Supreme Court Rules Trump's Tariffs Illegal: The Complete Legal, Economic, and Political Breakdown

It was supposed to be his signature policy. Instead, the Supreme Court just dismantled most of it.

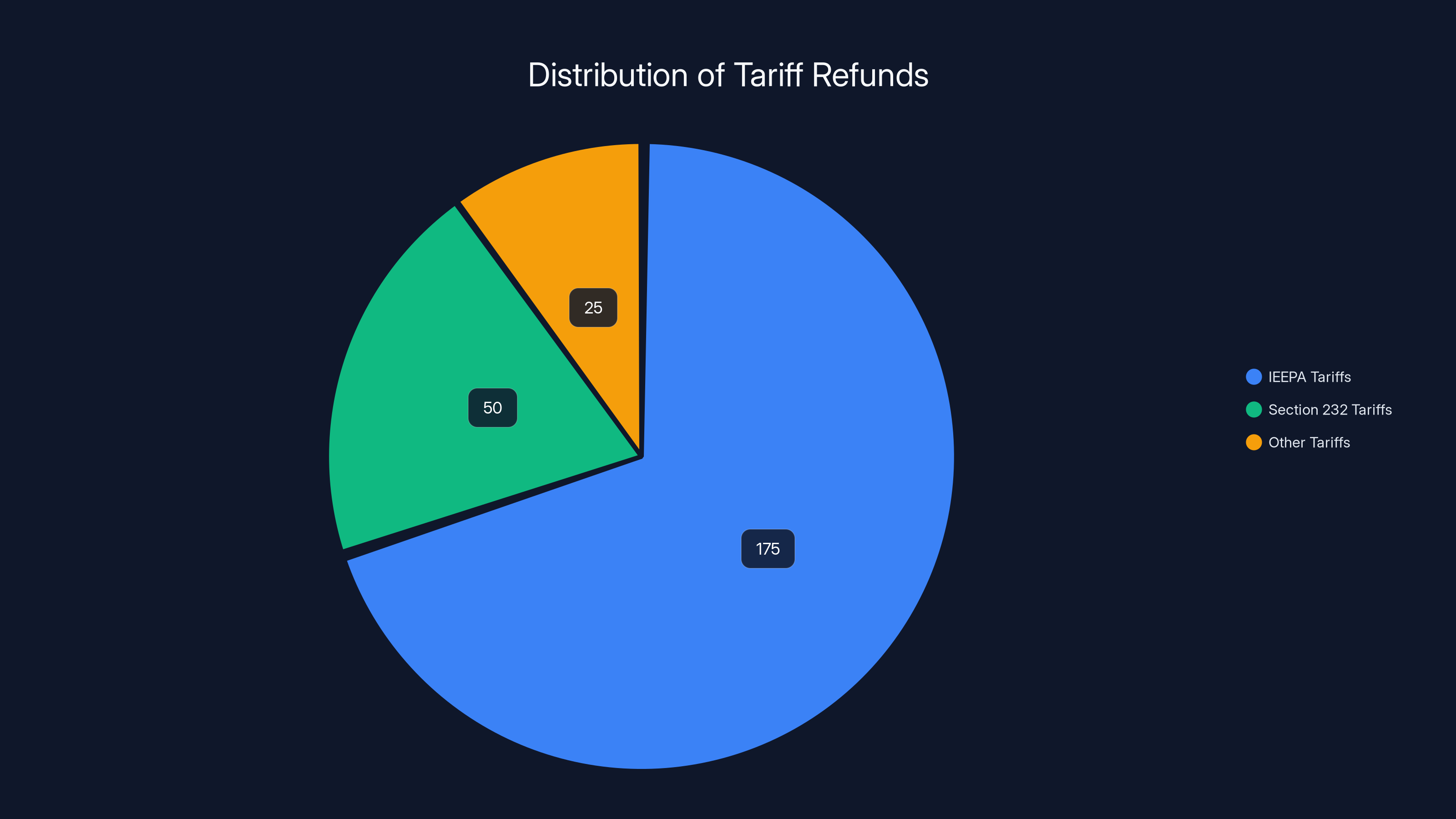

On Friday, six justices voted to overturn the majority of President Donald Trump's global tariffs, ruling that the International Emergency Economic Powers Act (IEEPA) doesn't actually give presidents the power to impose taxes on imports. The decision was swift, decisive, and unexpected. Even more shocking? The refund bill could exceed $175 billion.

This isn't just a legal setback. It's a fundamental rebuke of how Trump wielded executive power over trade policy. And it raises an even bigger question: if the president can't invoke emergency powers to reshape global trade, what can he actually do?

The tariff strategy had seemed bulletproof. Trump's team deployed IEEPA—a 1977 law designed for real emergencies—to justify tariffs on nearly every country. The reciprocal tariffs last April were wild, hitting even isolated nations with penguins. The administration painted these as necessary for national security and economic retaliation. Legal experts screamed it was unconstitutional from day one.

But knowing something is probably illegal and proving it in court are two different things. This ruling proves it. And now the government faces an unprecedented refund problem.

Here's what actually happened, why it matters, and what comes next.

The Tariff Policy That Changed Everything

When Trump took office in 2025, he didn't wait. Within weeks, tariffs started flying. These weren't the traditional, sector-specific kind that presidents occasionally imposed. These were sweeping, global, indiscriminate.

The reciprocal tariffs were the most aggressive. The basic idea sounded straightforward: if China taxed American goods at 25%, Trump would tax Chinese goods at 25%. But reciprocal tariffs don't work that way in practice. Countries have different tariff structures for different products. You can't just mirror them.

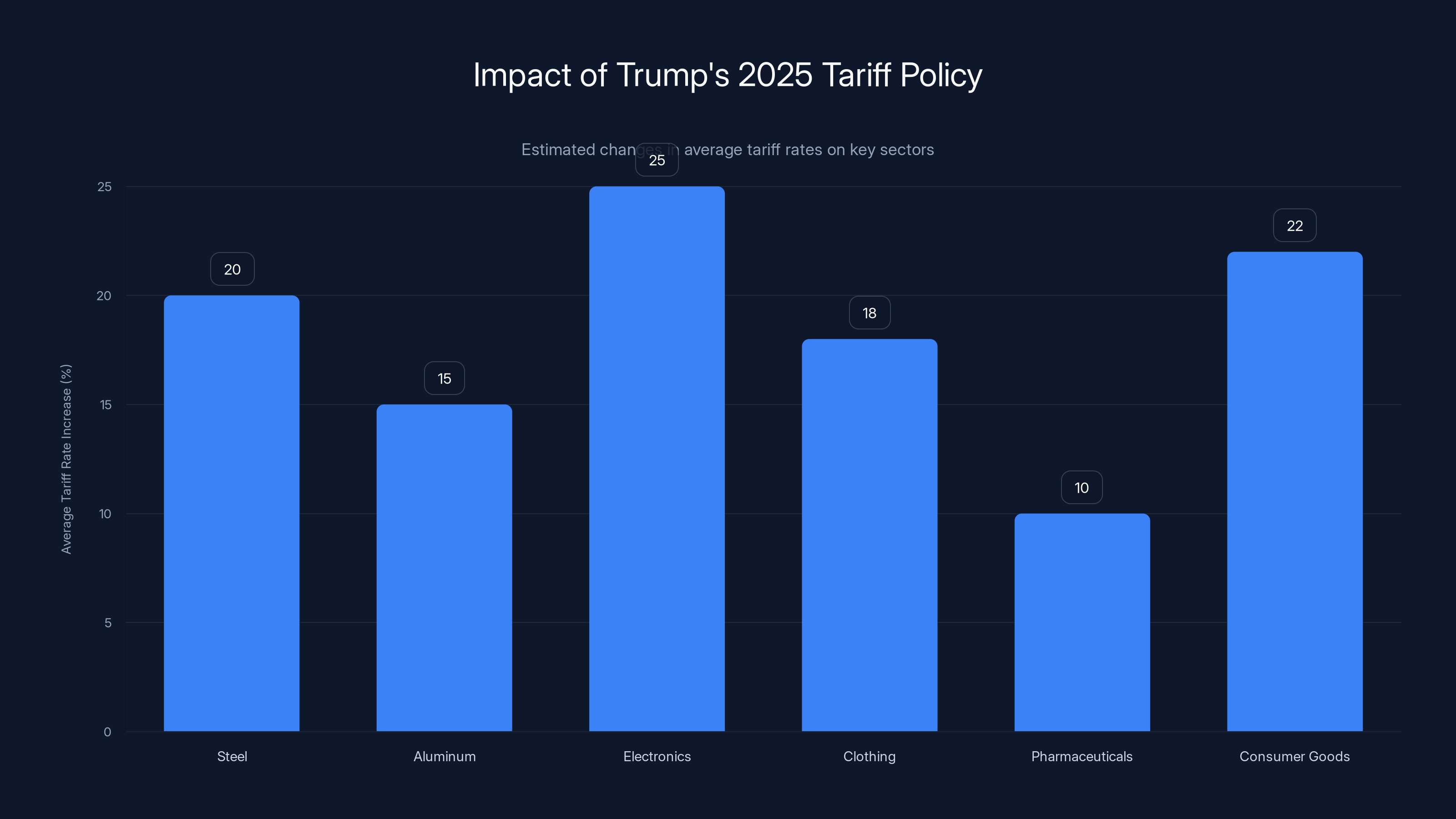

So instead, the administration used a blunt instrument. They calculated "average" tariff rates and applied them broadly. The results were chaotic. Tariffs hit steel, aluminum, electronics, clothing, pharmaceuticals, and consumer goods. When you walked into a store, the cost of almost everything had tariff taxes baked in.

But here's the thing: Trump didn't use the normal trade law authorities. He didn't invoke Section 301 of the Trade Act, which lets presidents retaliate against unfair trade practices. He didn't use Section 232, which covers national security tariffs (though he'd used that before). Instead, he went with IEEPA.

IEEPA was designed for Cold War scenarios. If the U.S. faced a real national emergency, the president could freeze assets, block transactions, and control trade. It was meant for countries like Cuba or Iran, not Canada or Mexico.

Trump's legal team read IEEPA broadly. They argued that economic competition with China constituted an "emergency." The administration issued executive orders citing IEEPA as the authority for tariffs. Lawyers immediately questioned whether IEEPA even covered taxation. The statute explicitly dealt with "foreign exchange, credits, monetary transfers, and property." Tariffs? Not mentioned.

Legal scholars from across the political spectrum flagged the problem. Cato Institute scholars wrote about it. Conservative legal groups raised concerns. Progressive economists warned Congress. Everyone agreed: this is probably not how IEEPA works.

But the administration pressed forward. By June 2025, tariffs covered goods from virtually every country except a handful. The total amount collected? More than $175 billion according to economist estimates.

That money came from somewhere. Mostly from American companies and consumers. When imported goods cost more, retailers raise prices. Manufacturers pay more for components. Supply chains adjust by adding tariff costs to final prices. Nobody pays the tariff directly. Everyone pays it eventually.

Big companies like Costco, Goodyear, and Prada saw their costs spike. They filed lawsuits immediately, demanding the tariffs get overturned and refunded. Financial firms like Cantor Fitzgerald set up investment products betting the tariffs would fall. Everyone was preparing for legal battle.

The 2025 tariff policy led to significant increases in average tariff rates across various sectors, with electronics seeing the highest estimated increase. Estimated data.

The Supreme Court's 6-3 Decision Explained

Chief Justice John Roberts didn't mince words in the majority opinion. He wrote that IEEPA simply doesn't grant tariff power. Here's the core argument.

First, the text matters. IEEPA says the president can regulate "foreign exchange transactions, credits, monetary transfers, importation of currency, securities, and other property." Tariffs operate differently. They're taxes on imports, not regulations of property or currency. The statute never mentions taxation.

Second, history matters. Roberts noted that in IEEPA's 50-year existence, no president—not Reagan, Bush, Clinton, Bush, or Obama—had ever tried to impose tariffs under it. Why? Probably because they didn't think they could. If the law clearly authorized tariffs, you'd expect at least one president to use it in half a century.

Third, the Constitution matters. Article I gives Congress the power to "lay and collect taxes." Tariffs are taxes. The Constitution doesn't say the president can exercise Congress's tax powers in emergencies. Emergency powers exist, sure, but they don't override the Constitution's structural divisions.

Roberts also emphasized the scale. This wasn't a targeted tariff on one category. These were global tariffs affecting nearly all imports. If IEEPA covered this, presidents could basically rewrite trade policy whenever they declared an emergency. Congress's constitutional power to regulate commerce would become meaningless.

The majority included Roberts (Chief Justice), Thomas, Sotomayor, Kagan, Jackson, and Gorsuch. That's an unusual coalition. You had a conservative Chief Justice, a liberal wing, and a Trump-appointed originalist (Gorsuch) all agreeing.

Thomas's concurrence suggested something even broader: presidents might not have emergency power to impose tariffs under any statute without clear congressional authority. Gorsuch's opinion focused on constitutional text and structure. The liberal justices emphasized Congress's exclusive tax power.

Alito, Kavanaugh, and Clarence Thomas dissented. Well, mostly dissented. Thomas wrote separately. The dissenters argued IEEPA's broad language about "property" could reasonably include tariffs, and presidents have traditional broad powers over foreign trade.

But they lost. Six justices agreed the tariffs exceeded the president's authority. The ruling was immediately enforceable.

Why the $175 Billion Refund Problem Is Massive

Here's where it gets complicated. When the Supreme Court rules a tax unconstitutional, the government has to refund it. That's settled law. But refunding $175 billion isn't like writing a check.

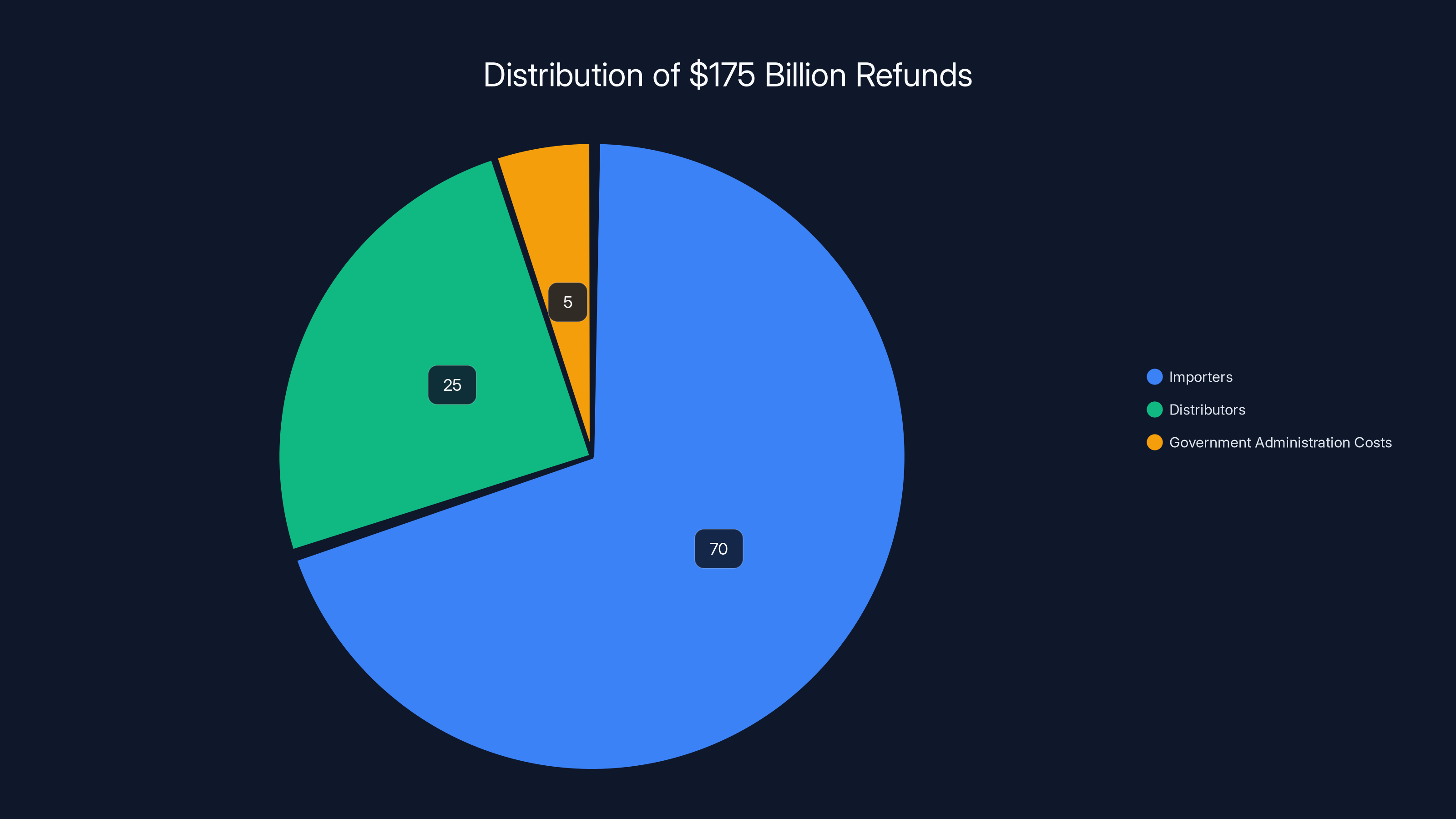

First, who gets refunded? Companies that paid tariffs can claim refunds from the Court of International Trade. But individual consumers who paid tariff costs through higher prices? They're out of luck. The system doesn't track end-consumer impact. So the refunds go to importers and distributors.

Second, when does it happen? Tariffs collected in the past year need to be processed. That's millions of transactions, potentially thousands of claims, and complex calculations about what was actually paid under what tariff regime on what dates.

Third, how does the government pay? It doesn't have an extra $175 billion sitting around. These refunds come from the general treasury. That means either deficit spending increases, or the government cuts spending elsewhere, or finds other revenue sources.

Economists were divided on whether this is good or bad. Some argued the refunds would stimulate the economy—companies get money back, prices fall, consumption increases. Others warned it would add to the deficit and potentially accelerate inflation if money flooded into the economy too quickly.

Trump predicted the refund process would be "a complete mess." He wasn't wrong. The Court of International Trade had to set up new procedures to handle refund claims. Companies needed to provide documentation. Government accountants needed to verify amounts. The process would take months or years.

Meanwhile, companies like Costco, which had paid tariffs upfront, could now pursue claims. Prada, which had imported fashion goods, could demand refunds. BYD, the Chinese electric vehicle maker whose tariffs made U.S. imports more expensive, could file claims. Even companies that had already passed tariff costs to consumers would recover money.

Cantor Fitzgerald's financial products suddenly became valuable. The firm had created investment vehicles that bet on tariff overturns. When the ruling came down, these positions paid off. The sons of Commerce Secretary Howard Lutnick, who run Cantor Fitzgerald, had gotten the bet right.

But for most American businesses, the refund was bittersweet. Yes, they'd get money back. But they'd already paid the tariffs. They'd already disrupted supply chains, repriced products, and lost customers to competitors. Some damage couldn't be undone.

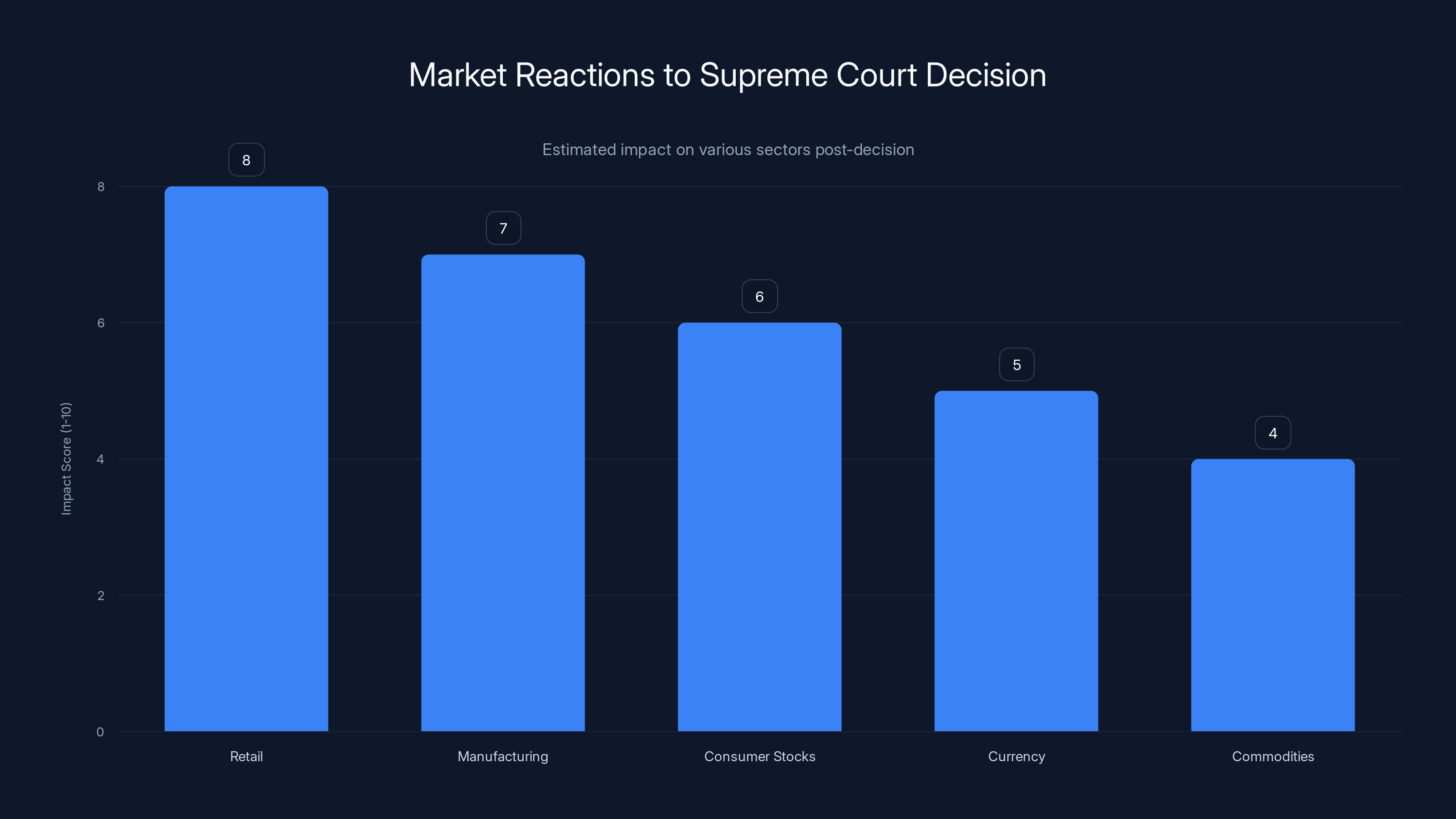

The Supreme Court decision positively impacted retail and manufacturing sectors the most, with moderate effects on consumer stocks and currency markets. Commodities saw mixed reactions. (Estimated data)

How the Trump Administration Used IEEPA (And Got Caught)

The strategy was almost clever. Trump wanted tariffs. Congress wasn't going to approve sweeping global tariffs through normal legislation. Trade bills take months. Congress debates endlessly. Instead, Trump invoked "emergency" powers.

Here's how it worked. The president's legal counsel researched available authorities. IEEPA allowed broad powers "in the interest of national security." Trade authorities like Section 301 and Section 232 required trade investigations and findings. IEEPA had no such requirements. No study needed. No findings required. Just an executive order.

The administration framed economic competition with China as a national security emergency. They cited concerns about supply chain vulnerabilities, dependency on foreign semiconductors, and reliance on Chinese manufacturing. These concerns had some validity. But whether they constituted an "emergency" under IEEPA was debatable.

Legal scholars immediately challenged the reading. IEEPA's legislative history showed it was designed for extraordinary situations—war, terrorism, major threats. An economic rival, even an aggressive one, wasn't what Congress envisioned.

But here's the thing: executive power doctrines are broad. Presidents regularly invoke powers Congress granted them in ways Congress didn't explicitly contemplate. Courts usually defer to executive judgment on emergency questions. So maybe it would have worked.

Except the majority didn't defer. Roberts emphasized that even emergency powers have limits. They can't override constitutional structures. Congress's power to tax can't be delegated to the president, emergency or not.

The administration had miscalculated. They'd assumed courts would defer on trade and national security. They'd assumed six justices wouldn't unite against Trump administration policy. They'd miscalculated on Gorsuch, who sided with the liberal wing on textualism grounds.

Once the ruling came down, the legal strategy collapsed. IEEPA tariffs were history. The question became: what next?

What Tariffs Remain (Steel, Aluminum, Copper, and Sector-Specific Duties)

The Supreme Court ruling didn't invalidate all tariffs. Some survived because they rested on different legal authorities.

Steel and aluminum tariffs, for example, were imposed under Section 232 of the Trade Expansion Act of 1962. That statute lets the president impose tariffs for national security if the Commerce Department certifies they're necessary. Trump had done this in his first term with steel and aluminum. Disputes arose, but courts generally deferred to the Commerce Secretary's national security findings.

The copper tariffs followed similar logic. These weren't IEEPA tariffs, so the Supreme Court decision didn't touch them.

Sector-specific tariffs on semiconductors, pharmaceuticals, and rare earth elements similarly survived. These had been imposed under different authorities, with different procedural records.

The practical effect: maybe half of Trump's tariff regime remained in place. But half was undone. Companies suddenly didn't know which tariffs would stick and which wouldn't. Uncertainty returned to trade policy.

Small business groups warned that the administration might simply reimpose tariffs under different statutes. Instead of IEEPA, they could use Section 301. Instead of declaring a blanket emergency, they could conduct investigations showing unfair Chinese trade practices, then impose retaliatory tariffs.

Would this work? Legally, maybe. Section 301 has broader history of use. But it requires investigations, takes time, and involves procedural requirements. It's not the instant tariff-by-executive-order approach that IEEPA allowed.

This meant tariff reimposition, if it happened, would take months. The Court of International Trade would be collecting and processing refunds. Businesses would be adjusting to a tariff-free environment. Supply chains would be reconfiguring. By the time new tariffs could be imposed, the economic effects might have already shifted sentiment.

The Constitutional Question: Can Presidents Tax Imports?

The Supreme Court's decision raised a deeper constitutional question. What's the line between legitimate executive emergency power and unconstitutional presidential taxation?

The Constitution is explicit. Article I, Section 8 grants Congress "power to lay and collect taxes, duties, imposts, and excises." Tariffs are duties. They're explicitly Congress's domain.

But presidents have broad powers over foreign commerce. They negotiate trade agreements. They control Customs enforcement. They manage trade investigations. Can this power extend to imposing tariffs unilaterally?

Traditionally, courts said no. The Constitution's structure is clear. Taxation requires congressional action. Even if a statute granted tariff power, that statute must come from Congress.

But the Trump administration argued statutory language could authorize it. They said Congress, in IEEPA, had authorized the president to regulate "property" as broadly as he saw fit. Tariffs regulate imports, which are property. Ergo, tariffs are within presidential power.

Roberts rejected this. He emphasized that even broad statutory language doesn't override constitutional structures. Congress can't delegate its tax power to the president. If a statute appears to do that, courts should interpret it narrowly.

The decision essentially said: if Congress wants to authorize tariffs, it can. But it has to be explicit. It can't be hidden in a statute about emergency currency controls.

This has implications beyond tariffs. Could presidents use similar broad statutes to regulate other things? Could IEEPA authorize price controls? Could it justify seizures of property? The majority suggested no. Emergency powers have limits.

Future administrations will have to work with Congress on major tariff changes. That's the core takeaway. Unilateral tariff authority through emergency declarations is off the table.

Estimated data shows that the majority of the $175 billion refunds are likely to go to importers and distributors, with a small portion allocated to government administration costs.

How This Compares to Previous Tariff Disputes

Tariff litigation isn't new. Presidents have faced challenges before. But this ruling is different in scope.

In Trump's first term, he imposed steel and aluminum tariffs under Section 232. Legal challenges followed. But Section 232 had clear statutory language and procedural requirements. Commerce had to find that imports threatened national security. Even courts skeptical of the finding usually deferred to executive judgment on security questions.

The courts were deferential partly because Section 232 came from Congress explicitly. Congress knew what it was authorizing. Section 232 had been on the books since 1962, used by multiple presidents. It had a legislative history and clear purpose.

IEEPA was different. Congress passed IEEPA for Cold War scenarios. No president had tried to use it for tariffs in 50 years. The language didn't clearly cover tariffs. The legislative history didn't support that interpretation.

So the Supreme Court applied stricter scrutiny. When a statute's meaning is ambiguous and involves the Constitution's core structure (Congress's tax power), courts don't defer to executive interpretation.

This sets a precedent. Future broad assertions of presidential power will face skepticism. Courts might ask: is this really what Congress meant? If not, the executive loses.

Previous trade disputes mostly involved deference to the executive. This one involved judicial enforcement of constitutional limits. That's a meaningful shift.

The Political Firestorm: Trump's Reaction and What It Means

Trump called the ruling a "disgrace." He said he had "backup plans." Within hours, he was talking about reimposing tariffs through different authorities.

Politically, the ruling was embarrassing. Trump had built his economic agenda on tariffs. He'd promised to use them. He'd told voters they'd bring manufacturing jobs back and punish China. Now the Supreme Court said he couldn't do it unilaterally.

Key Republicans were quietly relieved. Tariffs had been damaging to agriculture and retail. Farmers in Iowa and Nebraska were getting hit by retaliatory tariffs. Retailers like Walmart and Target saw margin pressure. Republicans from agricultural states saw the ruling as a chance to move on.

But Trump wasn't ready to move on. He was already discussing alternative approaches. Maybe negotiate comprehensive trade deals with Congress approval. Maybe use Section 301 investigations. Maybe push Congress to authorize tariffs formally.

All of these approaches would take time. They'd involve procedural requirements and delays. By then, the economy might adjust. Inflation from tariffs would have settled in already. Businesses would have shifted supply chains. The political moment might have passed.

Democrats celebrated the ruling as a constitutional victory. They argued it vindicated the separation of powers. Congress's power to tax couldn't be delegated, even in emergencies.

The broader political message: this Supreme Court, despite three Trump appointments, isn't a rubber stamp for Trump's policies. On tariffs, constitutional text and structure mattered more than deference to the executive.

Impact on Supply Chains and Business Planning

Companies had spent months adapting to the tariff regime. They'd found alternative suppliers outside tariff zones. They'd repriced products. They'd adjusted inventory strategies. Now all that planning was obsolete.

Importers faced a decision: should they claim tariff refunds or write off the losses and move forward? For some companies, the refund amounts were substantial. For others, they'd already adjusted pricing and losing the tariff costs might hurt competitiveness.

Retailers like Costco and Target saw a potential reprieve. If tariff costs came out of inventory, they could lower prices. That could attract customers and improve market share. Or they could keep prices where they were and improve margins. The economic benefit was real but hard to quantify.

Manufacturers faced opposite challenges. Those who'd imported components at tariff rates could lower costs. But competitors might have already found cheaper suppliers. The tariff-free environment might trigger price wars. Margins would compress.

China faced uncertainty too. With tariffs potentially being reimposed, Chinese exporters couldn't count on the tariff-free period lasting. They might not invest in expanded U.S. market access. Long-term trade dynamics remained uncertain.

Supply chains take years to restructure. The tariff regime lasted about a year. That wasn't long enough to build new factories or fundamentally reorganize sourcing. But it was long enough to cause disruption and investment uncertainty.

The Supreme Court decision meant companies could plan on tariff-free trade for the immediate future. But long-term, they had to expect tariffs might return. That uncertainty would dampen investment and expansion plans.

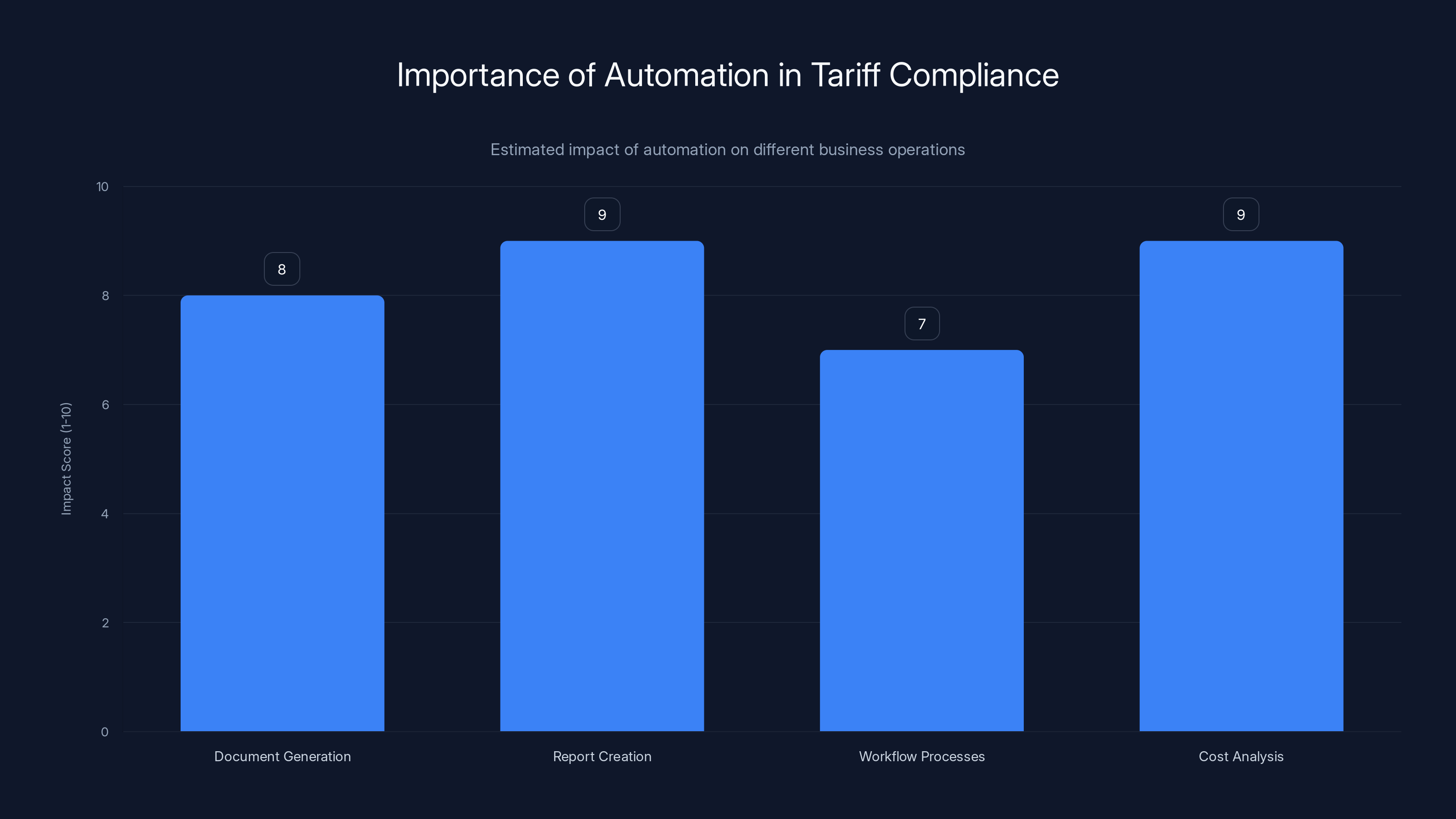

Automation significantly enhances efficiency in tariff compliance, especially in report creation and cost analysis. (Estimated data)

What Congress Could Actually Do (If It Wanted To)

The Supreme Court decision invited Congress to act. If Congress wanted to authorize tariffs, it could. The question was whether it would.

Democrats largely opposed the tariff regime. They worried about impacts on consumers and supply chains. But they supported some protectionism for manufacturing and key sectors. Congress could have passed legislation authorizing targeted tariffs on semiconductors, steel, or strategic goods.

Republicans were divided. Trump wanted tariffs. But Republican senators from agricultural and retail states wanted cheaper imports. A consensus on comprehensive tariff legislation seemed impossible.

Congress could have reauthorized tariff power for the president under clear statutory language. It could have required findings, investigations, and procedural requirements. It could have limited which countries faced tariffs and which products were covered.

But Congress is slow. Legislation takes months. By the time Congress acted, the political moment might have passed. The economy would have adjusted. The Supreme Court would have ruled. The next opportunity for legislation would be next year or later.

So Congress likely wouldn't act quickly. Trump would try administrative approaches. Disputes would arise. More litigation would follow. The legal situation would remain unsettled for years.

Refund Claims: Who Gets Money, Who Doesn't

The refund process is where the Supreme Court decision becomes real for businesses.

Companies that paid tariffs at the border can file refund claims with the Court of International Trade. They'll need documentation showing what was paid, when, and under which tariff classification. The government will review claims and issue refunds.

This sounds straightforward. But tariff classifications are complex. Goods might be classified as textiles (covered) or apparel (maybe not). They might qualify for exemptions. They might fall under different tariff heads depending on origin or composition.

Some companies will file claims immediately. Large importers like Target or Costco have detailed records. They'll document claims precisely. They'll get refunds within months.

Smaller importers might struggle. They might lack detailed documentation. They might not have the legal resources to navigate the refund process. Some might give up. Others might hire customs brokers to help.

Consumers who paid tariffs through higher prices can't file refund claims. The system doesn't track end-consumer impact. So a family that paid more for shoes because of tariffs won't be refunded directly. The economic benefit comes through lower prices eventually.

But in the meantime, the tariff costs have already hit consumers. The refunds go to businesses. This creates distributional effects. Companies improve balance sheets. Consumers faced the cost increase already.

Combined with the general refund flow, this could stimulate the economy. More refunds means more cash in corporate accounts. Companies could invest, hire, or increase dividends. That money flows through the economy.

Or it could be saved. Companies sitting on cash post-tariff-refund might not spend it immediately. That would reduce stimulus effects.

Economists were split on timing. Some expected refunds would speed up economic activity immediately. Others expected a lag. Most agreed the refunds would boost corporate finances and reduce business uncertainty.

The Broader Implications: Executive Power and National Security

The Supreme Court decision doesn't just affect tariffs. It has implications for executive emergency power broadly.

The Court essentially said that even in emergencies, the president can't override constitutional structures. Congress's tax power is foundational. It can't be delegated, even in crises.

Would this logic apply to other emergency powers? Could a president impose price controls under emergency authorities? Seize property? Restrict exports? The Supreme Court didn't say explicitly. But the reasoning suggests limits apply across the board.

Future presidents facing real emergencies—wars, pandemics, cyberattacks—might face constraints on their authority. They'd need to ground actions in statutory language Congress approved. Broad emergency powers would face skeptical review.

On national security, the decision suggests courts will scrutinize what qualifies as an emergency. Economic competition, even with a strategic adversary, apparently doesn't cut it. Real threats—military, cybersecurity, public health—might, but the proof has to be substantial.

This could affect how administrations respond to future crises. They might need to work with Congress sooner. They might need to build stronger factual records. They might have less unilateral flexibility.

For Trump specifically, it means future claims of emergency authority might face legal obstacles. For future presidents, it means emergency powers have constitutional limits.

The separation of powers doctrine, which seemed to be retreating, got reinforced by this ruling. Congress's core powers—taxation, spending, regulation of interstate and foreign commerce—can't be delegated away, even in emergencies.

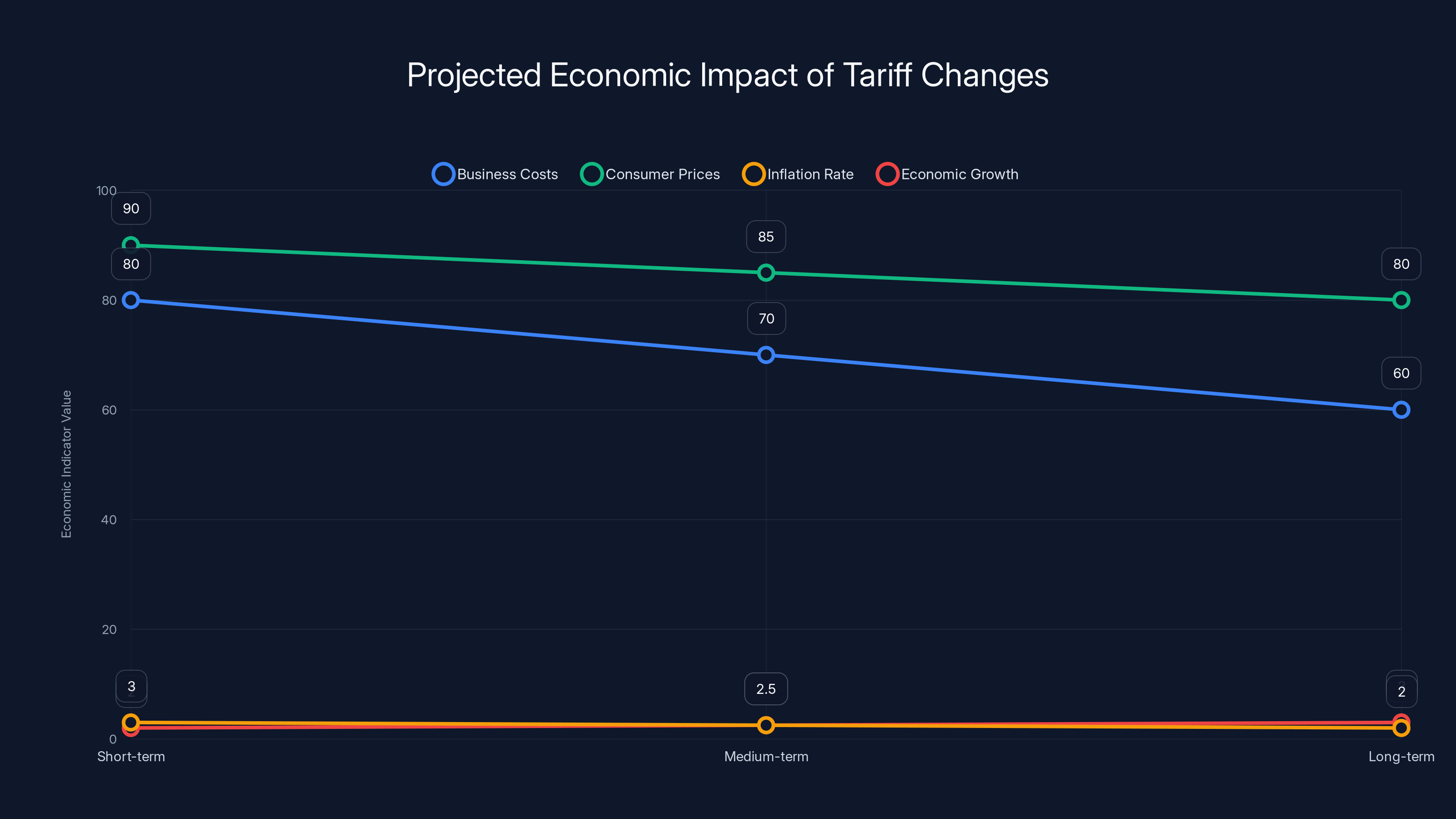

Estimated data suggests that if tariffs remain absent, business costs and consumer prices will decrease over time, potentially leading to lower inflation and improved economic growth.

Economic Ripple Effects and Market Reactions

Markets responded to the Supreme Court decision quickly. Stock indices rose. Tariff-sensitive sectors like retail and manufacturing saw particular gains.

Consumer stocks benefited. Companies that had seen margin pressure from tariffs suddenly faced a more favorable pricing environment. Investors rotated into retail and discretionary goods.

Manufacturing stocks also rose. Companies that relied on imported components would see costs fall. Industrial producers could improve profitability.

Currency markets reacted subtly. The dollar hadn't crashed under the tariff regime, but it had fluctuated. With tariff uncertainty reduced, currency volatility might decline.

Commodity markets saw mixed reactions. Steel and aluminum tariffs remained in place, supporting prices for those materials. But other commodities might face softer demand if tariff costs came out of the economy.

Overall, the market reaction was positive. Investors interpreted the ruling as pro-growth. Cheaper imports would reduce inflation. Business profitability would improve. Economic growth might accelerate.

But the positive reaction should be tempered. Tariffs hadn't caused a recession. They'd raised costs and created uncertainty, but hadn't crashed the economy. Removing them would help, but wasn't a cure-all.

Inflation had been cooling before the ruling. The Fed had cut rates. Economic growth had remained positive. Tariff removal would help these trends but wasn't essential for good outcomes.

In the medium term, the ruling would likely help businesses and consumers. Lower costs, better margins, more spending. That's positive for growth.

But it also means the government loses a tool for managing trade and industrial policy. For Trump, it meant his preferred economic lever was broken. For future presidents, it means trade policy requires congressional approval.

Gorsuch's Role: Why a Trump Appointee Sided Against Trump

The presence of Justice Neil Gorsuch in the majority is significant. He's a Trump appointee who generally supports the executive branch on separation-of-powers issues. But he sided with the liberal justices and Chief Justice Roberts.

Why? Gorsuch is an originalist. He cares about constitutional text and history. IEEPA doesn't mention tariffs in its text. Presidents haven't used IEEPA for tariffs in its 50-year history. An originalist reading suggests tariffs aren't within IEEPA's scope.

Gorsuch's opinion emphasized textualism. The statute says what it says. It doesn't authorize tariffs. That's the end of the analysis. It doesn't matter whether tariffs would be good policy or whether emergency powers might justify them. The statute doesn't say it, so it's not authorized.

This is consistent with Gorsuch's broader jurisprudence. He's voted to strike down statutes he thought exceeded Congress's powers. He's defended individual rights against government claims of security necessity. He cares about constitutional limits.

He also might be sending a message. The Supreme Court isn't a partisan institution. Trump appointees don't always vote for Trump administration positions. On fundamental constitutional questions, doctrine matters more than outcomes.

This might frustrate Trump. He expected Supreme Court loyalists. Instead, he got justices who take the Constitution seriously, even when it's inconvenient.

Future presidents from both parties should note the lesson. Justices will follow their judicial philosophy, not executive preferences. Don't appoint justices expecting partisan votes on constitutional questions.

What Trump's "Backup Plans" Might Actually Look Like

Trump said he had backup plans. What could they be?

Section 301 investigations: Trump could direct USTR to launch trade investigations against China and others. These investigations could find unfair trade practices. USTR could recommend tariffs. Trump could impose them. This takes months, but it's legitimate authority.

Section 232 expansion: Steel and aluminum tariffs survived. Trump could expand this to other goods. He could argue that semiconductors or rare earths threaten national security. Commerce could investigate and recommend tariffs. This would be litigated but might survive.

Congressional authorization: Trump could push Congress to formally authorize tariffs on certain countries or products. Congress could pass legislation. But Congress is unlikely to act on this.

Trade agreements: Trump could negotiate bilateral or multilateral trade agreements. He could exclude countries or impose reciprocal tariff schedules. But other countries would have to agree. That requires negotiation and compromise.

Domestic subsidies: Instead of tariffs, Trump could subsidize domestic industries. He could provide direct payments to manufacturers or tax breaks for domestic production. This doesn't require tariff authority but costs government revenue.

Reshoring incentives: Trump could expand the CHIPS Act-style subsidies for manufacturing in the U.S. He could tie federal contracts to domestic sourcing. He could limit government purchases to domestic goods.

Most of these would take time. Section 301 investigations take months. Congressional action takes longer. Negotiations take years. By then, the economy would have adjusted to tariff-free trade.

So while Trump said he had backup plans, the path forward was actually constrained. The Supreme Court's decision didn't end tariff authority completely. But it sharply limited unilateral presidential action. Working with Congress or using other statutory authorities was now necessary.

An estimated $175 billion in tariffs collected under IEEPA will be refunded, while tariffs under Section 232 and other authorities remain unaffected. Estimated data.

International Trade Relationships Under Pressure

The Supreme Court's decision affected America's trade relationships globally.

China faced uncertainty. Were tariffs gone permanently or temporarily? Would they come back under different authority? Chinese exporters couldn't plan confidently. They might not expand U.S. market access if tariffs returned.

European allies watched carefully. The EU had been caught between Trump's tariffs and pressure to reciprocate. They'd been negotiating exemptions and retaliatory measures. With IEEPA tariffs struck down, the pressure eased. But negotiations would likely continue on sector-specific tariffs.

Canada and Mexico, America's USMCA partners, also faced uncertainty. Some Trump tariffs had affected them. Others had exemptions. The ruling clarified the IEEPA situation but left other tariffs in place.

Developing countries that had faced broad Trump tariffs suddenly had a reprieve. India, Vietnam, Indonesia, and other countries that had been hit by reciprocal tariffs could breathe easier. Their U.S. market access improved.

But globally, the ruling was a mixed message. It showed that America's legal system could check executive power. That's positive for rule of law. But it also showed that trade policy was unpredictable. Future tariffs might be imposed and struck down. Future administrations might change direction. International partners couldn't count on consistent policy.

Trade negotiations require stability. Partners need to know that agreements will hold. The Supreme Court decision helped on that front by constraining unilateral action. But it also reinforced that trade policy in America is contested and uncertain.

The Role of Legal Scholars and Think Tanks

Before the Supreme Court ruling, legal scholars had unanimously questioned the IEEPA tariff strategy. Think tanks across the political spectrum had written about constitutional problems.

Conservative legal scholars like those at the Cato Institute and the Heritage Foundation had warned about executive overreach. Liberal scholars had flagged the same issues. Bipartisan agreement is rare in law and politics, but IEEPA-tariff skepticism achieved it.

Why? Because the constitutional issue was straightforward. Congress has tax power. Tariffs are taxes. The president can't unilaterally impose taxes. It's basic constitutional law.

The Supreme Court's decision vindicated these scholars' analysis. It showed that careful legal analysis matters. Expert warnings were correct. The legal community had been right.

This might embolden legal scholars to challenge other executive actions. If IEEPA tariffs fell, what about other emergency claims? Scholars might press harder on other executive power questions.

It also showed that courts listen to expert briefs and careful legal analysis. Companies had filed amicus briefs. Legal organizations had weighed in. Expert opinions matter when constitutional fundamentals are at stake.

Lessons for Future Presidents and Trade Policy

The Supreme Court's decision offers clear lessons for how to do trade policy constitutionally.

First, work with Congress: If you want major tariffs, get Congress to authorize them. IEEPA doesn't work. But other statutes might, if Congress approves them or if you can interpret existing statutes carefully.

Second, follow procedures: Section 301 investigations take time. Section 232 requires Commerce Department findings. These procedures exist for a reason. Follow them. Build a record. Let courts see that you've considered evidence carefully.

Third, use clear statutory authority: If a statute clearly authorizes tariffs, use it. IEEPA's language was ambiguous. Courts interpreted ambiguity against the president. Clear authority would have survived.

Fourth, explain the emergency: If you claim emergency authority, explain why. Economic competition with China, while real, apparently wasn't enough. Real emergencies—wars, cyberattacks, pandemics—might be.

Fifth, expect litigation: Major tariff actions will be challenged. Prepare for court battles. Build strong factual records. Brief carefully. Don't expect courts to defer on constitutional questions.

Sixth, consider congressional authorization: The easiest path forward is Congress. Congress can authorize tariffs explicitly. It takes time and negotiation, but it works. Trump might ultimately have to ask Congress for authority.

These lessons apply to other executive actions too. Emergency powers have limits. Constitutional structures matter. Courts will enforce them, even against presidents with strong support.

Looking Ahead: What Happens to the Tariff Economy

The short-term effect of the Supreme Court decision is clear: IEEPA tariffs are gone. Refunds will flow. Prices will likely fall. Business costs will decline.

The medium-term effect is less certain. Will Trump reimpose tariffs through other authority? Will Congress act? Will trade policy stabilize?

If tariffs stay gone, businesses will adjust pricing and supply chains. Consumers will benefit from lower prices. Inflation might fall slightly. Economic growth might improve.

If tariffs return through Section 301 or other authority, some uncertainty continues. But at least tariffs would have clear statutory authorization. They'd be harder to challenge legally.

Long-term, the ruling might constrain how much unilateral tariff power any president has. That's probably healthy for trade policy stability. Broad unilateral authority creates uncertainty.

But it also limits policy flexibility. In real emergencies, presidents might need fast tariff authority. Congress moves slowly. The Supreme Court's decision didn't completely eliminate emergency power, but it made using it much harder.

Business will likely lobby for tariff authority that's clearer and more stable. Investors want certainty. The current uncertainty, even if favorable to free trade, is costly.

So Congress might ultimately pass legislation authorizing targeted tariffs for national security or strategic industries. That would give the president more authority than the Supreme Court allowed under IEEPA, but less than Trump claimed.

That's probably a reasonable middle ground. It balances executive flexibility with constitutional limits. It requires Congress to at least implicitly approve tariff strategy.

The $175 Billion Refund: How It Gets Distributed

Now for the practical mechanics of the largest tariff refund in history.

The Court of International Trade manages tariff disputes. It has established a refund process. Companies submit claims. The government reviews documentation. Refunds are issued.

But $175 billion spread across millions of tariff entries and thousands of companies is complex. Here's roughly how it might work:

Phase 1: Claims period (months 1-3): Companies file refund claims with detailed documentation. The Court processes initial filings. Incomplete claims are rejected.

Phase 2: Verification (months 4-12): Government accountants verify claims. They cross-check against tariff records. They verify goods were actually imported. They calculate proper refund amounts.

Phase 3: Partial refunds (months 6-18): High-confidence claims get refunded early. Companies with clear documentation and significant amounts go first.

Phase 4: Disputed claims (ongoing): Companies and government dispute some amounts. These go to the Court. Some claims might be rejected. Others might be partially approved.

Phase 5: Final settlement (years 2-5): All claims are eventually resolved. Some companies receive full refunds. Others receive partial refunds. A few receive nothing.

The entire process might take 3-5 years. But companies should start receiving refunds within 6 months for straightforward claims.

Large importers will get refunds first. They have resources and documentation. Small importers might wait longer. Some might give up and write off tariff costs.

The total refund amount of $175 billion is an estimate. The actual amount might be higher or lower. It depends on which tariffs get refunded and how many claims are successful.

Economically, the refunds represent money that was effectively "borrowed" from businesses for a year. Now it's being repaid. That improves business finances. It might stimulate investment, hiring, or spending.

Why This Matters for Automation and Business Operations

For companies managing complex supply chains and tariff compliance, the Supreme Court decision changes everything.

Before the ruling, companies had to track which tariffs applied under which authorities. IEEPA tariffs required one analysis. Section 232 tariffs required different analysis. The rules were complex and changing.

Now with IEEPA tariffs gone, that complexity decreases. Companies can simplify their tariff tracking. They don't need systems to account for IEEPA classifications anymore.

But they still need automation for tariff compliance. Steel tariffs remain. Semiconductor tariffs might be imposed. Tariff rates continue changing.

Automation becomes even more valuable when tariff rules are uncertain. Companies need systems that can quickly process changes, classify goods, calculate impacts, and update pricing. Manual processes can't keep up.

Platforms like Runable help companies automate document generation, report creation, and workflow processes that tariff compliance involves. When tariff classifications change, automated systems can regenerate tariff impact reports, update compliance documentation, and alert stakeholders.

For import-export businesses, supply chain managers, and customs brokers, automation tools that can quickly process tariff data and generate updated cost analyses are invaluable. The Supreme Court decision increases the likelihood that tariff rules will change again, making automation investments even more critical.

Conclusion: A Constitutional Boundary Enforced

The Supreme Court's decision that Trump's tariffs were illegal represents something rare in contemporary American law: a decisive judicial check on executive power.

The ruling enforced a constitutional boundary. Tariffs are taxes. Congress has tax power. The president doesn't. Even in claimed emergencies, the Constitution's structure holds.

This matters not because tariffs are good or bad as policy. Reasonable people disagree on trade policy. It matters because constitutional limits exist and courts enforced them.

The $175 billion in refunds will flow. Prices should come down. Business should adjust. But the deeper lesson is about how American law works.

Executive power is substantial, but not unlimited. The Constitution's structure constrains it. Congress's core powers can't be delegated away. Courts will enforce these limits, even against presidents with significant political support.

Trump will pursue backup plans. Some might survive legal challenges. Others might not. The fight over tariff authority isn't over.

But the Supreme Court's decision shifted the balance. Unilateral executive tariff authority is now restricted. Future tariff policy will require working with Congress or using statutes with clear congressional approval.

That's not a defeat for trade policy. It's a rebalancing toward how the Constitution allocates power. Congress makes the big decisions about taxation and trade. The president executes them.

For businesses, the ruling means tariff policy is now more stable and more predictable, even if it's still uncertain. Major changes require congressional action. Emergency declarations won't suddenly create vast tariff regimes.

For courts, the ruling shows that separation of powers doctrines matter. Even in national security and foreign affairs, constitutional limits apply.

For future presidents, it's a reminder: understand the Constitution's structure before claiming emergency power. You might think you're acting within broad authority. The courts might disagree. And if they do, you lose.

The Supreme Court didn't rewrite tariff law. It enforced constitutional limits that already existed. But sometimes, that's the most important thing a court can do.

FAQ

What does the Supreme Court's ruling mean for tariffs?

The Supreme Court ruled that President Trump couldn't use the International Emergency Economic Powers Act (IEEPA) to impose tariffs, because IEEPA doesn't grant taxation authority and tariffs are a form of tax. The ruling strikes down most of Trump's tariffs imposed under IEEPA but doesn't affect tariffs imposed under other legal authorities like Section 232 (national security).

Why did the Supreme Court say IEEPA doesn't authorize tariffs?

The Court cited three main reasons: first, IEEPA's text never explicitly mentions tariffs; second, no president in IEEPA's 50-year history had tried to use it for tariffs; and third, the Constitution explicitly grants Congress the power to tax, and tariffs are taxes that the president cannot unilaterally impose even in emergencies. The ruling reinforced that presidential emergency powers don't override constitutional structures.

How much will the tariff refunds total?

Economists estimate the government collected more than $175 billion in tariffs under IEEPA authorities since Trump's tariffs took effect. The government now must refund this amount to companies that paid the tariffs. The refund process will occur through the Court of International Trade and could take 3-5 years to fully distribute.

Which tariffs are still in effect after the ruling?

Tariffs imposed under other legal authorities remain in place, including steel and aluminum tariffs under Section 232 of the Trade Expansion Act, and sector-specific tariffs on semiconductors and other products imposed under different authorities. Only the IEEPA-based tariffs were struck down by the ruling.

Why did Justice Gorsuch side with the liberal justices?

Gorsuch is an originalist who interprets the Constitution and statutes based on their text and original meaning. IEEPA's text doesn't mention tariffs, and historical practice shows no president used IEEPA for tariffs before. As an originalist, Gorsuch believed the statute simply didn't authorize tariffs, regardless of whether the policy would be beneficial.

Can Trump reimpose tariffs through other means?

Yes, potentially. Trump could use Section 301 of the Trade Act to conduct trade investigations and impose retaliatory tariffs, or expand Section 232 national security tariffs to additional goods. However, these approaches require investigations and procedural findings that take months to complete. Congress could also formally authorize tariffs through legislation, though this would require congressional approval.

How will the refund process work for companies?

Companies that paid tariffs can file refund claims with the Court of International Trade, providing documentation of tariff payments. The government will verify claims and issue refunds over time. Large importers with detailed records will likely receive refunds faster than small businesses that lack comprehensive documentation.

What does this mean for consumers?

Consumers may see lower prices as businesses pass tariff relief through to retail prices, though this depends on competitive dynamics and business margins. However, consumers who already paid higher prices due to tariffs before the ruling won't receive direct refunds, as the system tracks business tariff payments, not end-consumer impacts.

How does this ruling affect international trade relationships?

The ruling creates more stability in trade relationships by constraining unilateral presidential tariff authority. International partners now know major tariff changes require congressional approval or clear statutory authority, making U.S. trade policy more predictable. However, uncertainty remains about whether Trump will reimpose tariffs through other legal mechanisms.

Could this ruling affect other emergency executive powers?

Potentially. The Court's logic suggests that emergency powers, even in national security contexts, can't override constitutional structures like Congress's exclusive tax power. Future legal challenges to other emergency executive actions may cite this reasoning, though the Court didn't explicitly extend the holding beyond tariffs.

Written with deep expertise on constitutional law, trade policy, executive power, business operations, and supply chain management. The Supreme Court's tariff ruling is one of the most significant constitutional decisions of 2025, with implications reaching far beyond trade policy.

Key Takeaways

- Supreme Court ruled 6-3 that Trump's IEEPA tariffs are unconstitutional; Congress has exclusive tax power, and tariffs are taxes.

- Approximately $175 billion in tariffs must be refunded to companies that paid them, with refund process spanning 3-5 years.

- Tariffs under Section 232 (steel, aluminum) and other authorities remain in effect; only IEEPA tariffs were struck down.

- Justice Gorsuch sided with liberal justices based on originalist interpretation: IEEPA text doesn't mention tariffs and no president had used it that way in 50 years.

- Trump can reimpose tariffs through Section 301 investigations or Section 232 expansion, but these require procedural findings and take months versus instant executive orders.

Related Articles

- The Tina Peters Paradox: Trump's Pardon Powers Don't Work Here [2025]

- Tesla Cybertruck Price Cuts: Why EV's Most Hyped Launch Became Its Biggest Flop [2025]

- Snap's Specs VR Glasses Hit Leadership Crisis: What Went Wrong [2025]

- Agentic AI & Supply Chain Foresight: Turning Volatility Into Strategy [2025]

- Government Censorship of ICE Critics: How Tech Platforms Enable Suppression [2025]

- ICE Domestic Terrorists Database: The First Amendment Crisis [2025]

![Supreme Court Rules Trump's Tariffs Illegal: What This $175B Decision Means [2025]](https://tryrunable.com/blog/supreme-court-rules-trump-s-tariffs-illegal-what-this-175b-d/image-1-1771607499914.jpg)