Rivian's Survival Plan Goes Way Beyond Cars: The Autonomy, AI, and Licensing Strategy Behind the Pivot

Rivian's survival story isn't your typical EV startup narrative. While most electric vehicle makers are still figuring out how to turn a profit on cars alone, Rivian is quietly building an entirely different business model. The company isn't just trying to sell more R1T pickups and R1S SUVs to consumers. Instead, it's developing custom silicon, autonomous driving software, AI assistants, and licensing deals that could eventually generate as much revenue as the vehicles themselves.

I'll be honest: when I first heard about Rivian's Autonomy and AI Day back in December 2024, I was skeptical. Another flashy press event from an EV startup? But after digging into what the company actually announced—and more importantly, what it didn't—I realized this was a fundamental shift in how Rivian sees its future. The company is building a technology platform, not just a car company.

Here's the thing: traditional automakers make money three ways. They sell vehicles. They charge for service and maintenance. And they collect data. Rivian is attacking all three, but with a twist. They're also trying to sell their technology to other companies, license their software, and create entirely new product categories. It's ambitious, risky, and possibly the only way a startup EV manufacturer survives the next five years.

The numbers are telling. Tesla showed the world that EV makers could be profitable by focusing on software, energy products, and autonomous driving. Rivian is learning from that playbook, but with a unique angle: they're building modular tech that other companies actually want to buy. That's not Tesla's strategy. Tesla keeps everything proprietary and closed. Rivian is opening some doors—carefully.

Let me walk you through what Rivian is really building, why it matters, and whether this survival plan actually has a shot.

The Custom Processor: Rivian's Bet on Silicon Independence

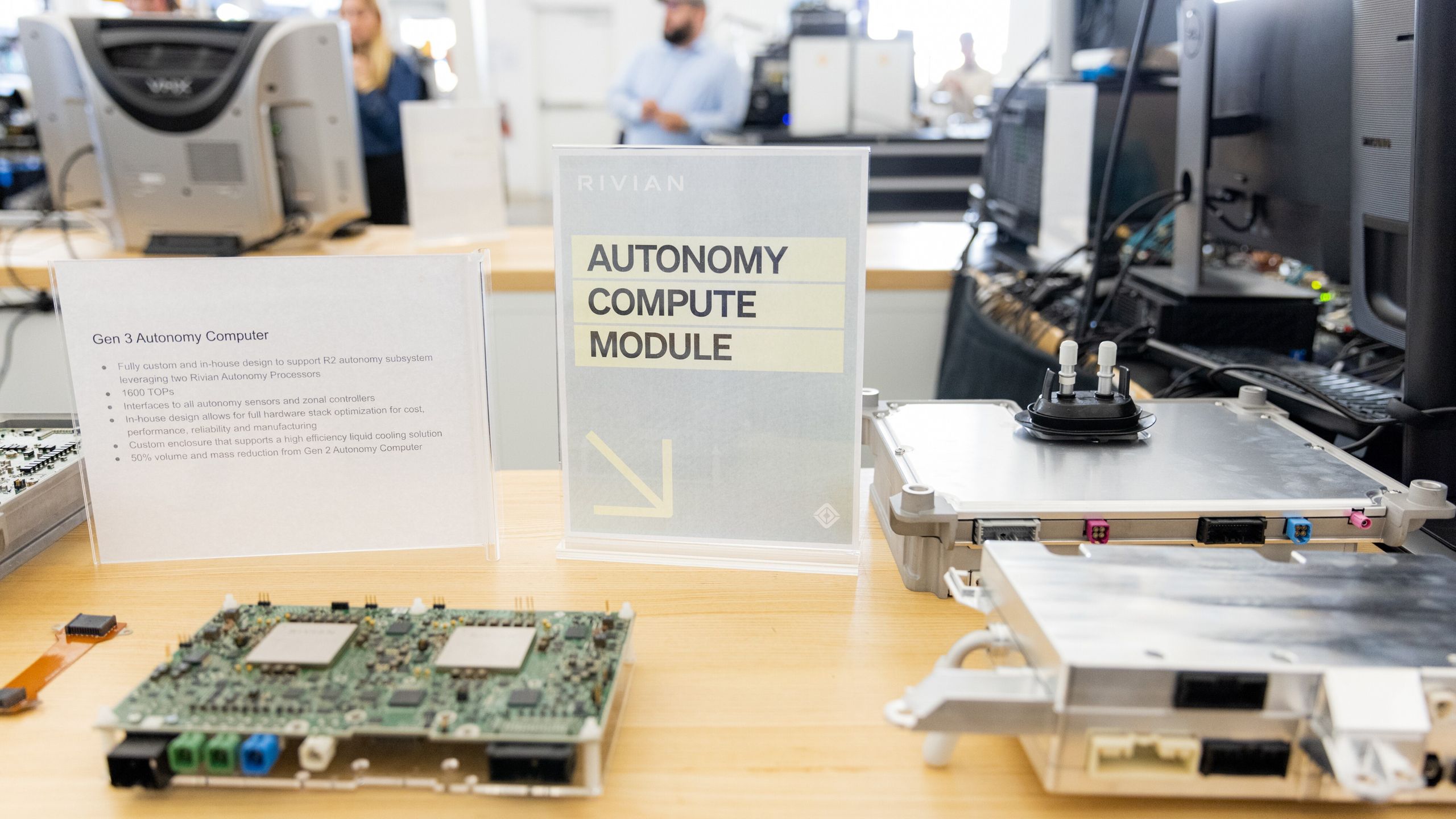

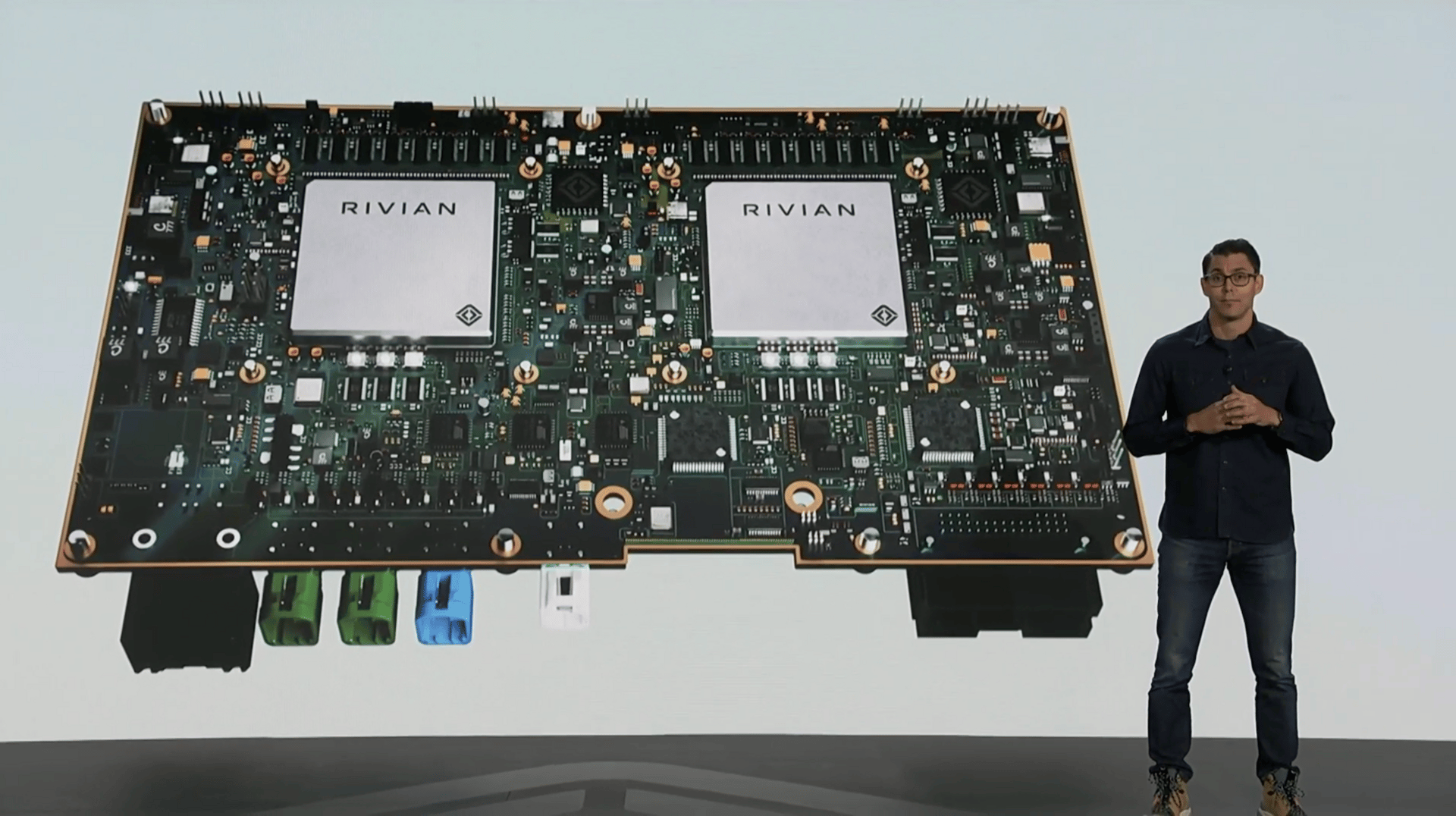

One of the biggest announcements from Rivian's event was the reveal of its custom 5-nanometer processor, developed in collaboration with Arm and TSMC. This isn't just another chip. It's the foundation of Rivian's entire autonomous driving future.

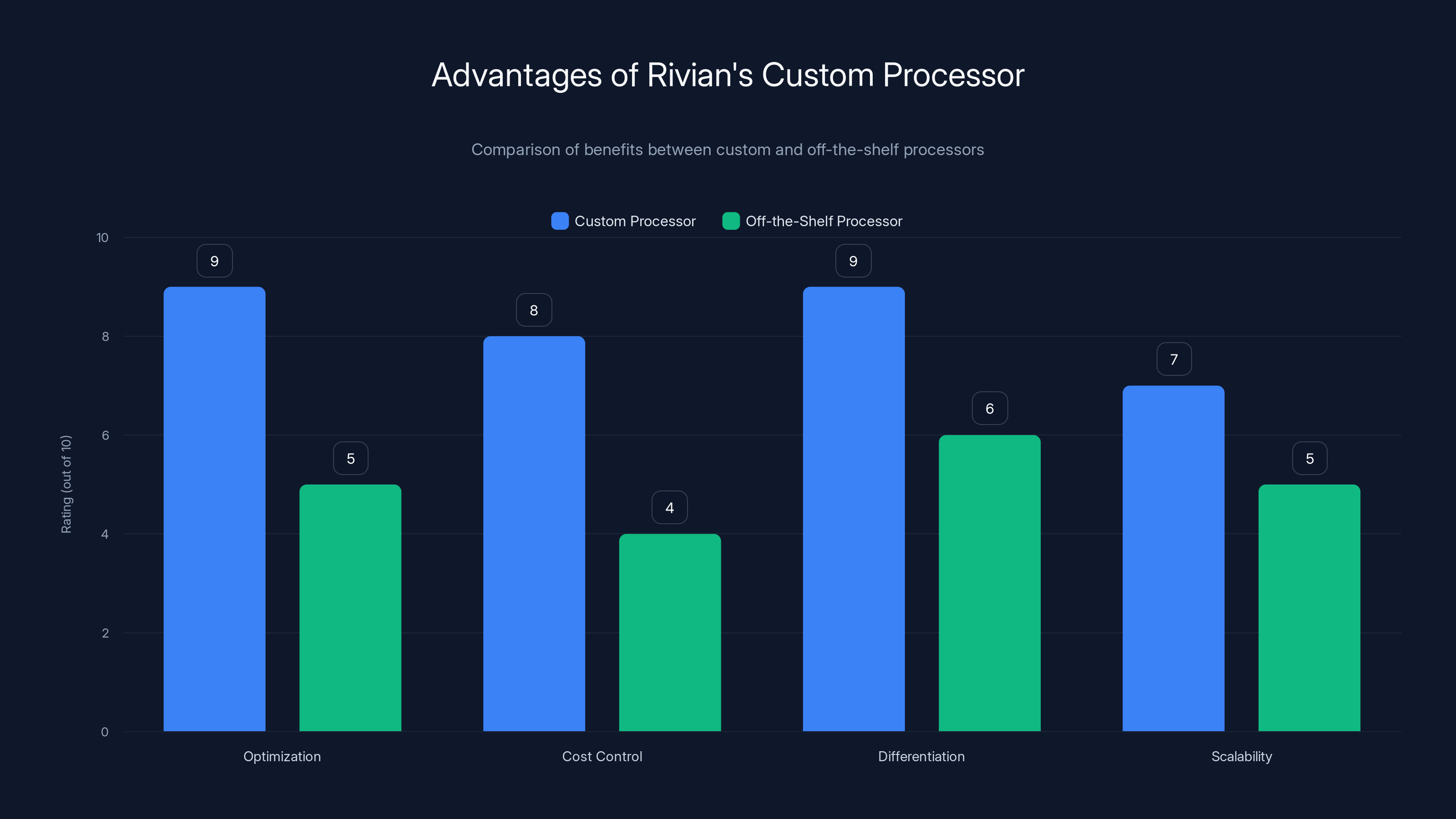

Here's why this matters: autonomy at scale requires massive computational power. Current systems rely on off-the-shelf processors from companies like Nvidia, which are expensive, power-hungry, and don't give you much room for optimization. By designing their own chip, Rivian gains several advantages. First, they can optimize the processor specifically for their autonomous driving algorithms. Second, they control the cost structure. Third, they can differentiate their technology from competitors in meaningful ways.

The processor will power what Rivian calls its "autonomy computer," which is the backbone of their upgraded autonomous driving system. This system is set to debut in the R2 SUV in late 2026. But here's where it gets interesting: the processor isn't just for Rivian's cars. CEO RJ Scaringe dropped a hint that suggests Rivian might sell this chip to other companies. When asked if Rivian would sell the processor to Mind Robotics—one of the startups the company spun out this year—Scaringe responded with a knowing smile: "It doesn't take a lot of imagination."

Translate that: yes, they're absolutely planning to sell it.

This is a smart play because it gives Rivian multiple revenue streams from a single investment. The chip development costs money upfront, but once it's built, they can sell it to their own vehicles, license it to competitors, power their robotics startups, or sell it standalone. That's not a car company anymore. That's a technology company that happens to also make cars.

Compare this to Tesla's approach: Musk's company builds everything in-house, but they don't sell components to competitors. Rivian's approach is different. They're more open to partnerships, which makes sense given their cash constraints. They need revenue now, not five years from now.

From Hands-On to Hands-Off: The Autonomy Roadmap

Rivian's autonomous driving journey is happening in phases, and understanding the timeline is crucial to grasping how the company plans to generate revenue.

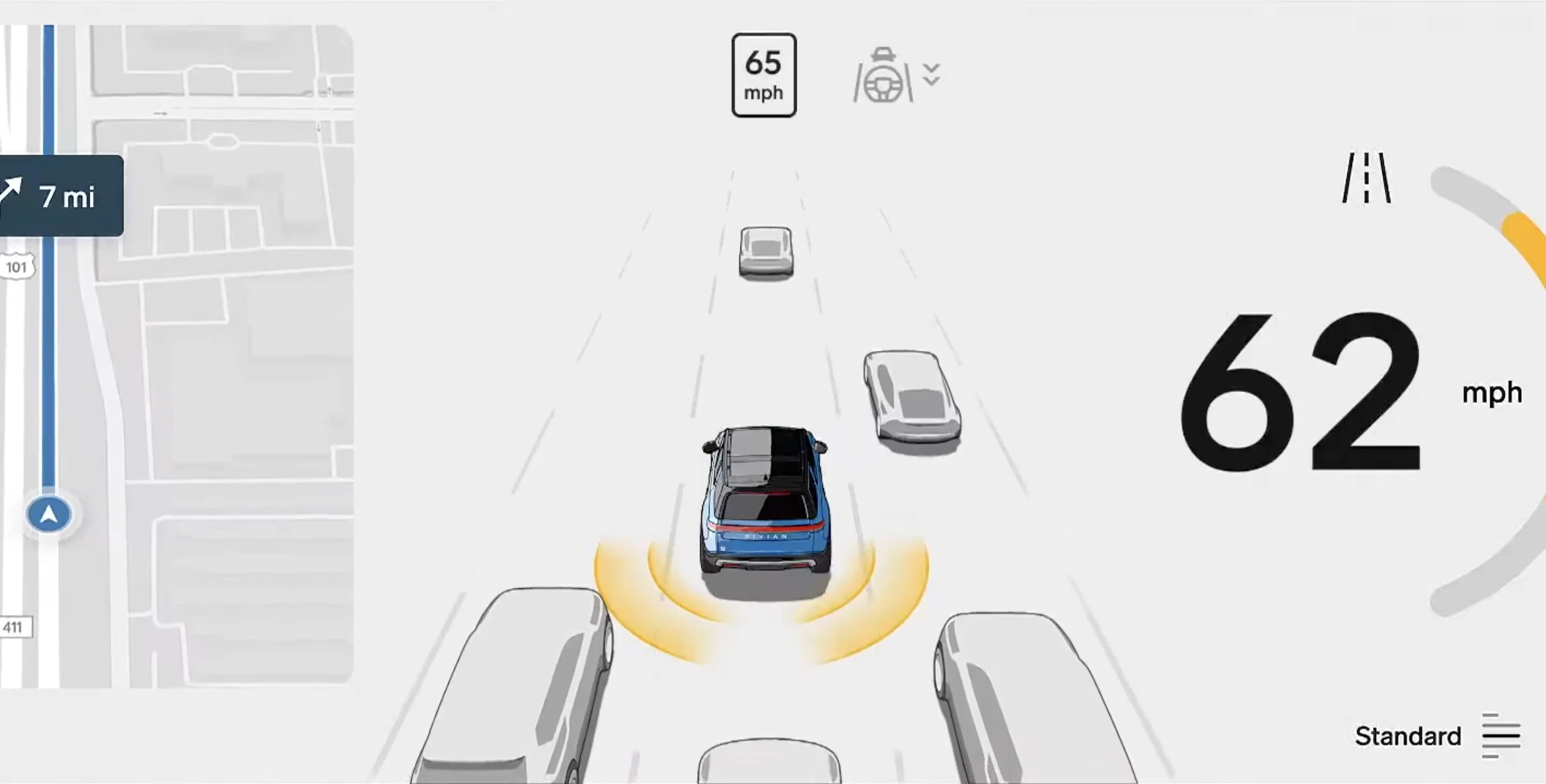

First, there's the current system already deployed in Rivian vehicles. Their hands-free driver assistance software—which they're calling an advanced driver assistance system (ADAS)—is currently available on about 135,000 miles of road. It's hands-free but not eyes-free. You can let the car handle driving on certain highways, but you still need to pay attention.

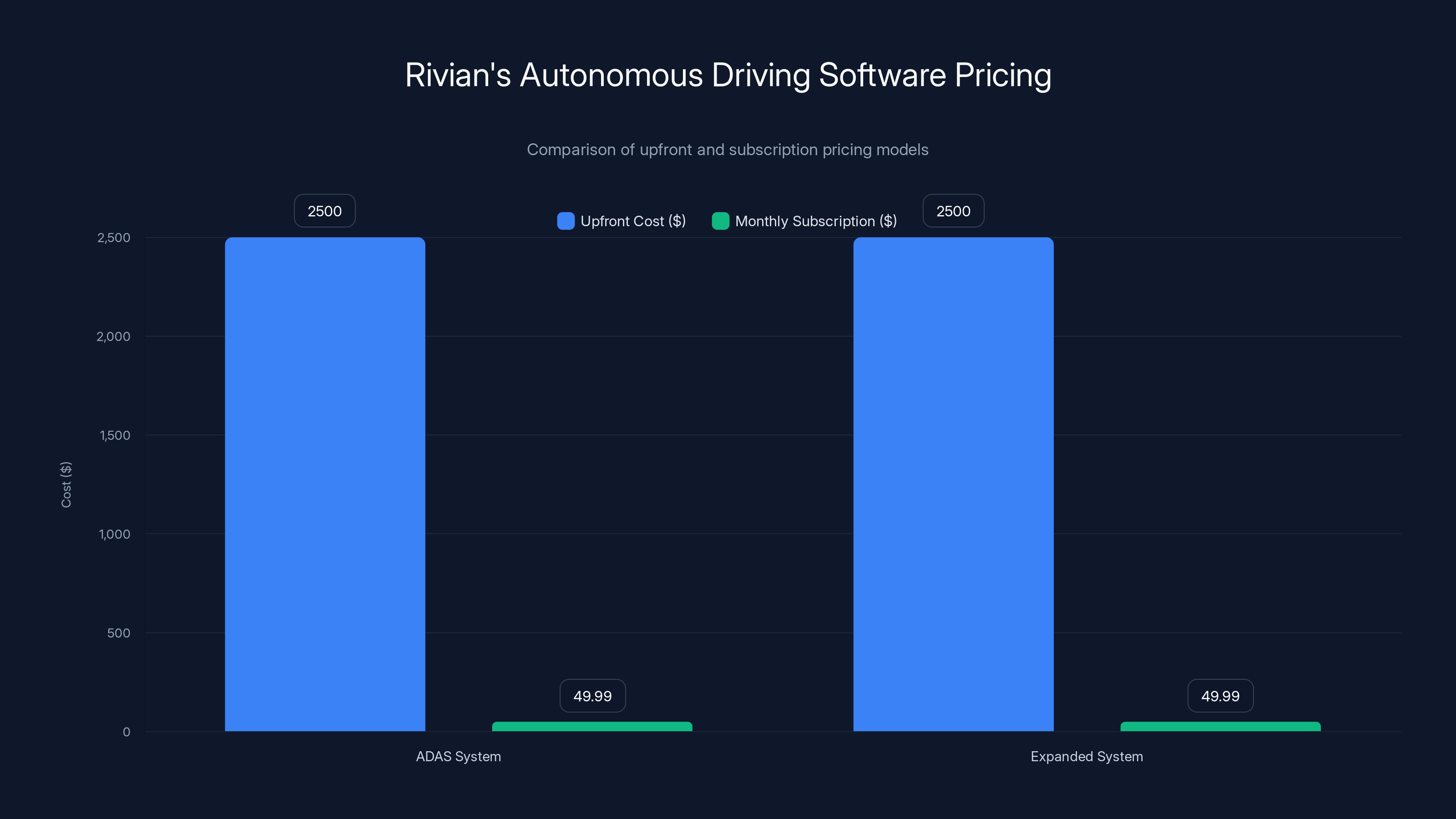

Rivian is expanding this capability to 3.5 million miles of road, including surface streets, launching in early 2026. That's a 26-fold increase in usable road miles. This expansion comes with a price tag:

But the real goal is the third phase: a true hands-off, eyes-off system. This is where the custom processor becomes essential. A fully autonomous system requires processing vastly more visual data, making quicker decisions, and handling edge cases that would normally require human intervention. That requires compute power that off-the-shelf solutions struggle to provide.

The timeline matters here. Rivian is planning to introduce this advanced autonomy system sometime after 2026, likely in the R2 or subsequent models. It will probably carry an upcharge beyond the $2,500 fee, though Rivian hasn't committed to specific pricing yet. The company is being deliberately vague because they're still testing the technology and don't want to overpromise and underdeliver. Smart move—public demos are risky.

Rivian actually did a public demonstration of its AI assistant during the autonomy event, and apparently, the testing that morning was rocky. One wrong move and the demo fails in front of industry analysts and journalists. But they went for it anyway. That takes guts, and it says something about how confident Rivian is in this technology.

Rivian offers both upfront and subscription pricing for its autonomous driving systems, providing flexibility for customers. Estimated data for future systems.

The AI Assistant: A Software Revenue Line That Actually Works

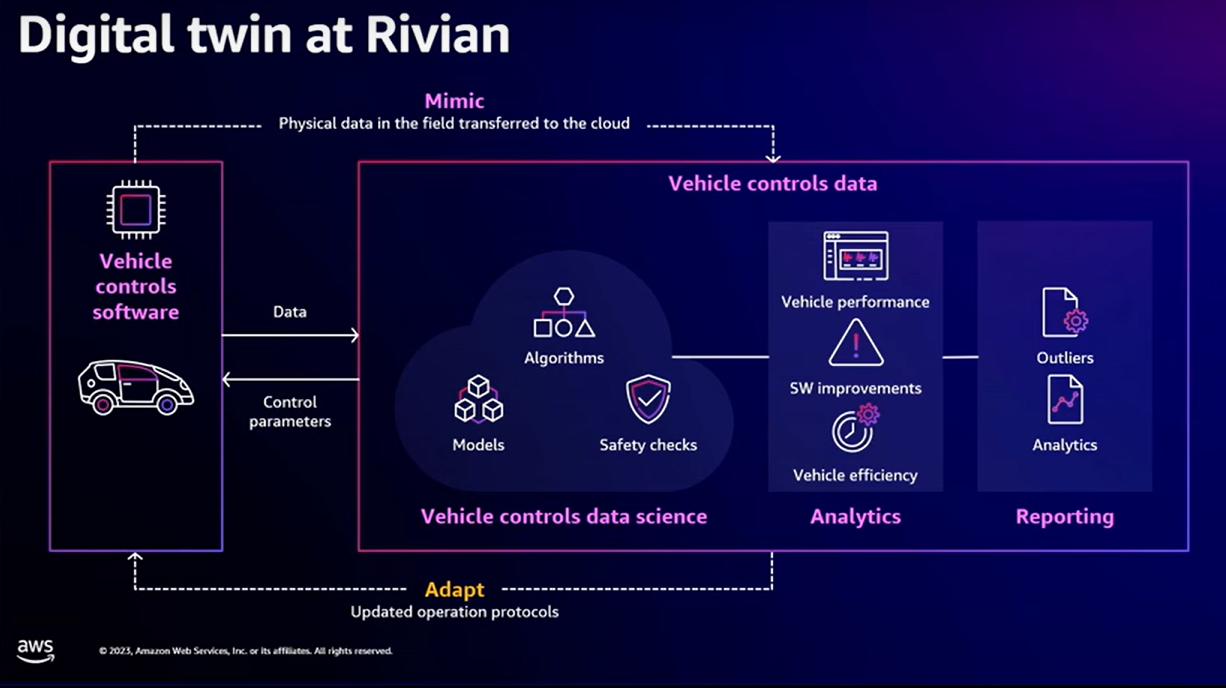

Beyond autonomous driving, Rivian is building an AI assistant that will be integrated into its vehicles starting in early 2026. This is separate from the autonomous driving system, though they'll work together.

The assistant will handle navigation, infotainment, vehicle control, and potentially other functions. Think of it as a specialized version of Chat GPT optimized for in-car use cases. The difference between Rivian's assistant and something like Tesla's voice control is that Rivian has the advantage of being built on newer foundation models and can integrate with their own architecture more seamlessly.

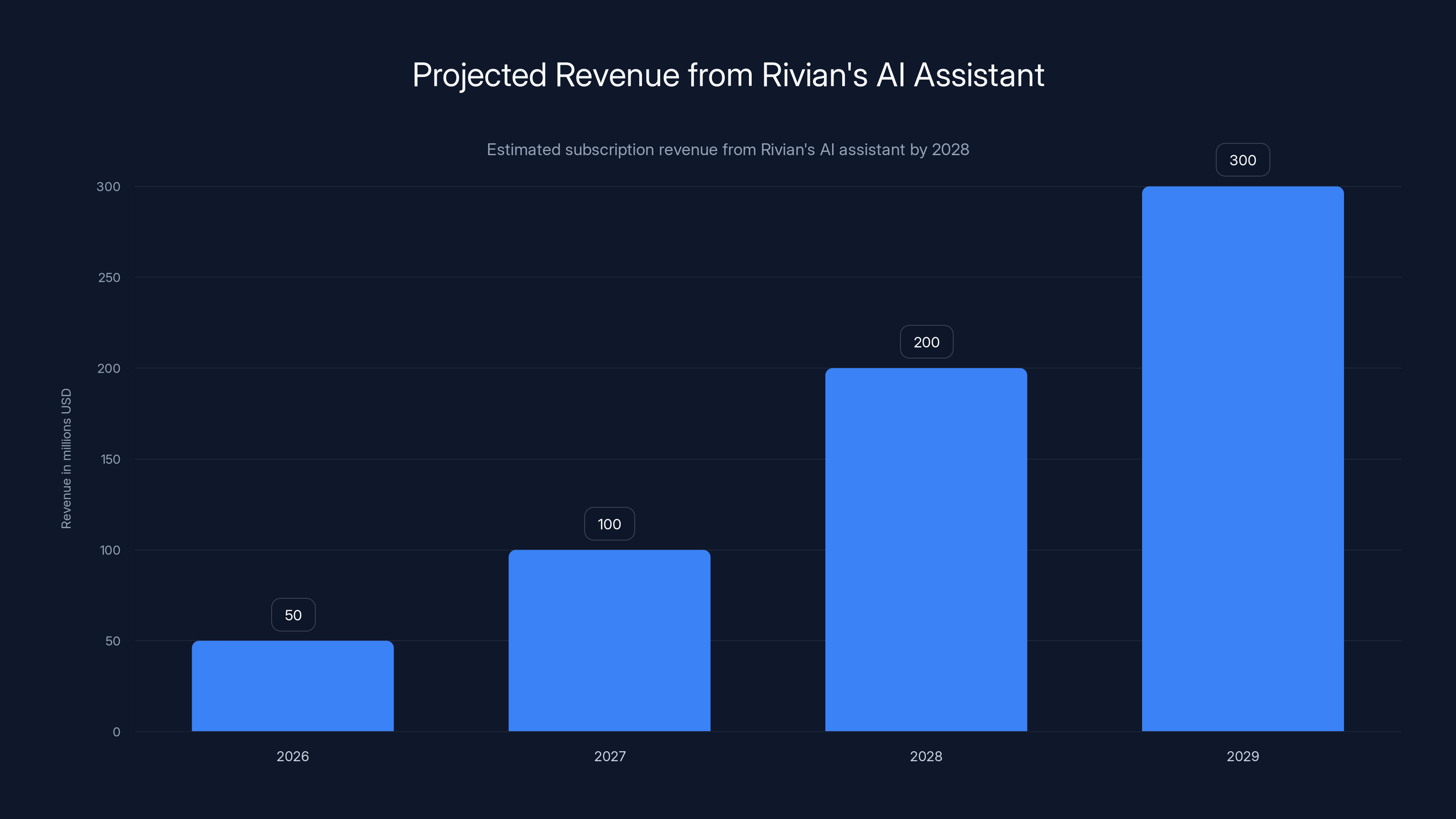

Here's why this matters for revenue: software features are software features. Once built, they can be sold to every customer at relatively minimal marginal cost. If even 50% of Rivian vehicle owners subscribe to a premium AI assistant for $10-20 per month, that's recurring revenue. And with an estimated installed base that could reach hundreds of thousands of vehicles by 2028, that's serious money.

The AI assistant also creates a feedback loop for improving autonomous driving. Every interaction with the assistant generates data that helps train the underlying models. Every time a customer asks the assistant "what's the best route to work," the system learns more about human preferences and intent. That data feeds back into improving the autonomy algorithms.

This is where Rivian's bet on licensing becomes even smarter. If they can build an AI assistant that works well for their vehicles, they can license that technology to other manufacturers. Imagine Volkswagen (Rivian's JV partner) wanting to integrate a Rivian-powered AI assistant into its vehicles. Or Mind Robotics wanting that same assistant to control industrial equipment. Suddenly, the software development cost gets amortized across multiple product categories.

Rivian's custom processor offers significant advantages in optimization, cost control, and differentiation over off-the-shelf processors, positioning them well for future scalability. Estimated data.

The Volkswagen Partnership: Licensing Architecture as a Business Model

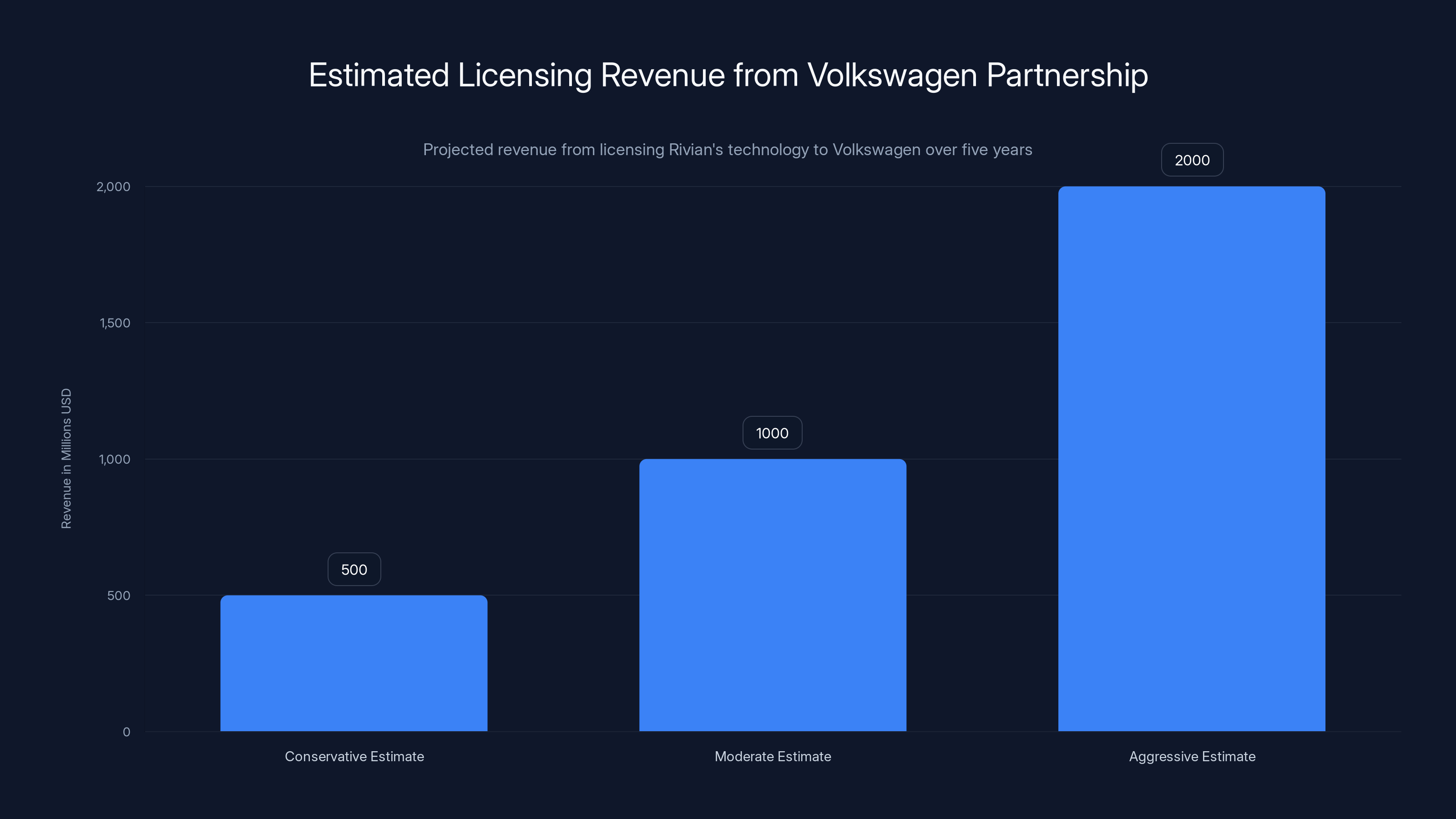

One of Rivian's underrated advantages is its joint venture with the Volkswagen Group. This isn't just about shared costs on factory construction. Rivian is actually licensing its electrical architecture and base-level software to Volkswagen.

Let that sink in: Rivian is selling fundamental technology to one of the world's largest automakers. That changes the financial math entirely. Instead of just building cars and hoping to reach profitability on volume, Rivian gets licensing fees from every Volkswagen vehicle that uses its platform.

Barclays analyst Dan Levy has speculated that this partnership could extend further. Rivian might license not just the electrical architecture but the entire autonomous vehicle platform. Or just specific components like the custom processor. The key insight is that Rivian has a scalable, modular tech stack that other companies want.

This is fundamentally different from Tesla's approach. Tesla builds everything for Tesla. Rivian is building modular components that work for Rivian but can also work for others. It's a lower-risk strategy because it diversifies revenue and reduces the pressure to become a mass-market EV manufacturer overnight.

The Volkswagen partnership also validates Rivian's technology at a crucial moment. When a company as established and risk-averse as Volkswagen commits to licensing your software, it's a signal to the market that your technology actually works.

Software Licensing Economics

Understanding the licensing model requires understanding automotive economics. When Volkswagen pays Rivian to license electrical architecture, what does that actually cost?

Assuming Volkswagen wants to integrate Rivian's platform into vehicles that will sell hundreds of thousands of units over five years, licensing fees probably range from

The beauty of software licensing is that it scales without needing to build factories, hire manufacturing workers, or manage supply chains. Once the software is written, licensing it to another manufacturer has almost zero marginal cost. Volkswagen has to integrate it, test it, and support it, but the core development cost for Rivian is already sunk.

This is why Rivian's CEO kept hinting at more licensing deals in the future. If they can get even two or three major OEMs to license components or platforms, the company's financial runway extends dramatically.

The Robotics Play: Mind Robotics and the Broader Picture

Rivian spun out two startups in 2024: Also, focused on mobility, and Mind Robotics, focused on industrial AI and robotics. On the surface, these seem unrelated to a car company. But they're actually a crucial part of Rivian's strategy.

Mind Robotics gives Rivian a way to monetize its AI and robotics capabilities in adjacent markets. The same custom processor that powers autonomous vehicles can power industrial robots. The same AI assistant that lives in a car can manage logistics or warehouse operations. The same machine learning pipelines that improve autonomous driving can improve robotic perception.

By spinning out separate companies, Rivian doesn't have to internally resource these efforts. Instead, they fund startups that use Rivian technology as the foundation. If those startups succeed, Rivian wins through equity upside and continued licensing fees. If they fail, the losses are compartmentalized.

It's a clever structure because it also attracts outside investment. Venture capitalists will fund Mind Robotics because it has a clear path to market and Rivian's technology backing. Without that, the startup would have a much harder time raising capital.

Think about it from a different angle: if Rivian's autonomous driving technology is worth anything, it should have applications beyond cars. Warehouse robots, delivery drones, manufacturing automation, construction equipment—all of these could benefit from the same perception and decision-making systems that Rivian is building for vehicles.

By creating separate startups for these applications, Rivian essentially creates multiple exit opportunities. Mind Robotics could get acquired by a robotics giant, providing Rivian with a windfall. Also could be acquired by a mobility platform. Or they could go public independently. Each outcome returns value to Rivian shareholders while still maintaining licensing relationships.

Estimated data shows significant revenue growth from Rivian's AI assistant subscriptions, potentially reaching $300 million by 2029.

The Business Model Stack: How These Pieces Work Together

If you zoom out and look at Rivian's overall strategy, there's a coherent business model emerging. It's not just about selling cars anymore.

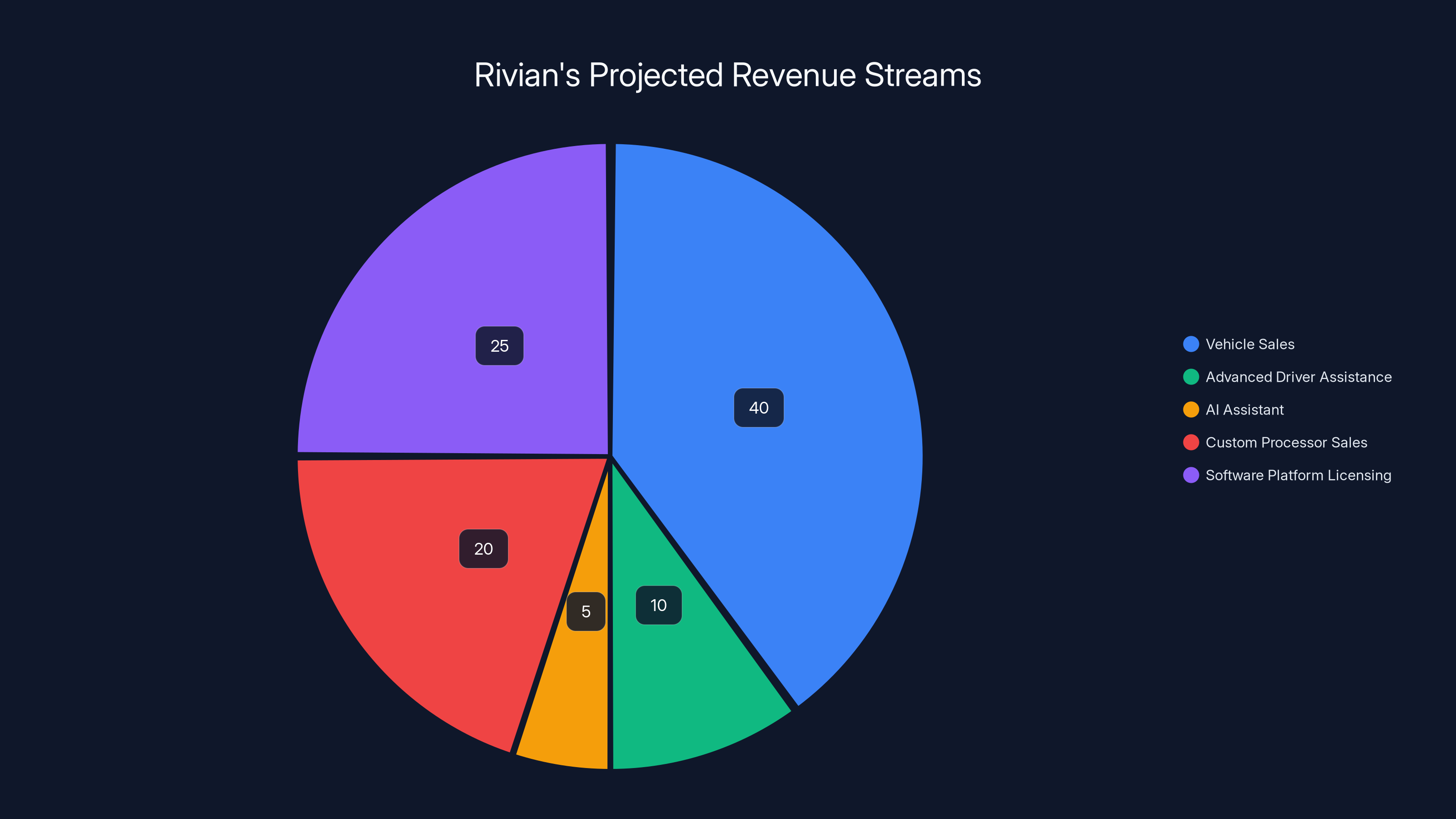

The foundation is still vehicle sales. Rivian needs to sell R1 Ts, R1 Ss, and the upcoming R2 to generate revenue and fund operations. That's not changing. But on top of vehicle sales, Rivian is layering on multiple revenue streams:

Advanced Driver Assistance:

AI Assistant: Potentially $10-20/month per subscriber. If 50% adoption, that's another substantial revenue stream.

Custom Processor Sales: To Mind Robotics, other robotics companies, or potentially other automakers. Hard to estimate, but potentially hundreds of millions in licensing revenue.

Software Platform Licensing: To Volkswagen and potentially other OEMs. This could be the biggest revenue stream once mature.

Equity Upside in Spun-Out Companies: Also and Mind Robotics could become valuable independent companies.

Here's the formula: if Rivian can execute on even 50% of these initiatives, the company's financial profile changes dramatically. Instead of needing to reach profitability on vehicle sales alone—which is incredibly difficult—the company can use these other revenue streams to absorb losses while scaling manufacturing.

That's the survival plan. It's not unique in concept—software and services have become crucial to auto profitability. But it's ambitious in execution, and it requires Rivian to maintain excellence across multiple very different product categories.

The Timing Imperative: Why This Matters Now

Rivian can't afford to wait for these revenue streams to mature. The company is burning cash, and traditional vehicle margins in the EV market are tightening rapidly.

Tesla proved that EV makers can be profitable, but only at scale and with exceptional operational efficiency. Traditional automakers are improving rapidly and have massive cost advantages. Rivian can't compete on price or volume, so they need to compete on technology and software differentiation.

The timing of these announcements—the custom processor, the AI assistant, the licensing partnerships—suggests Rivian is on a deadline. They need to demonstrate to investors and creditors that there's a path to profitability beyond just selling more vehicles. The autonomy event was essentially Rivian making that case publicly.

Without these additional revenue streams, Rivian probably doesn't survive. With them, the company has a shot. That's the underlying tension of the pitch.

Estimated revenue from Rivian's licensing deal with Volkswagen ranges from

Comparison to Tesla, Lucid, and Traditional Automakers

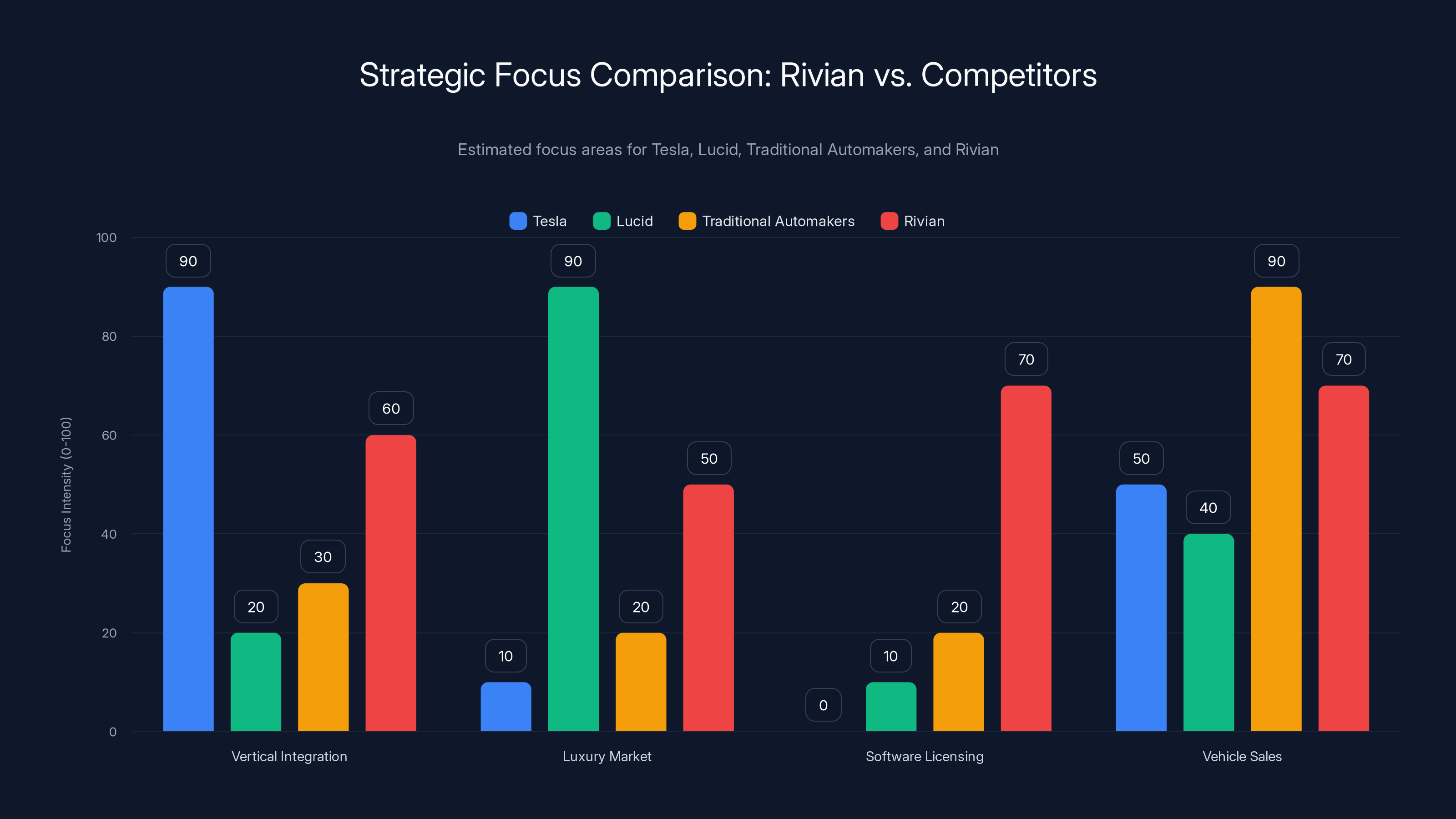

To understand how bold Rivian's strategy is, it's worth comparing it to what competitors are doing.

Tesla's Approach: Vertical integration, proprietary everything, focus on energy products and software. Tesla doesn't license technology to competitors. Everything serves Tesla's unified ecosystem.

Lucid's Approach: Focus on luxury vehicles and proving the EV luxury market exists. Minimal software differentiation, minimal licensing strategy. Lucid is essentially betting everything on being a high-end EV maker.

Traditional Automakers: Continuing to sell vehicles as the core business. Incrementally improving software. Occasionally licensing technology when it makes sense. But fundamentally still car-focused.

Rivian's Approach: Multi-pronged strategy combining vehicle sales with software licensing, component sales, and spin-out companies. Trying to be everything at once.

Rivian's approach has the highest upside but also the highest execution risk. If the custom processor works well, if the AI assistant resonates with customers, if Volkswagen's integration succeeds, if Mind Robotics gains traction—then Rivian could become a technology holding company with a vehicle manufacturing arm, rather than a vehicle manufacturer with technology.

But if any of these pieces fail to execute, Rivian's diversification strategy becomes a distraction, consuming resources that could have been focused on the core business.

The Public Demo Risk: Autonomy at the Worst Time

One detail worth diving into is Rivian's decision to do a public demonstration of its AI assistant at the autonomy event. According to reports, the testing beforehand was rocky. There was tension in the morning. But the public demo worked.

This is significant for a few reasons. First, it shows Rivian has enough confidence in the technology to take the public risk. Most companies avoid live demos because they're prone to failure and generate negative headlines. Rivian went for it anyway.

Second, it signals to the market that Rivian is past the point of hiding failures. When you're confident enough to demonstrate technology publicly, it usually means you've tested it thoroughly. The alternative is arrogance, but given the financial pressures on Rivian, arrogance would be self-destructive.

Third, a successful public demo is worth money. It's worth investor confidence. It's worth media attention. Rivian needed this win, and they executed.

But there's also a risk reading here. Live demos create expectations. If the next iteration of the AI assistant has issues, if the autonomous driving expands more slowly than projected, if the hardware doesn't perform as promised—investors will remember this successful demo and compare future efforts unfavorably.

Rivian has set a high bar for itself.

Estimated data shows Rivian's revenue diversification, with vehicle sales still significant but software and licensing growing in importance.

The Licensing Revenue Paradox

Here's something worth thinking about: if Rivian's technology is good enough to license to major automakers like Volkswagen, why doesn't Rivian just build its own vehicles at scale and make the money directly?

The answer comes down to manufacturing. Building vehicles at scale requires enormous capital investment, supply chain mastery, and operational excellence. Rivian has some of this, but not all. Licensing technology to companies that already have scale, existing factories, and established supply chains is capital-efficient.

Imagine Rivian's electrical architecture powering Volkswagen Group vehicles in Europe, Asia, and North America. Millions of vehicles over five years. Rivian doesn't need to build the factories or manage the supply chain. They just collect licensing fees. The margin might be lower per vehicle, but the capital requirement is also vastly lower.

This is the fundamental insight: Rivian doesn't need to be a mass-market automaker to be successful. It just needs to be a technology provider that also makes some vehicles for brand presence and proof-of-concept.

Autonomy Ethics and Regulatory Considerations

One thing Rivian's public demo didn't address is the ethical and regulatory complexity of autonomous driving. The company is being smart about this—they're not overselling the capabilities. The system is hands-free and eyes-free for specific use cases, not full autonomy.

But as Rivian pushes toward truly autonomous systems, they'll face increasing regulatory scrutiny. Different countries have different rules. Some states in the US have been more permissive with autonomous vehicle testing, while others are extremely cautious. Insurance liability is still ambiguous. Cybersecurity requirements are evolving. Hacking risks are real.

Rivian's custom processor and proprietary software give them more control over security and updates, which is good. But they also assume full liability for failures. A crash caused by Rivian's autonomous system is Rivian's legal problem. That's why the company is moving incrementally rather than jumping straight to full autonomy.

The regulatory environment could accelerate or decelerate Rivian's timeline significantly. If regulations become more permissive, the company can move faster. If they become more restrictive, everything slows down. This is an underappreciated risk in Rivian's plan.

Rivian's strategy is the most diversified, with significant focus on software licensing and vehicle sales, unlike Tesla's strong vertical integration or Lucid's luxury market focus. (Estimated data)

The Cash Runway Challenge

None of Rivian's multi-faceted business model matters if the company runs out of cash before these revenue streams materialize. This is the existential question.

As of late 2024, Rivian had raised billions in funding but was still burning cash on vehicle production and development. The licensing deals might eventually provide meaningful revenue, but they don't immediately solve the cash problem. Software licensing doesn't generate revenue until products are released, customers integrate them, and payments are received.

Rivian needs the R2 to succeed. This is the affordable vehicle that could actually achieve scale. If the R2 doesn't resonate with customers, if manufacturing costs exceed projections, if demand falls short of expectations—then the entire plan collapses.

The company also has the Volkswagen joint venture to lean on. That partnership provides both funding and a safety net. VW wouldn't let Rivian completely fail because they've got billions invested in the relationship. But there are limits to how much VW will prop up an underperforming venture.

The Broader EV Market Context

Understanding Rivian's survival plan requires understanding the broader EV market dynamics. The industry is consolidating. Weaker players are getting acquired or going under. Capital is flowing to winners, not also-rans.

In this environment, Rivian's strategy of diversifying beyond pure vehicle sales makes sense. The company is betting that being a technology provider is safer than being a pure vehicle manufacturer. And given the margin pressures in the EV industry, that's probably a rational bet.

Tesla succeeded by being exceptional at vehicles and creating a brand halo. Lucid is trying to follow a similar path in the luxury segment. Traditional automakers are trying to transition their existing business models to electric powertrains. Rivian is doing something different—building a platform business on top of a vehicle business.

This is high-risk, high-reward. It requires execution excellence across multiple domains. But it might be the only viable path for a startup EV manufacturer in the 2025-2030 timeframe.

The Competitive Moat: Is Custom Silicon Defensible?

Rivian's custom processor is important, but is it actually defensible? Other companies are building custom chips too. Qualcomm, Nvidia, Intel, and others all have automotive-focused processor offerings. How does Rivian's processor provide sustainable advantage?

The answer is specificity and integration. Rivian's processor is optimized for Rivian's autonomous driving algorithms. It's integrated with Rivian's software stack. It's designed for the power and cooling constraints of Rivian vehicles. A generic processor, even a more capable one, might not deliver the same performance-per-watt.

But this advantage is temporary. As the autonomous driving industry matures, processors will become commoditized. Companies will either use standardized solutions or build their own. The window where a custom processor provides meaningful advantage is probably 5-10 years.

Rivian understands this. That's why they're also building software moats (the AI assistant, the autonomous algorithms) and relationship moats (the Volkswagen partnership, the licensing deals). The processor is one piece of a larger strategy.

What's Missing From Rivian's Plan

For all the innovation in Rivian's strategy, there are some notable gaps. The company hasn't announced any robotaxi plans, unlike Tesla and Waymo. There's no mention of energy products (Powerwalls, charging networks) like Tesla has. There's limited discussion of vertical integration in battery production.

Robo Taxis would be the logical next step. If Rivian successfully deploys autonomous vehicles, why not operate them as robotaxis? The revenue potential is enormous. But robotaxi operations are operationally complex and regulatory complicated. Rivian might not be ready to take on that business.

Energy products made sense for Tesla because the company had established manufacturing and brand loyalty. Rivian doesn't have that yet. Building energy products would be spreading too thin.

Battery integration is interesting. Rivian doesn't manufacture its own batteries, which puts them at a cost disadvantage versus companies like Tesla. But manufacturing batteries requires massive capital and technical expertise. It might be outside Rivian's bandwidth.

These aren't necessarily failures. They might be deliberate choices to stay focused. Rivian can do more eventually. For now, the company is betting on vehicles, autonomous driving, and software licensing. That's a coherent strategy.

The Likelihood of Success: A Realistic Assessment

So what's the probability that Rivian's survival plan actually works?

Let's break it down:

Vehicle Sales: High probability of continued sales in the near term. The R1T and R1S have customers who want them. The R2 is anticipated. This generates near-term revenue.

Advanced Driver Assistance: Medium-high probability. Other companies are doing this successfully. But adoption rates are uncertain. Will customers actually pay for advanced ADAS? Probably some will, but maybe not most.

Custom Processor and AI Assistant: Medium probability for initial success, lower probability for meaningful differentiation. These are good products, but they're also targets for competition.

Software Licensing: High probability for Volkswagen (already committed). Lower probability for broad licensing deals with other OEMs. Automakers are skeptical of building critical technology on competitors' platforms.

Spinout Companies Success: Low to medium probability. Mind Robotics and Also are nascent and competitive. They might succeed, or they might struggle like most startups.

Overall Survival: Medium to medium-high probability. Rivian probably survives 5 years. Whether it thrives or just survives is a different question.

The company's biggest risk isn't any individual business line. It's execution across multiple domains simultaneously while bleeding cash. That's incredibly difficult. Tesla has done it, but Tesla is exceptional.

Looking Forward: 2026 and Beyond

The next 12-18 months are crucial for Rivian. Here's the roadmap:

Early 2026: Expanded ADAS system with 3.5 million miles of road coverage. AI assistant launches in vehicles. This drives revenue and customer engagement.

Late 2026: R2 ramp begins manufacturing. Custom processor integration into R2. This is the make-or-break product for Rivian's volume aspirations.

2027+: Hands-off, eyes-off autonomous system launches. Wider licensing deals potentially announced. Mind Robotics and Also show meaningful traction or get acquired.

If Rivian hits these milestones, the company's survival is much more assured. Miss some of them, and the company is back to square one, begging for more funding.

The Bigger Picture: What Rivian's Strategy Means for the Industry

Rivian's diversified approach has implications for the entire EV industry. If the company succeeds with software licensing and component sales, other EV makers will follow. Tesla's approach—vertical integration and no partnerships—might not be the only viable path.

Alternatively, if Rivian's licensing strategy fails and the company survives only because of Volkswagen's financial support, it signals that EV makers can't successfully sell technology to competitors. Everyone will go back to focusing exclusively on their own vehicles.

The industry is watching closely. Rivian's Autonomy and AI Day wasn't just for customers. It was for competitors, investors, and suppliers. It was Rivian making a case for its viability in a consolidating industry.

Whether that case succeeds is still an open question. But the fact that Rivian is making it, publicly and confidently, tells us something: the company isn't going down without a fight.

Key Takeaways

Rivian's survival plan is fundamentally different from traditional vehicle manufacturing:

- The company is building multiple revenue streams: vehicles, ADAS, AI assistants, custom processors, software licensing, and spinout companies.

- Custom silicon gives Rivian differentiation in autonomous driving but is probably a temporary advantage.

- Software licensing to Volkswagen and other OEMs could become the most valuable part of the business.

- The company needs to execute across many domains simultaneously while managing cash carefully.

- The next 18 months are critical for proving the strategy works.

- Success isn't assured, but the plan is coherent and ambitious.

FAQ

What is Rivian's Autonomy and AI Day?

Rivian's Autonomy and AI Day was a December 2024 event where the company unveiled its autonomous driving roadmap, custom processor, and AI assistant capabilities. The event was positioned as demonstrating Rivian's vision for becoming more than just a vehicle manufacturer. It included technical details about the company's autonomous driving software, the custom 5nm processor being developed with Arm and TSMC, and early demonstrations of the AI assistant that will be integrated into vehicles starting in early 2026.

How does Rivian's custom processor improve autonomous driving?

Rivian's custom 5-nanometer processor is specifically optimized for the company's autonomous driving algorithms and sensor fusion requirements. Unlike off-the-shelf processors designed for general-purpose computing, this chip is tuned for the specific computational tasks needed to process camera, lidar, and radar data in real time. The processor provides better performance-per-watt, lower latency, and improved power efficiency compared to generic solutions, giving Rivian's autonomous vehicles faster reaction times and lower energy consumption.

What is the business model for Rivian's autonomous driving software?

Rivian is monetizing autonomous driving through several channels. The current hands-free ADAS system costs

How does Rivian's partnership with Volkswagen differ from traditional joint ventures?

Rivian's Volkswagen partnership goes beyond shared manufacturing costs. The companies are collaborating on electrical architecture and base-level software licensing, meaning Volkswagen pays Rivian for technology that goes into Volkswagen vehicles. This is significant because it creates recurring licensing revenue for Rivian without requiring the company to manufacture those vehicles. Traditional joint ventures typically involve shared investment and shared profits from jointly manufactured vehicles. Rivian's approach is about selling technology platforms to a partner with existing manufacturing scale.

What are Mind Robotics and Also, and why did Rivian spin them out?

Mind Robotics and Also are separate startups created by Rivian in 2024. Mind Robotics focuses on industrial AI and robotics applications, while Also addresses mobility challenges. By spinning these out as independent companies rather than keeping them as divisions, Rivian can attract outside investment, venture capital, and specialized talent to these ventures. The spinouts also use Rivian's underlying technology (processors, algorithms, AI assistants) as foundational elements. If these companies succeed, they become acquisition targets or public companies, generating returns for Rivian shareholders while maintaining licensing relationships.

Will Rivian sell its custom processor to other companies?

Yes, according to CEO RJ Scaringe's hints at the autonomy event, Rivian plans to license and sell its custom processor to other companies. The processor will initially power Mind Robotics' industrial applications and potentially be licensed to other robotics and automotive companies. This component sales strategy converts a cost center (internal processor development) into a profit center. Similar to how Arm Holdings makes billions licensing processor designs without manufacturing anything, Rivian aims to monetize its silicon investment across multiple product categories and customers.

How is Rivian's AI assistant different from Tesla's Autopilot?

Rivian's AI assistant is designed as a conversational AI specifically for in-vehicle use, similar to having a digital copilot. It handles navigation, infotainment, vehicle control, and information requests through natural language. Tesla's Autopilot is primarily an autonomous driving system focused on steering, acceleration, and braking. While both companies use AI, they're addressing different problems. Rivian's assistant is built on modern large language models and trained for in-vehicle contexts. It could also be licensed to other manufacturers or extended to non-automotive applications, whereas Tesla's Autopilot is tightly integrated with Tesla's specific vehicle architecture.

What is Rivian's timeline for fully autonomous (hands-off, eyes-off) driving?

Rivian hasn't announced a specific launch date for fully autonomous driving capability. The company is moving incrementally: hands-free but eyes-on ADAS (available now, expanding to 3.5 million miles in early 2026), followed by more advanced autonomy integrating the custom processor. Industry patterns suggest true hands-off, eyes-off systems are likely 2027 or later. Rivian is being deliberately vague about timelines because autonomous driving technology has a history of overpromise and underdeliver. The company wants to demonstrate capability before committing to specific dates.

How much revenue could software licensing generate for Rivian?

Software licensing revenue potential depends on multiple factors: the number of OEMs that license technology, vehicles per OEM, licensing fee per vehicle, and market penetration. If even one major OEM like Volkswagen licenses Rivian's electrical architecture for millions of vehicles over five years at $500-2,000 per vehicle in licensing fees, that could represent hundreds of millions to billions in cumulative revenue. For context, Volkswagen Group manufactures over 10 million vehicles annually globally. Even a fraction of these vehicles with Rivian technology at reasonable licensing rates represents a transformative revenue opportunity for Rivian compared to pure vehicle sales margins.

What are the biggest risks to Rivian's survival plan?

The primary risks include: (1) execution risk across multiple business lines simultaneously while cash-constrained, (2) R2 vehicle production and adoption falling short of projections, (3) licensing partners reducing commitments or building competing technologies, (4) custom processor providing only temporary competitive advantage, (5) autonomous driving capabilities not matching public promises, and (6) regulatory changes slowing autonomous vehicle deployment. Additionally, traditional automakers and well-funded competitors like Tesla continue improving their own autonomous capabilities, which could reduce the value of Rivian's licensing proposition.

Conclusion: The Bet That Rivian Is Making

Rivian is making a calculated bet that the future of the automotive industry isn't just about vehicles. It's about platforms, software, and licensing technology to companies with distribution channels you don't have to build yourself.

This is the most interesting thing the company announced in 2024, even if it wasn't the flashiest. The custom processor got attention. The AI assistant got attention. But the real story is the business model—the understanding that Rivian doesn't need to be a mass-market automaker to be valuable.

Tesla proved you could build a successful EV company by doing everything yourself and controlling the narrative. Rivian is trying to prove you can do it by being a technology supplier to companies that already have scale and distribution. Both strategies could work. Neither is guaranteed.

The next 18 months will tell us whether Rivian's survival plan is prescient or just wishful thinking. The company needs the R2 to succeed. It needs advanced ADAS to drive meaningful adoption. It needs Mind Robotics and Also to show progress. It needs Volkswagen's licensing payments to start flowing. It needs at least one more major licensing partnership.

If all that happens, Rivian goes from "struggling startup running out of cash" to "valuable technology platform that happens to also make vehicles." That's a fundamental shift in valuation and sustainability.

If it doesn't happen, all the AI assistants and custom processors in the world won't save the company. It becomes another EVentual acquisition or bankruptcy statistic.

Rivian's leadership clearly understands the stakes. That's why they went public with the Autonomy and AI Day. It's why they're confident enough to do live demos. They need investors, customers, and partners to believe the survival plan is real. And sometimes, belief is enough to make something real—at least long enough to prove it works.

The company has momentum, partnership support, and a coherent strategy. Whether that's enough is the question that drives the EV industry's next chapter. Rivian isn't the answer to that question yet. But increasingly, it looks like the company is asking the right questions.

![Rivian's Survival Plan Goes Way Beyond Cars [2025]](https://runable.blog/blog/rivian-s-survival-plan-goes-way-beyond-cars-2025/image-1-1765808936875.png)