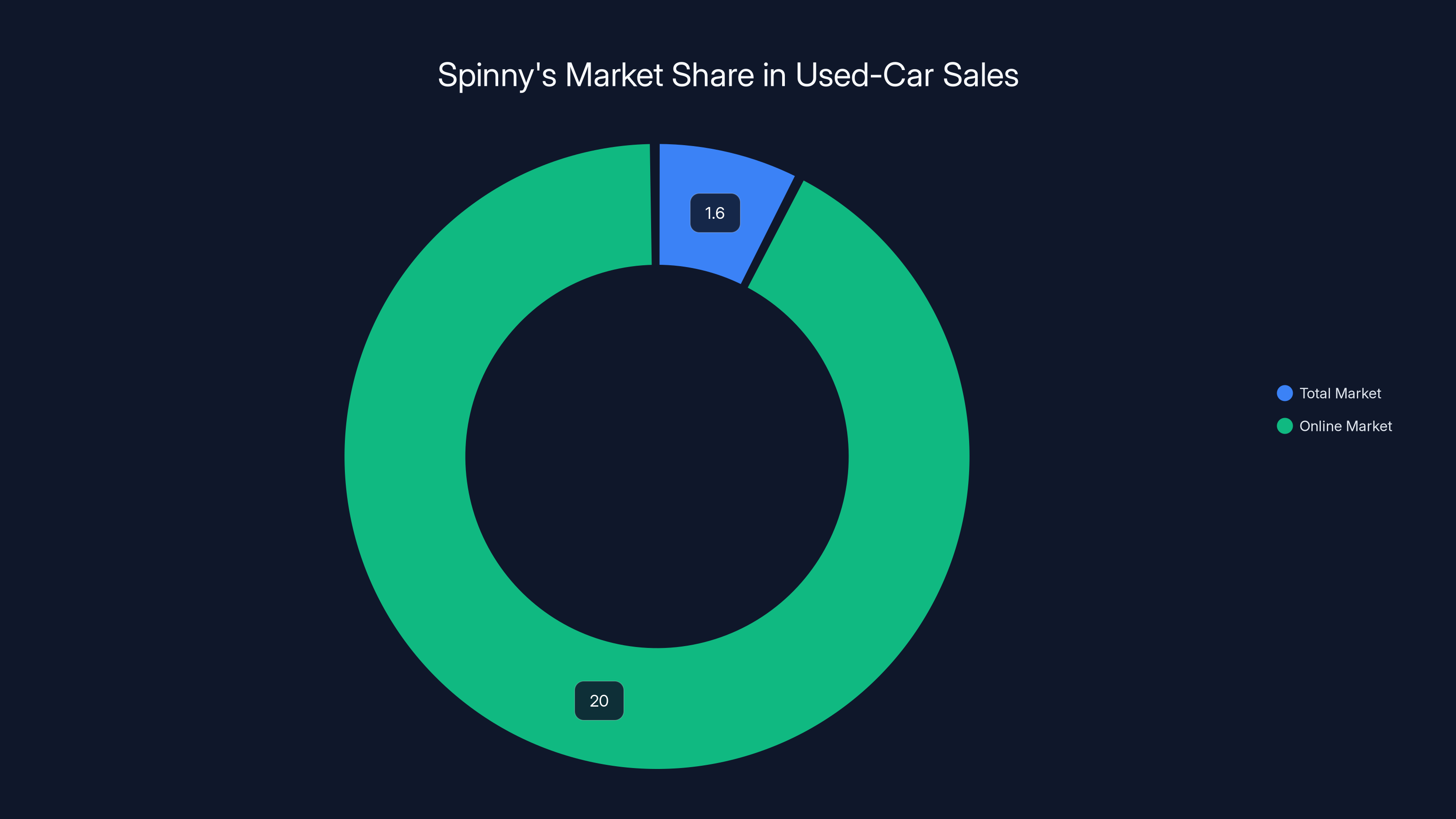

Spinny holds a 1.6% share in the total used-car market but commands a significant 15-25% share in the online segment, highlighting its strong digital presence. Estimated data.

Market Context: Why This Consolidation Matters Right Now

Timing matters in acquisitions. Spinny could have made this move two years ago. Why now?

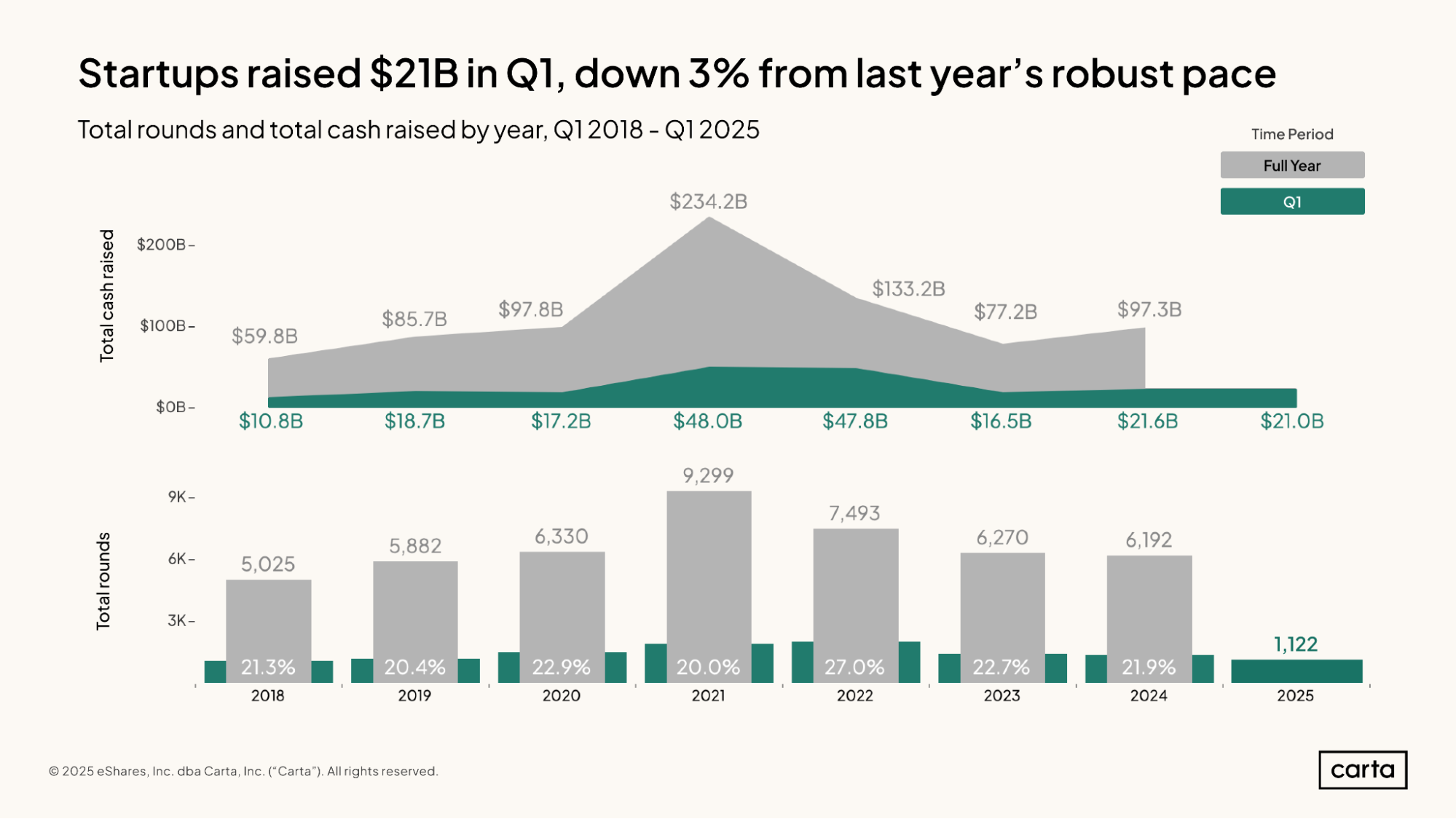

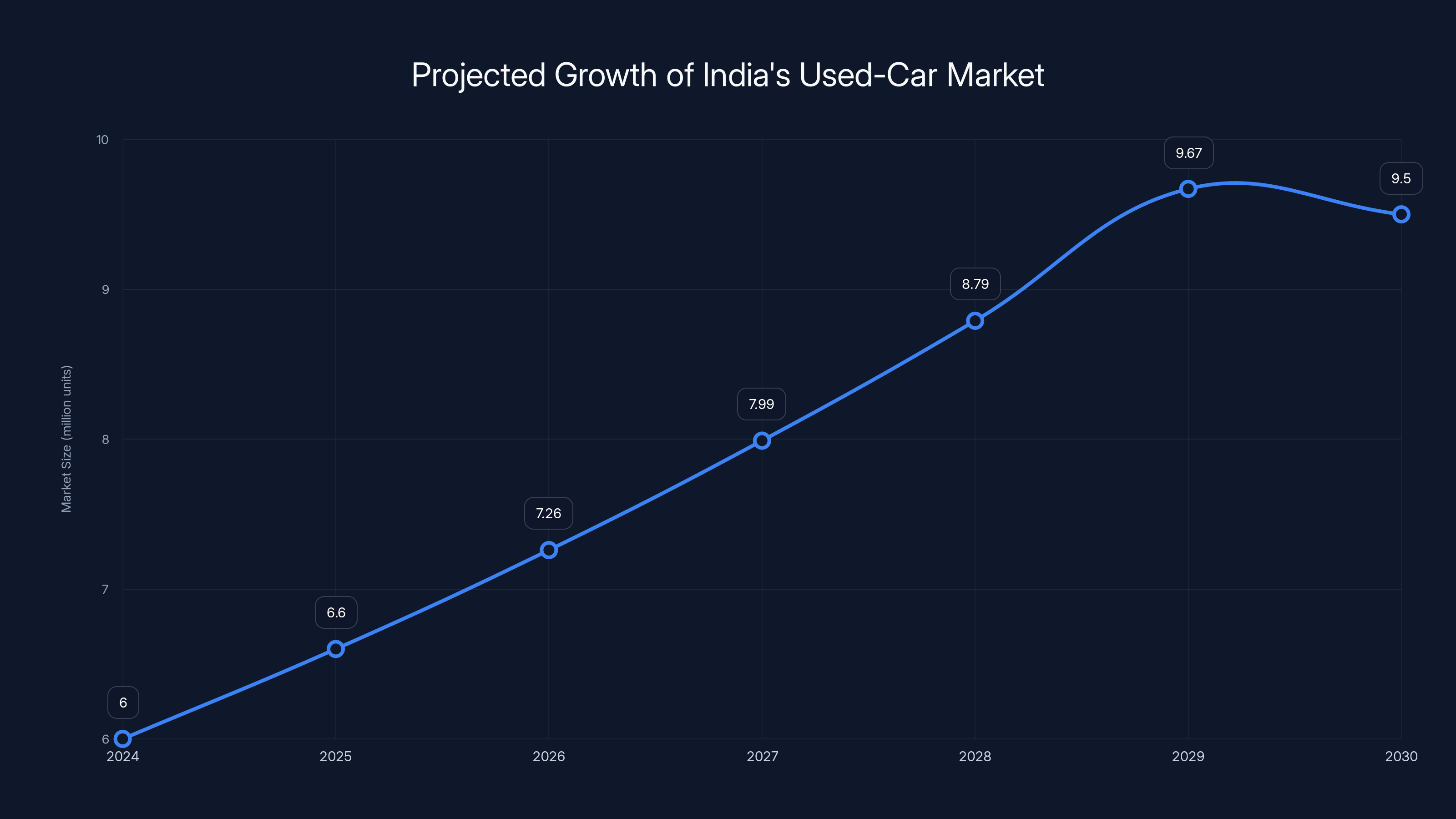

India's used-car market is projected to grow from approximately 6 million units in 2024 to roughly 9.5 million units by 2030. That's a compound annual growth rate of approximately 10% over six years. This is significant in an Indian economic context. It reflects rising incomes, increased replacement purchases among car owners, and the growth of lease-to-own models.

But growth alone doesn't necessitate consolidation. What matters is the structure of that growth and who captures the value. India's used-car market is currently highly fragmented. A majority of used-car transactions still happen offline, through local dealers, private transactions, or word-of-mouth networks. Spinny and competitors like Cars 24 have made dramatic progress digitizing this market, but online platforms still represent less than 20% of total used-car transactions nationally.

This fragmentation creates an opportunity. As digital adoption accelerates and consumers increasingly expect transparent pricing, inspection reports, and guaranteed quality, the platforms that can offer a complete ecosystem—not just finding cars, but also financing them, servicing them, and eventually trading them in or selling them—will capture disproportionate value.

Consider the customer lifecycle. An individual buys a used car through Spinny at age 32. Over the next 10 years, that customer needs maintenance every few months, major repairs occasionally, eventually decides to upgrade to a newer used car, sells the original car to a dealer (potentially Spinny's auction network), and repeats the cycle. If Spinny owns every touchpoint in this journey—sales, financing, services, remarketing—the customer lifetime value compounds dramatically.

West Bridge Capital and Accel understand this. They're not just betting on Spinny's ability to sell used cars at scale. They're betting on Spinny's ability to build an integrated automotive services company that will capture value across the entire spectrum of car ownership in India.

The Broader Portfolio Strategy: Beyond Used Cars

The Go Mechanic acquisition doesn't exist in isolation. It's part of a broader strategic push by Spinny to expand beyond its core used-car marketplace into adjacent services and financial products.

In the past 12 months alone, Spinny has made several significant moves:

Content and Brand Expansion: Spinny acquired Autocar India, Autocar Professional, and What Car? India from London-based media group Haymarket. These automotive publication brands carry significant authority in India. They're trusted sources for vehicle reviews, comparisons, and industry insights. For Spinny, this acquisition solves multiple problems. First, it gives the company its own media properties where it can publish content that drives organic traffic and SEO authority. Second, it creates advertising and sponsorship opportunities. Third, it positions Spinny as an authority in automotive information, not just a marketplace.

Financial Services: Spinny launched Spinny Capital, a non-banking financial company (NBFC) offering vehicle loans. This is critical. Most used-car purchases in India are financed through traditional bank loans or NBFC loans. By creating Spinny Capital, the company can now offer financing directly to customers purchasing through its marketplace, improving margins and customer experience. An NBFC also allows Spinny to collect financial data on customers, assess creditworthiness, and build a lending business that can be profitable at scale.

Services Integration: The Go Mechanic acquisition is the latest and most significant move in this direction.

When you step back, you see a company that's no longer trying to be a marketplace. Spinny is building an integrated automotive services company with ownership stakes across:

- Vehicle acquisition (used cars bought by consumers from dealers or other buyers, then sold through Spinny)

- Vehicle refurbishment (Spinny's own reconditioning centers)

- Vehicle financing (Spinny Capital)

- Vehicle servicing (Go Mechanic post-acquisition)

- Content and discovery (Autocar brands)

- Vehicle resale and auction (Spinny's B2B dealer network)

This is a fundamentally different business model than it was five years ago. Spinny started as Uber for used cars—a marketplace connecting buyers and sellers. It's evolving into more of an integrated automotive lifecycle company, something closer to how traditional car dealerships operate, but with technology-enabled efficiency and digital-native customer experience.

Financial Runway and the Primary vs. Secondary Split

Why does it matter that

If Spinny needed

This matters because integrating Go Mechanic is operationally complex. You need to:

- Retain key Go Mechanic personnel, which typically requires salary increases and retention bonuses

- Invest in systems integration—connecting Go Mechanic's platform to Spinny's infrastructure

- Upgrade Go Mechanic's operational standards to meet Spinny's quality expectations

- Consolidate duplicate locations and geographies

- Migrate customer data securely and set up new payment flows

- Retrain staff on new policies and procedures

- Market the integration to existing customers of both platforms

All of this costs real money. Typically, integration budgets for acquisitions of this size run 15-25% of the acquisition price annually for 2-3 years. If Go Mechanic's acquisition price is around

The fact that Spinny is raising $90 million in primary capital while simultaneously cashing out existing investors via secondary transactions suggests strong confidence from continuing investors that the business is healthy and growing.

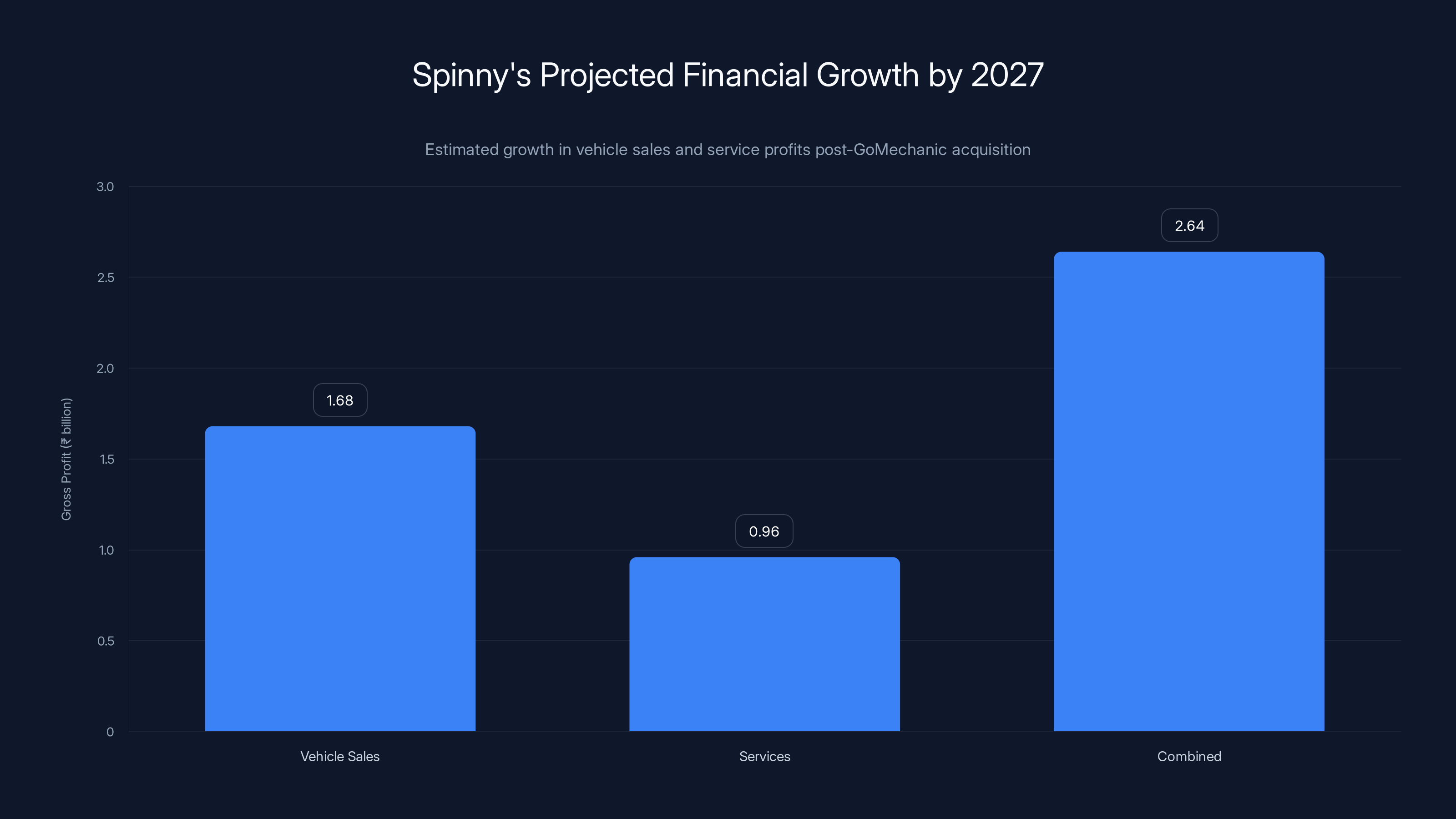

By 2027, Spinny could generate a combined gross profit of ₹2.64 billion annually, driven by vehicle sales and service integration. Estimated data based on projected growth.

Competitive Implications: What This Means for Cars 24 and Others

Spinny's consolidation play puts immediate pressure on competitors, particularly Cars 24, which is India's second-largest used-car platform after Spinny.

Cars 24 has historically competed with Spinny on the same primary metric: getting car inventory to market quickly at competitive prices. But Cars 24 lacks Spinny's vertically integrated services. If Spinny can now offer customers both buying and ongoing servicing through one platform, that's a meaningful competitive advantage.

Cars 24 could respond in several ways:

First, they could pursue their own services acquisition or partnership. There are other car services players in India that aren't integrated with any platform yet. However, the pool of high-quality targets is limited, and prices have likely increased following the Spinny-Go Mechanic announcement.

Second, Cars 24 could double down on dealer-to-dealer sales through its auction platform. Cars 24 has invested heavily in B2B transactions, creating a network where smaller dealers can buy and sell inventory. This is a different thesis—not integrating services, but instead becoming the operating system for dealer networks. It's a valid strategy but faces different competitive dynamics.

Third, Cars 24 could pursue financial services integration (loan, insurance) more aggressively. The company already offers financing options, but a dedicated NBFC subsidiary like Spinny Capital would give them more control and margin.

The broader implication is that India's used-car market is consolidating toward platform companies with integrated services. Single-product marketplaces face structural disadvantages because they can't capture as much customer lifetime value. This may force consolidation among smaller players.

The Go Mechanic Acquisition Price: Valuation Mathematics

The reported acquisition price for Go Mechanic is approximately ₹4.5 billion, or roughly $49.70 million in USD terms. Let's put this in context.

Go Mechanic's peak valuation was reportedly around $200 million (or more). That means the company sold for less than 25% of its highest valuation. In financial terms, this is a dramatic markdown reflecting the loss of investor confidence after the accounting scandal.

But even at $50 million, is this a good price for Spinny? Consider the value Spinny is acquiring:

Network Value: Go Mechanic has a network of partner mechanics and service centers across major Indian cities. In India's fragmented services market, network effects are real. Spinny isn't starting from zero in building a services network; it's acquiring an existing one.

Customer Base: Even after the accounting scandal, Go Mechanic still serves car owners who actively use its platform. These are customers Spinny can now cross-sell to.

Brand Recognition: Despite the scandal, "Go Mechanic" remains a recognized brand among urban Indian car owners, particularly in tier-1 and tier-2 cities.

Operational Infrastructure: The company has built operational systems for managing mechanic networks, handling customer payments, managing ratings and reviews, and scheduling appointments.

If Spinny values just the service mechanics network at

Series F to Series G: The Acceleration Trajectory

It's worth noting the pace at which Spinny has been raising capital. The company's Series F round, which began in March 2025 with a

This accelerating pace reveals something important about how fast Spinny is deploying capital and the confidence investors have in the company's ability to execute. Most companies spend 18-24 months deploying the proceeds from a major funding round before raising again. Spinny is raising new capital in 5-month intervals. This suggests:

- Rapid deployment: Spinny is burning capital quickly to fund expansion, acquisitions, and operational scaling

- High conviction: Investors have sufficient confidence that they're willing to commit fresh capital even before the previous round has fully deployed

- Strategic optionality: Having fresh capital available allows Spinny to move quickly on opportunities like Go Mechanic without lengthy negotiation delays

The math works like this: Spinny's Series F (

Spinny's

The Regulatory Environment and Why NBFC Status Matters

One detail worth noting: Spinny Capital, the financing subsidiary, is licensed as a non-banking financial company (NBFC). This is a highly regulated designation in India that requires specific capital ratios, asset quality standards, and reserve requirements.

Why does Spinny need an NBFC license rather than partnering with banks or existing NBFCs? Because profitability and control. If Spinny partners with an NBFC, that company takes a cut of the lending spread. If Spinny operates its own NBFC, the lending margins accrue to Spinny directly.

India's regulatory environment around automotive lending is also worth understanding. The Reserve Bank of India (RBI) has been increasingly focused on credit quality and underwriting standards, particularly after the default crises that affected some unregulated lending platforms a few years ago. An RBI-regulated NBFC like Spinny Capital has to meet specific capital adequacy ratios, asset quality standards, and lending practices that build consumer confidence.

For customers, this means Spinny Capital-financed loans carry the credibility of RBI-regulated lending, rather than relying on a third-party partner's reputation. This is a genuine customer value-add that competitive platforms would struggle to match without their own licensing.

Market Share and Scale: The 13,000 Cars Per Month Benchmark

Spinny's scale is important context. Selling 13,000 used cars per month translates to approximately 156,000 cars per year. In a market of 9.5 million used-car units, Spinny's share is roughly 1.6%. This sounds low, but remember: a significant portion of used-car transactions still happen offline. Among digital platforms, Spinny's share is considerably higher—likely in the 15-25% range of total online used-car sales.

This scale provides leverage. With 156,000 customers buying cars through Spinny annually, even modest penetration into after-sale services creates significant revenue. If just 30% of Spinny's customers use Go Mechanic for their first service within 12 months, that's 46,800 service customers acquired through the most efficient channel possible: existing customers.

Assuming an average service cost of ₹3,000-5,000 per visit and 2-3 visits per year per car, this alone could generate ₹250-750 million ($3-9 million) in annualized services revenue from just the cohort of customers who use the service once.

Scale also provides negotiating leverage with mechanic networks and parts suppliers. As Spinny consolidates Go Mechanic and scales the services business, it gains purchasing power to negotiate better parts pricing, labor economics, and platform terms. This creates a virtuous cycle where integration improves unit economics.

Integration Risks and Execution Challenges

Acquisitions are notoriously difficult to execute. The Go Mechanic deal comes with several integration risks worth considering:

Cultural Mismatch: Spinny is a technology-forward, fast-moving marketplace company. Go Mechanic, even post-acquisition by Lifelong Group, has operational and mechanical elements that require different expertise. Merging these cultures without losing either the tech advantage or the operational depth is challenging.

Quality Control: Go Mechanic's previous accounting issues raise questions about operational rigor and financial controls. Spinny will need to implement robust oversight of Go Mechanic's operations to ensure the quality standards it promotes to customers are actually being met. This requires investment in auditing and compliance infrastructure.

Mechanic Network Retention: The partner mechanics and service center owners in Go Mechanic's network are independent business people with their own preferences and concerns. They may resist integration with Spinny's platforms and systems. Retaining them while upgrading operational standards requires careful change management.

Market Saturation in Some Areas: Both Spinny and Go Mechanic may have overlapping presence in certain cities. This creates decisions about whether to consolidate redundant locations or maintain dual operations. The wrong choice here can erode margins or reduce service quality.

Technology Integration: Connecting Go Mechanic's booking, payment, and quality systems with Spinny's used-car marketplace infrastructure is technically complex. Botched integrations can degrade user experience for both platforms.

Management's track record on execution is relevant here. Spinny's CEO Niraj Singh has successfully scaled the company from near-zero to market leadership over the past decade. But scaling a marketplace is different from integrating and managing a services network. This will test whether Spinny's management team can execute across multiple business models simultaneously.

India's used-car market is projected to grow from 6 million units in 2024 to 9.5 million units by 2030, reflecting a CAGR of approximately 10%. Estimated data.

The Broader India Story: Why This Matters Beyond Spinny

Zooming out, the Spinny-Go Mechanic consolidation is part of a larger narrative about how India's startup ecosystem is maturing.

Even five years ago, the dominant narrative in Indian tech was: build a marketplace, achieve gross margins of 5-15%, scale to profitability through unit economics improvements. Most Indian startups pursued narrow, single-product strategies.

Now, the most successful Indian startups are increasingly pursuing integrated strategies. Reliance Industries (through Jio) built integrated telecommunications and retail. Pay TM moved from payments into fintech services. Flipkart and Amazon have pushed into financial services and advertising. Even food delivery platforms like Zomato are investing in quick commerce.

Spinny's move is consistent with this broader pattern: successful platforms are building integrated ecosystems rather than optimizing single transactions. This requires significantly more capital, more operational complexity, and more management sophistication. But the payoff is defensible moats and higher profitability.

For India's venture capital ecosystem, this also signals a shift. Newer funds need to be comfortable with companies that pursue increasingly complex strategies. Simple marketplace arbitrage plays are becoming increasingly commoditized. The winners are those who can build integrated platforms with multiple revenue streams and customer lock-in.

What's Next: Potential Integration Scenarios

Based on the structure of this deal and Spinny's strategic positioning, several integration scenarios are plausible:

Scenario 1: Full Platform Integration Spinny fully integrates Go Mechanic into its app and website. When a customer buys a car, they're prompted to schedule their first service through Go Mechanic. Services are displayed alongside cars in customer communications. This creates the tightest possible integration but requires significant technical investment.

Scenario 2: Parallel Operations with Cross-Promotion Spinny maintains Go Mechanic as a semi-independent brand that can stand alone as a services platform, but drives Spinny car-buying customers to it through marketing and partnerships. This is lower integration risk but lower upside in terms of customer capture.

Scenario 3: Service Center Network Consolidation Spinny uses Go Mechanic's service network to fulfill post-sale warranty and maintenance for its cars, while maintaining Go Mechanic's visibility to consumers as an independent services brand. The back-end systems converge, but the customer-facing brands remain separate.

Scenario 4: Rapid Network Optimization Spinny aggressively consolidates Go Mechanic's service center network, closing underperforming locations and focusing on major metropolitan areas where Spinny has high car-sales volume. This maximizes margin but risks losing network breadth.

Most likely, Spinny will pursue a hybrid approach: parallel operations initially with aggressive cross-promotion, followed by gradual platform integration as systems are upgraded. This balances speed-to-market with execution risk.

Competitive Dynamics in India's Used-Car Market

Beyond Cars 24, what are the other competitive forces Spinny faces?

Traditional Dealerships: Old-school car dealers still dominate Indian used-car sales by volume. They're fragmented, often lack digital presence, but benefit from geographic distribution and local customer relationships. However, they're increasingly losing customers to digital platforms among younger, urban buyers.

Auto Auction Platforms: India has several B2B auto auction platforms (including Spinny's own BMS auction platform) that serve institutional buyers and smaller dealers. These are profitable niches but lack direct consumer access.

Fintech Integration: Companies like Bajaj Fin Serv and ICICI Bank are increasingly offering integrated auto-financing and insurance. Direct competition with Spinny's services? Not yet. But banks' distribution advantage is significant.

International Players: Can legacy auto companies (Maruti Suzuki, Hyundai, Tata Motors) launch serious digital used-car businesses? Their brand recognition and warranty capabilities are strong, but their tech agility is questionable. Most haven't invested in this space.

Spinny's consolidation play puts it ahead of most of these competitors in terms of ecosystem completeness. But none of these threats are eliminated by the Go Mechanic acquisition. Instead, Spinny is raising the competitive bar, forcing rivals to either consolidate or specialize.

Spinny's funding round consists of

Capital Efficiency and Path to Profitability

One question investors will ask: when does Spinny become profitable? At $1.8 billion valuation, the company is expected to have a clear path to profitability, not just hope.

Used-car marketplace economics typically work like this:

- Gross margin: 5-15% on cars sold (Spinny's exact margin isn't public, but it's likely in the 8-12% range given market competition)

- Operating costs: 20-30% of revenue (includes customer support, refurbishment, marketing, platform costs)

- Net result: Often negative or low single-digit margin at scale

But when you add services:

- Services margin: 35-50% (much higher than car sales because Spinny is coordinating existing mechanics, not taking inventory risk)

- Cross-sell efficiency: Services CAC drops dramatically when acquired through existing car-buying customers

- Lifetime value: Customers who use both buying and services have 2-3x higher lifetime value than car-sales-only customers

This math suggests Spinny's path to profitability is through services integration, not car sales optimization. The Go Mechanic acquisition is a direct investment in this path.

Most late-stage investors don't fund companies for another $160 million unless they've modeled this path and believe management can execute it. The fact that Accel and West Bridge are doubling down suggests they're convinced.

The Role of Secondary Capital: What It Signals

Let's revisit the secondary component one more time because it's really important for understanding investor psychology.

Fundamentum and Blume Ventures, both prominent early-stage investors in India, are selling portions of their Spinny stakes. This could signal several things:

Liquidity Preferences: VC funds typically have 10-year lifespans. Investors in Fundamentum or Blume funds may be approaching end-of-fund life and requesting distributions. Secondary sales allow the fund to return capital without waiting for a full exit event.

Portfolio Rebalancing: Early investors often hold concentrated positions in successful companies. Selling a portion reduces concentration risk and frees up capital for diversification.

Valuation Locks: When investors sell stakes at a fixed valuation (in this case,

For Spinny, the secondary sales are strategically neutral but optically positive. They signal investor confidence (early backers are willing to sell at current valuations because they expect the company to outperform). They also provide validation that later-stage investors are willing to pay recent prices.

The secondary markets for Indian startup stakes have matured significantly in recent years. Companies like Aspada, Stake Club, and various placement agents make it easier for early investors to sell stakes to later investors. This is economically efficient—it keeps capital flowing without requiring public exits—but it does complicate valuation stories. A company can show a consistent valuation across multiple rounds while still experiencing significant shareholder churn.

India's Automotive Industry Transformation

To fully appreciate why this acquisition matters, you need to understand the structural changes happening in Indian automotive.

India historically had a fragmented, inefficient used-car market because:

- Information asymmetry: Buyers couldn't easily access vehicle history, accident records, or maintenance data

- Quality variance: Used cars ranged from legitimate pre-owned vehicles to salvage cars being relabeled and resold

- Geographic isolation: Buyers were limited to cars available locally; sellers couldn't easily reach distant buyers

- Payment friction: Coordinating large payments between strangers was complex and risky

- Regulatory opacity: Title transfers and registration processes were paper-based and slow

Digital platforms like Spinny have systematically addressed each of these constraints. Now, the competitive frontier is shifting to services, financing, and convenience.

Spinny's integration strategy makes sense in this context. By the time the Indian used-car market reaches maturity (probably 5-7 years from now), the winners will likely be:

- Integrated ecosystem companies that can serve customers across buying, financing, and servicing

- Vertical specialists that have become so efficient at one part of the value chain that they can't be disrupted

- Geographic dominators that have achieved near-100% market share in key cities

Spinny is positioning itself as an integrated company. This requires more capital and more operational complexity than being just a marketplace. But it's the right strategic bet given where the market is heading.

Financial Projections and Market Size

Let's model out what success looks like for Spinny post-Go Mechanic.

Assuming:

- Spinny grows from 13,000 cars/month to 20,000 cars/month by 2027 (due to market growth + market share gains)

- Average car sale price: ₹7 lakh ($8,400 USD)

- Gross margin on cars: 10%

- Services penetration: 40% of car-buying customers use Go Mechanic

- Services CAC: ₹1,500 (much lower than external CAC of ₹4,000-5,000 due to cross-selling)

- Services lifetime value per customer: ₹25,000 ($300 USD) over 3 years

- Services gross margin: 40%

By 2027, Spinny could be generating:

Vehicle Sales: 20,000 cars/month × 12 months × ₹7 lakh × 10% gross margin = ₹1.68 billion ($20 million USD) gross profit annually

Services: 20,000 cars/month × 12 months × 40% penetration × ₹25,000 LTV × 40% margin = ₹960 million ($11.5 million USD) gross profit annually

Combined Gross Profit: ₹2.64 billion ($31.5 million USD) annually

With operating costs around 20-25% of total revenue, Spinny could achieve low double-digit net margins by 2027. At 10% net margins on ₹5.6 billion in revenue, that's ₹560 million ($6.7 million USD) in annual net profit.

With typical Saa S multiples of 8-12x net profit for profitable growth companies, that implies a valuation of ₹4.5-6.7 trillion (

Actually, I was using conservative assumptions. If Spinny achieves 40,000 cars/month (doubling current volume), services penetration hits 60%, and margins are slightly higher due to scale, revenue could reach ₹10+ billion (

The point: the financial math needs to work. Investors aren't betting on Spinny reaching

FAQ

What is the significance of Spinny's $160 million Series G funding round?

The

How does Spinny's vertical integration strategy differentiate it from competitors like Cars 24?

Spinny's acquisition of Go Mechanic creates an integrated ecosystem spanning vehicle sales, financing through Spinny Capital, and post-sale services. This is fundamentally different from Cars 24's approach of focusing on marketplace efficiency and dealer-to-dealer transactions. By owning the post-sale relationship with customers, Spinny improves customer lifetime value, reduces customer acquisition costs for services, and creates switching costs that make it harder for customers to move to competitors.

Why did Spinny pursue a Go Mechanic acquisition rather than building services capabilities organically?

Organic development would have taken 3-5 years and cost significantly more than the $50 million acquisition price. Go Mechanic already operates a network of service centers, has brand recognition among Indian car owners, and possesses the operational infrastructure for managing mechanic partnerships. Spinny gains immediate scale, an existing customer base, and operational expertise. The two-way funnel value—where Spinny car customers are directed to Go Mechanic services, and Go Mechanic users become potential Spinny customers—creates additional justification for acquisition rather than organic building.

What does the secondary transaction component of this funding round reveal about early investors like Fundamentum and Blume Ventures?

The secondary sales suggest these early investors are taking liquidity opportunities while the company is hot. This could reflect fund-level liquidity needs, portfolio rebalancing after strong gains, or simply timing the sale of a mature stake. Secondary sales are increasingly common in Indian startup funding and don't necessarily indicate loss of confidence in the company. In Spinny's case, they validate that later-stage investors are willing to pay current valuations, which is a positive signal.

How does India's used-car market growth trajectory (projected 10% CAGR through 2030) support Spinny's funding and acquisition strategy?

India's used-car market is growing from approximately 6 million units in 2024 to a projected 9.5 million units by 2030. This expansion is driven by rising incomes, increased vehicle replacement cycles, and growing adoption of lease-to-own models. Within this expanding market, digital platforms are capturing an increasing share of transactions. Spinny's consolidation strategy positions it to capture disproportionate value during this growth phase by offering a complete ecosystem (buying, financing, servicing) rather than just marketplace access.

What are the primary integration risks Spinny faces in acquiring Go Mechanic, and how might they impact the company's timeline to profitability?

Key integration risks include cultural mismatch between a tech-forward marketplace company and an operationally-focused services network, quality control challenges given Go Mechanic's previous accounting issues, retention of independent mechanics and service center operators, and technological complexity in connecting disparate platforms. Poorly executed integration could extend the timeline to profitability by 1-2 years, increase operational costs, or degrade customer experience on both platforms. Spinny's management track record in scaling the core used-car business suggests capability to execute, but services integration is a fundamentally different operational challenge.

How does Spinny Capital, the company's NBFC subsidiary, contribute to its competitive moat and profitability path?

Spinny Capital allows the company to capture lending margins directly rather than partnering with external financial institutions. For customers, it creates convenience (financing integrated with vehicle purchase) and potentially better rates through competitive leverage. For Spinny, it generates higher-margin revenue and provides financial data on customers that can be used for risk assessment and cross-selling of services. RBI-regulated NBFC status also builds consumer confidence in the financing product.

What does the timing of Spinny's Series G funding (just months after completing Series F) suggest about the company's capital deployment speed?

The rapid succession of funding rounds indicates aggressive capital deployment. Series F (

How might India's venture capital ecosystem changes (shift toward later-stage funding, more secondary transactions) impact Spinny's future funding rounds?

India's VC ecosystem is increasingly dominated by later-stage capital as early-stage funding has become more competitive. This shift favors companies like Spinny that have achieved product-market fit and clear paths to scale. Secondary markets are developing rapidly, creating liquidity opportunities for early investors without requiring public exits. This means Spinny can expect future funding rounds to be easier to raise (more capital chasing proven businesses) but potentially at higher valuations given improved access to late-stage capital.

What would indicate that Spinny's Go Mechanic acquisition has succeeded versus failed in 12-24 months?

Success indicators include: customer adoption of integrated buying-and-servicing journeys reaching 25%+ of Spinny car customers within first year, Go Mechanic service center utilization rates improving by 20%+ post-integration, customer retention of car-buying customers increasing by 10-15% (measured through higher engagement and repeat purchases), and successful retention of 80%+ of Go Mechanic's mechanic network. Failure would be evidenced by mechanic attrition above 20%, inability to maintain service quality standards, technology integration delays extending beyond 18 months, or Go Mechanic customer base stagnation despite being incorporated into Spinny's platform.

The Path Forward: What Investors Should Watch

For anyone tracking Spinny's progress post-announcement, here are the metrics and milestones worth monitoring:

Integration Execution: How quickly can Spinny connect Go Mechanic's platforms with its core systems? Successful integration should be largely complete within 12 months, not 24+.

Network Quality: Are service quality scores improving or declining post-integration? Ratings and reviews are critical trust signals in services marketplaces.

Cross-Sell Rates: What percentage of Spinny car-buying customers are actually using Go Mechanic services within their first year of ownership? If this isn't reaching at least 30% within 18 months, the integration isn't delivering expected value.

Margin Expansion: Are combined Spinny + Go Mechanic margins improving due to scale and integration efficiencies? Or are they declining due to integration costs and competitive pressure?

Customer Retention: Are car-buying customers who also use services showing higher retention rates and higher lifetime value than car-only customers?

These are the metrics that will determine whether the $50 million Go Mechanic acquisition was a brilliant strategic move or an expensive mistake.

Conclusion: A Bigger Bet on India's Automotive Future

At its core, Spinny's $160 million Series G round and the Go Mechanic acquisition represent something bigger than a single transaction. This is a company making a conscious decision to evolve from being a used-car marketplace to being an integrated automotive services company.

The math is compelling: a customer who buys a car through Spinny, finances it through Spinny Capital, and services it through Go Mechanic is far more valuable than a customer who only buys a car. Margins improve, customer lifetime value multiplies, and switching costs increase. This is how sustainable competitive advantages are built in the platform economy.

But execution is brutal. Integrating Go Mechanic will consume significant management attention. Services is operationally complex in ways that marketplaces are not. Quality control is harder when you're coordinating independent service operators rather than managing owned inventory. The path to the $3-5 billion revenue scale that justifies current valuations is clear in theory but uncertain in practice.

Investors like Accel and West Bridge are betting that Niraj Singh and Spinny's management team can pull this off. They're putting real money behind that conviction. The next 24 months will reveal whether that bet was visionary or premature.

For India's automotive market, the Go Mechanic acquisition signals that consolidation is accelerating. The winners will be integrated companies offering complete ecosystems. The losers will be single-product platforms that can't match the customer value proposition of full-service integration. This dynamic will likely drive further M&A, forcing smaller platforms to either consolidate or find niche specializations they can dominate.

Spinny is placing a massive bet that integration wins. The market will soon tell whether it was the right call.

Key Takeaways

- Spinny raised 90M primary and1.8B valuation to fund GoMechanic acquisition

- Vertical integration strategy aims to capture entire customer lifecycle: buying, financing, and servicing vehicles through one platform

- India's used-car market projected to grow 10% CAGR to 9.5M units by 2030, creating consolidation opportunities

- GoMechanic's service network provides immediate scale and two-way funnel benefits for customer acquisition across both platforms

- Secondary transactions reveal investor confidence while allowing early backers like Fundamentum and Blume Ventures to take liquidity

Related Articles

- Best IT Management Software 2025: Complete Guide & Alternatives

- Best Dictation & Speech-to-Text Software [2026]

- Obsidian vs. Notion: Complete Comparison [2025]

- Best Free Project Management Software [2026]

- Best Time Blocking Apps & Tools for Productivity [2026]

- How to Type an Em Dash on Mac or Windows [2025]

![Spinny's $160M Funding Round and GoMechanic Acquisition: India's Auto Market Consolidation [2025]](https://runable.blog/blog/spinny-s-160m-funding-round-and-gomechanic-acquisition-india/image-1-1765808978891.jpg)