Mackenzie Scott's $7.1 Billion Donation & The Bezos Divorce Saga: What's Really Going On [2025]

When Mackenzie Scott walked away from her marriage to Jeff Bezos in 2019, she didn't just take a massive settlement. She took on a moral obligation that would reshape how billionaire philanthropy works in America.

Fast forward six years, and the numbers are staggering. In 2025 alone, Scott announced she'd donated

But here's where it gets interesting (and messier). While Scott's been methodically redistributing her wealth to charitable causes, her ex-husband has been dealing with his own financial headaches. Recent reports show that Bezos and his current wife, Lauren Sánchez, are locked in a legal battle that's bleeding money into attorney fees. The couple's legal team is demanding that Sánchez's estranged brother, Michael, pay nearly $190,000 in costs related to a defamation case.

This collision of wealth, divorce, charity, and litigation tells us something profound about how ultra-high-net-worth individuals navigate their fortunes in the 2020s. It's no longer just about making money or even keeping it. It's about what you do with it when the public is watching, when the courts are involved, and when your ex-spouse is essentially running an alternative model for extreme wealth redistribution.

Let's break down exactly what happened, why it matters, and what it reveals about the billionaire class in America.

TL; DR

- **Mackenzie Scott donated 26.3 billion

- Focus areas shifted to historically Black colleges and universities, climate solutions, and community development organizations

- Scott's net worth is approximately $32.5 billion, making her one of the world's wealthiest women and most active philanthropists

- Bezos faces mounting legal costs as he battles Lauren Sánchez's brother over defamation and attorney fees exceeding $190,000

- The contrast is stark: Scott redistributes wealth while Bezos litigates over it, reflecting two radically different approaches to post-divorce wealth management

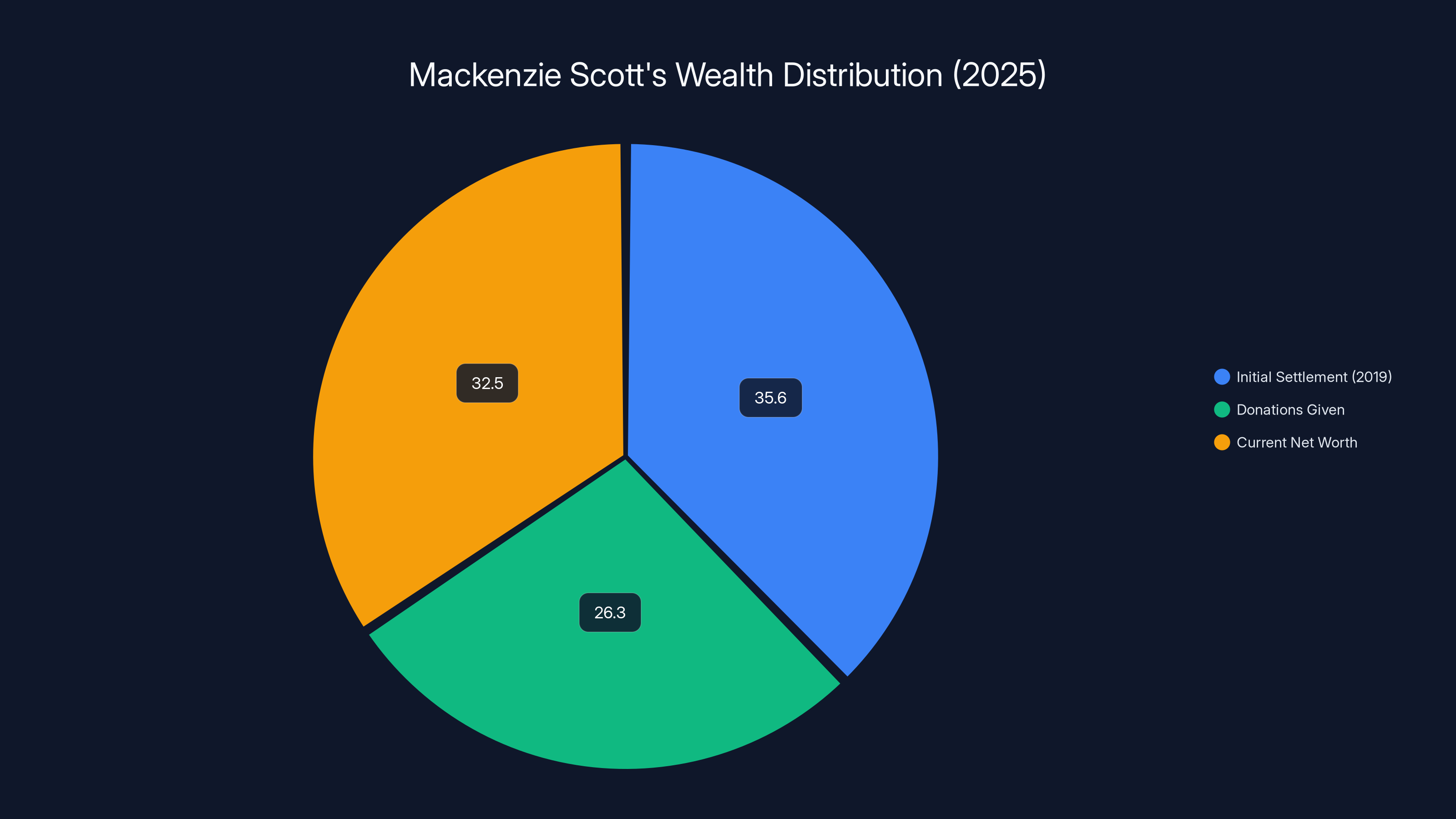

Mackenzie Scott's wealth has been significantly impacted by her philanthropy and investment returns. Despite donating $26.3 billion, her net worth remains substantial due to stock performance and investment gains.

Who Is Mackenzie Scott, Really?

Mackenzie Scott wasn't born into wealth. She wasn't a celebrity or influencer before the divorce. She was, for most of her adult life, a novelist and the wife of the man who founded Amazon in a garage.

Scott wrote novels. The Testing, her debut, was published in 2006 and was nominated for the Pulitzer Prize. She kept writing while raising children with Bezos. She worked quietly, without the public fanfare, while her husband became the world's richest person.

Then came 2019. The divorce happened. Scott received approximately 25% of the couple's Amazon shares, which valued her settlement at roughly $35.6 billion at the time. Suddenly, she wasn't just a novelist with an interesting life. She was one of the wealthiest people on the planet.

But here's what sets Scott apart from other ultra-wealthy individuals: she immediately announced she was going to give it away.

Not eventually. Not after she died. During her lifetime. Most of it.

In a 2019 blog post titled "A Pivotal Moment," Scott wrote: "I have a disproportionate amount of money to manage. My approach so far has been to work with teams of experts and to read tediously on many issues to figure out where I should direct my philanthropic efforts." She committed to distributing her wealth "as quickly as possible" because "a half-trillion-dollar fortune is not a social good."

That's not typical billionaire rhetoric. Most billionaires talk about leaving money to their foundations, about long-term strategic giving, about tax efficiency. Scott said: I have too much money. I'm getting rid of it. Next.

The Scale of $7.1 Billion: What Does It Actually Mean?

Numbers this large become abstract. We lose the ability to conceptualize them. So let's break down what $7.1 billion actually represents in practical terms.

If you earned **

If we distributed

Scott's

Why the acceleration? Scott herself addressed this in her 2025 announcement. She wrote about the interconnectedness of global crises: climate change, mass displacement, inflation, political polarization. She argued that billionaires have a moral responsibility to address these issues now, not later.

"The question isn't whether to act, but how quickly," she essentially said.

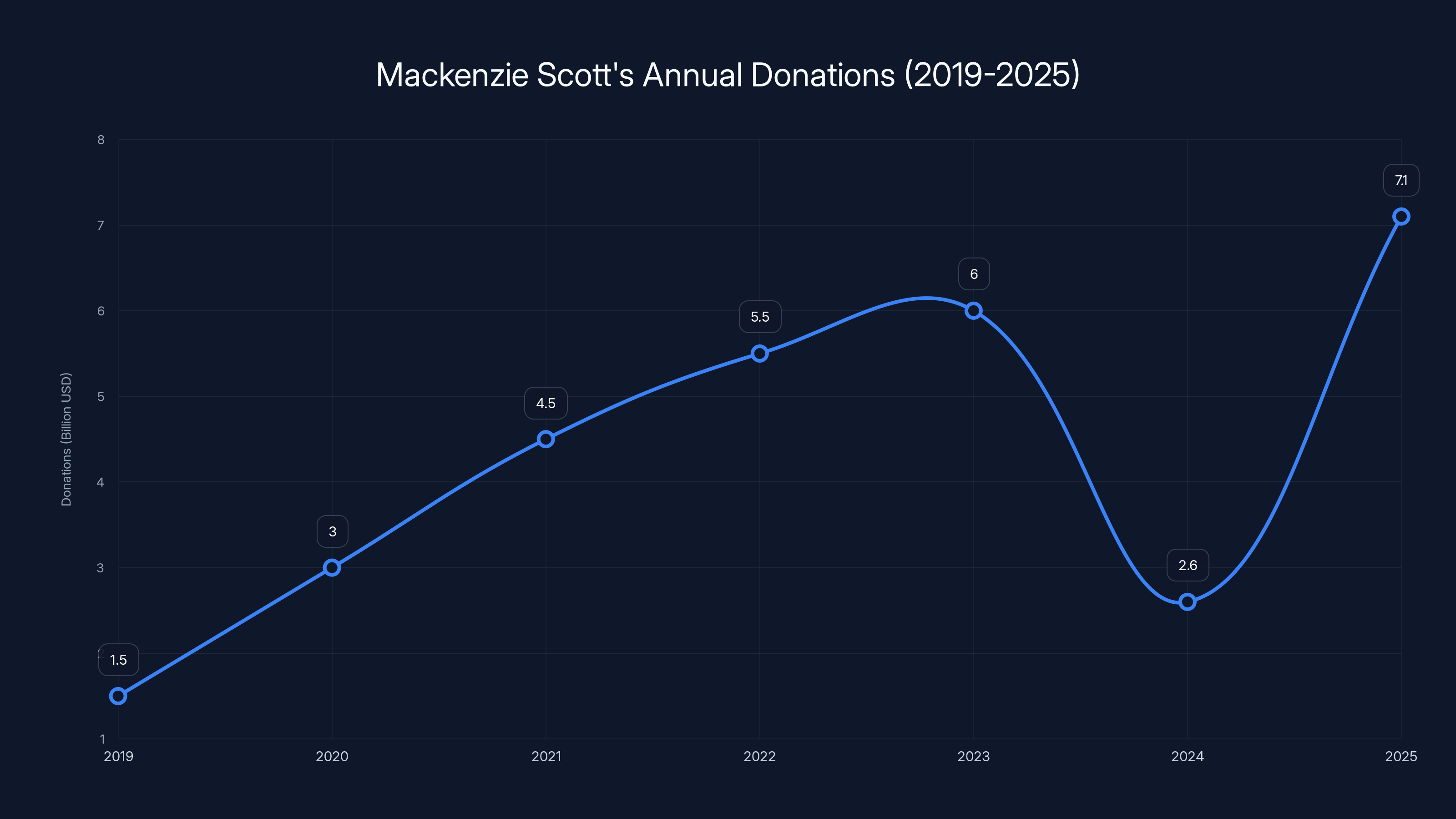

Consider the cumulative impact since 2019:

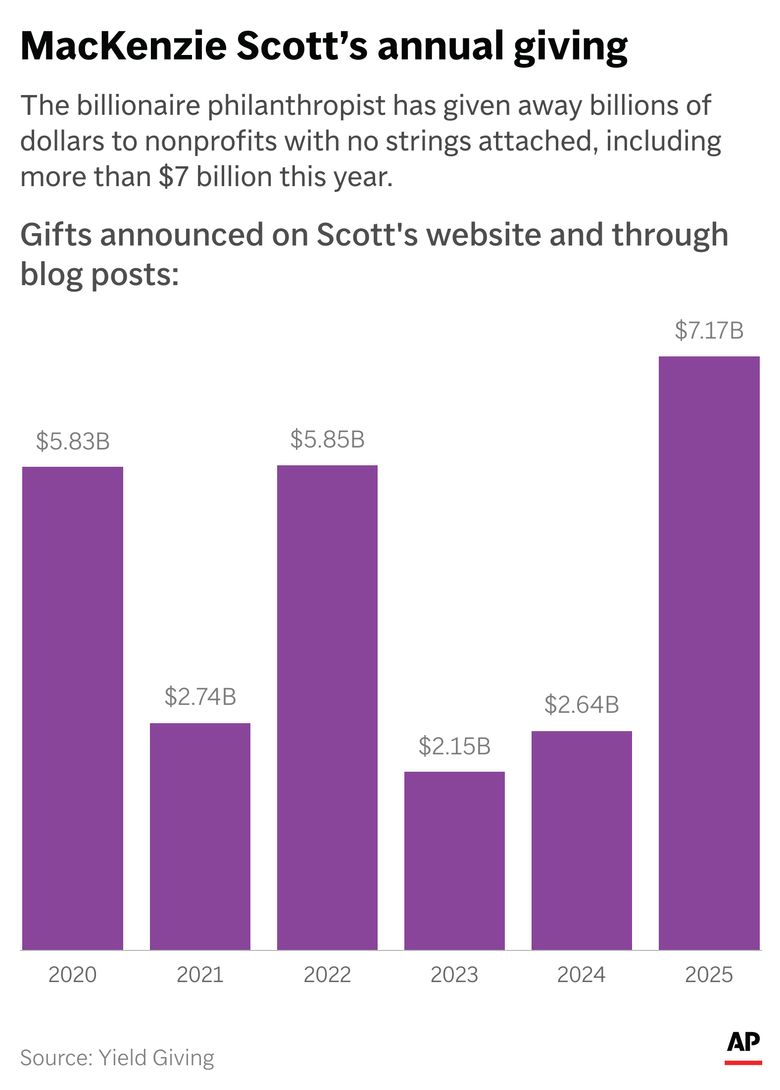

- 2019: $1.7 billion

- 2020: $4.2 billion

- 2021: $4.1 billion

- 2022: $8.6 billion

- 2023: $2.1 billion

- 2024: $2.6 billion

- 2025: $7.1 billion

Total: $26.3 billion in six years.

That's not a steady linear increase. That's someone learning how to give effectively and then choosing to open the floodgates.

Mackenzie Scott's donations have increased significantly over the years, with a notable peak in 2025. Estimated data based on available information.

Where Is The Money Going?

This is where Scott's approach diverges dramatically from traditional billionaire philanthropy. Most mega-wealthy individuals establish foundations, which have legal requirements to distribute only 5% of their assets annually. Scott? She's not using that structure. She's making direct grants to organizations.

More importantly, she's being specific about which organizations.

In 2025, Scott emphasized donations to historically Black colleges and universities (HBCUs). This wasn't a token gesture. We're talking about substantial, transformative gifts to institutions like Howard University, Spelman College, and Morehouse College. These schools have historically been underfunded compared to their predominantly white counterparts, despite producing generations of leaders in medicine, law, business, and government.

Scott also prioritized:

- Climate solutions organizations working on renewable energy transitions and climate adaptation

- Food and nutrition programs addressing hunger and food insecurity

- Community development financial institutions (CDFIs) that provide capital to underserved communities

- Higher education initiatives beyond HBCUs, including debt relief programs for students

- Gender equity programs focusing on women's economic participation and safety

- Racial equity initiatives across multiple sectors

In her 2025 announcement essay, Scott wrote something striking: "Generosity and kindness engage the same pleasure centers in the brain as sex, food, and receiving gifts, and they improve our health and long-term happiness as well." She wasn't justifying the giving from an abstract moral high ground. She was pointing to neuroscience, to the literal brain chemistry of generosity.

She also wrote: "The peace-fostering byproducts of one unexpected act of kindness toward a stranger of a different background or beliefs might inspire a beneficial chain reaction that goes on for years. Respect, understanding, insight, empathy, forgiveness, inspiration—all of these are meaningful contributions to others."

That's not corporate philanthropy speak. That's someone thinking deeply about how to actually change systems.

The Strategic Shift: Investments Aligned With Values

Here's something most coverage of Scott's giving misses: she's not just donating money. She's restructuring her entire portfolio around her values.

Scott mentioned in her 2025 statement that she's moving more of her wealth into investments that align with her philanthropic goals. This is a sophisticated wealth management strategy that goes beyond charity. It's about redirecting capital flows themselves.

When a billionaire with $32.5 billion says "I'm moving my investments to align with my values," that affects markets. It affects which companies get funding, which industries attract capital, which business models become viable.

Think about the ripple effects:

If Scott invests heavily in renewable energy companies, her capital helps scale those businesses. As they scale, costs decrease, adoption increases, and the entire clean energy sector becomes more competitive. This is capitalism being redirected toward different outcomes.

If she invests in community development financial institutions, she's essentially redirecting capital back to communities that have historically been redlined and excluded from traditional banking systems.

This is a different model than traditional charity. Traditional charity treats the symptoms. Strategic investment treats the system itself.

Mackenzie Scott vs. Jeff Bezos: A Tale of Two Billionaires

The contrast between how Scott and Bezos manage their post-divorce wealth is almost literary in its starkness.

Scott is giving it away. Bezos is fighting in court over how much his current wife's brother has to pay back in legal fees.

Let's be clear about what's happening here. According to reports, Bezos and Lauren Sánchez filed a motion in California Superior Court demanding that Michael Sánchez (Sánchez's estranged brother) pay

Where did this come from? The backstory involves an affair between Bezos and Sánchez that allegedly occurred while she was still married to her ex-husband, Patrick Whitesell. The details of that affair somehow became public. Michael Sánchez was suspected of leaking the information, though he denied responsibility and sued for defamation.

The Los Angeles County Superior Court ruled in Bezos's favor. The judge sided with Bezos. Now Bezos is demanding that Sánchez cover all the legal costs incurred in the process.

From a purely financial perspective, Bezos's net worth is approximately **

But here's what's telling: while Bezos is fighting over

Bezos's approach to post-divorce wealth is traditional wealth protection: maintain ownership, defend against litigation, minimize losses. Scott's approach is radical redistribution: accelerate giving, align investments with values, give away the majority of your fortune.

They're playing completely different games.

Scott's donations show a significant increase in 2022 and 2025, indicating strategic shifts in her philanthropic approach.

The Lauren Sánchez Factor: How New Money Changes Old Dynamics

Lauren Sánchez isn't a billionaire. She's a journalist and television personality. When she married Bezos in 2022, she gained access to his enormous wealth but no legal claim to it (unless that were to change through some future agreement).

The lawsuit with her brother, Michael Sánchez, appears to stem from the affair revelations and subsequent legal disputes. But here's what's interesting: Michael Sánchez is being asked to pay Bezos's legal costs. This suggests Bezos's legal team was sufficiently confident in their position that they're demanding reimbursement from Michael for defending against his defamation claims.

From Michael's perspective, this is a disaster. He lost the lawsuit. He's being ordered to pay nearly $200,000 in his opponent's legal fees. And the opponent is one of the world's richest people, with unlimited resources to pursue such claims.

For Bezos and Sánchez, this legal victory probably represents something else: validation. The court agreed with them. The person they accused of leaking their private communications lost. And now that person has to pay for it.

But the broader context is important. This legal battle is happening while Scott is giving away billions, while Bezos is getting remarried, while the entire structure of their post-divorce relationship is being negotiated in public.

The Sánchez lawsuit is a sideshow to the main production, which is: how do we reorganize an enormous fortune after divorce?

For Scott, the answer is: give most of it away to people and causes that matter.

For Bezos, the answer seems to be: defend against legal threats, maintain control, and restructure the family around a new spouse.

Mackenzie Scott's Net Worth: A Detailed Breakdown

Scott's current net worth is estimated at approximately $32.5 billion by Forbes, though this number fluctuates daily based on Amazon stock performance.

Here's how we got there:

The Divorce Settlement (2019)

- Scott received 25% of the couple's Amazon shares

- This represented approximately 16.3 million shares

- At the 2019 settlement value: roughly $35.6 billion

- The remaining 75% stayed with Bezos

The Current Situation (2025)

- Scott has given away $26.3 billion since 2019

- Her remaining fortune is approximately $32.5 billion

- This decrease reflects both her donations and some market fluctuations (Amazon stock hasn't increased linearly)

- Her wealth rank places her among the top 10 wealthiest women globally

- She's the second-wealthiest person focused primarily on philanthropy (after Bill Gates, though Gates has a higher net worth)

The Math of Wealth Reduction

Let's think about this mathematically. If Scott started with ~

Several factors:

-

Amazon Stock Performance: Amazon stock has fluctuated. Some years it's appreciated significantly, other years it's declined. These gains/losses affect the total value of her holdings.

-

Investment Returns: Scott hasn't just left money sitting in a bank account. She's invested it. Some investments have generated returns. These returns increase her net worth even as she gives money away.

-

Reporting Delays: Net worth estimates are snapshots in time. Forbes publishes annually. The actual number changes daily.

-

Diversification: Scott has diversified her portfolio beyond Amazon stock. These holdings have different performance profiles.

The key insight: even while giving away money at extraordinary rates, Scott's wealth remains enormous because of compounding returns, stock appreciation, and investment performance.

Jeff Bezos's Remaining Empire and Legal Position

Bezos still controls an estimated 9% of Amazon, worth roughly

- Blue Origin: His space exploration company (estimated value: $15-20 billion)

- The Washington Post: The newspaper he purchased in 2013 (estimated value: 250 million)

- Real Estate: Multiple properties worth an estimated $500 million+

- Other Investments: Various tech and venture capital investments

Bezos's wealth is more diversified than it was during his Amazon-only days, but Amazon still dominates his net worth.

From a legal standpoint, the Michael Sánchez situation represents a victory for Bezos, but it's relatively minor in financial terms. Approximately $190,000 in attorney fees is genuinely negligible at his wealth level. We're talking about a rounding error in his daily wealth changes (his net worth fluctuates by more than that every time Amazon stock moves a fraction of a percent).

But the victory matters symbolically. It means the court agreed with Bezos's position. It means a private legal conflict was resolved in his favor. It means Michael Sánchez lost.

For someone accustomed to winning, that's what matters.

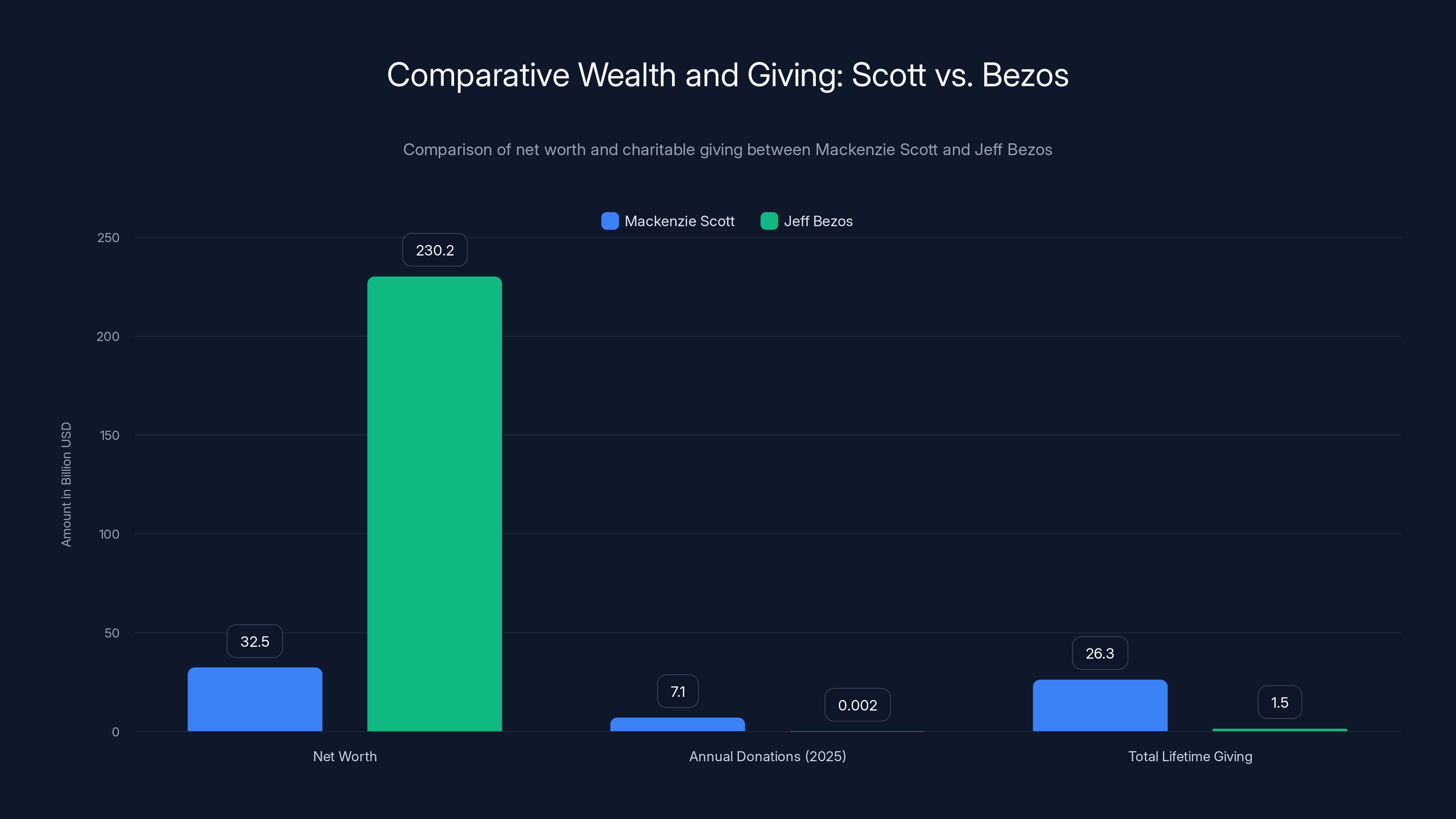

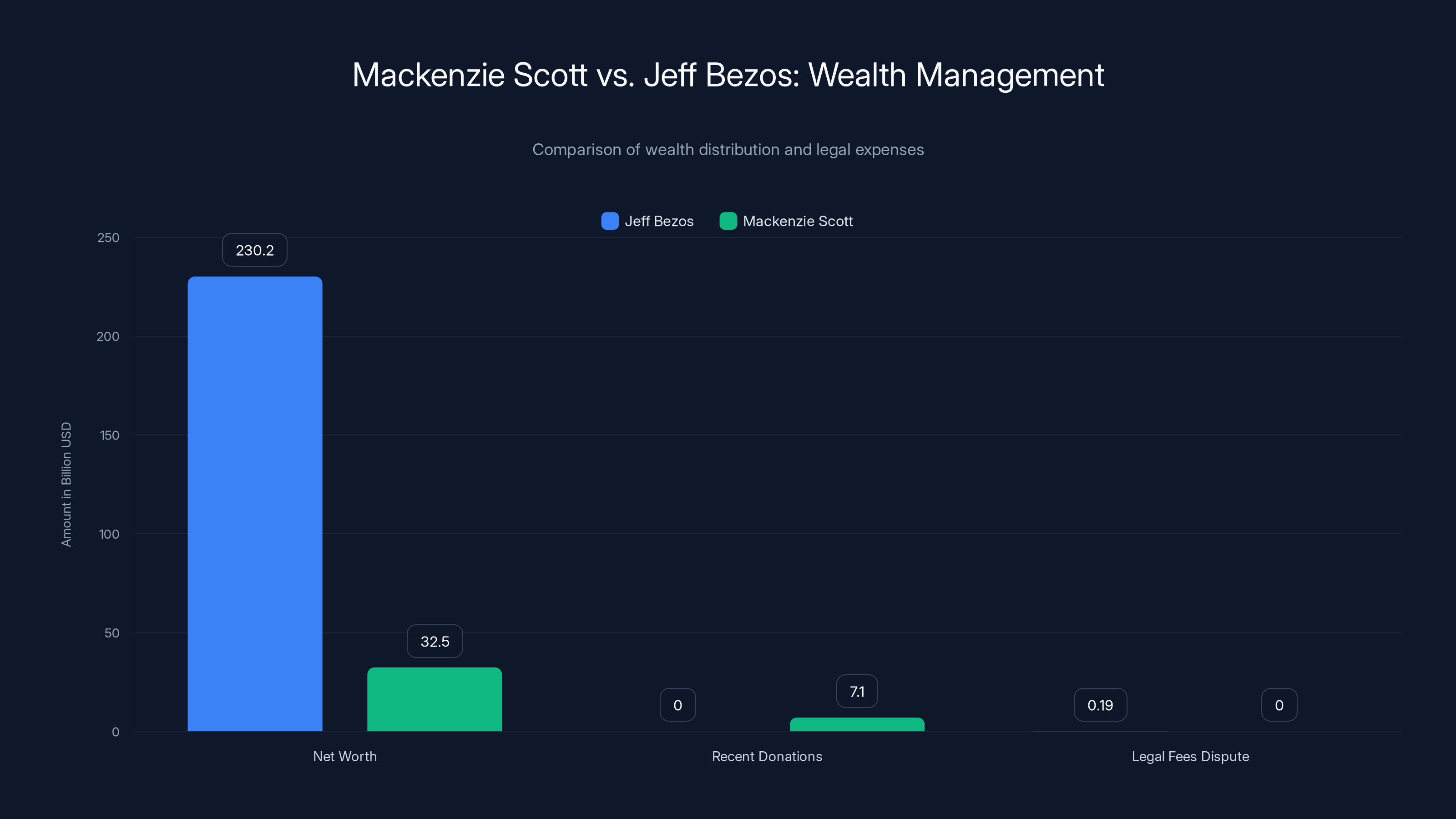

Mackenzie Scott's net worth is about 14% of Jeff Bezos's, yet her annual donations are significantly larger in proportion to her wealth. Estimated data for Bezos's lifetime giving.

The Defamation Case: What Actually Happened

Let's dig into the actual lawsuit, because it reveals something about modern celebrity litigation.

In January 2019, the National Enquirer published details about Bezos and Sánchez's extramarital affair. The story included private messages, details of their relationship, and information that was clearly supposed to be confidential.

Bezos immediately claimed he was the victim of a politically motivated hit job. He suggested that Saudi Arabia (through the Saudi Public Investment Fund, which owns stakes in multiple media companies) had orchestrated the leak to embarrass him. He published a detailed account of the situation online, essentially crowdsourcing an investigation into who leaked the information.

The prevailing theory was that Michael Sánchez leaked the information. Why? Allegedly because he was angry about something related to his sister's relationship with Bezos.

Michael Sánchez sued for defamation. Bezos's legal team countersued and essentially won. The court found that Bezos's statements about Sánchez were substantially true (or at least not provably false, which is the legal standard for public figures). Therefore, no defamation occurred.

Now Bezos is using the judgment to demand attorney fees.

Why is this significant? It establishes a legal precedent that can be used against others making similar claims. It also sends a message: if you sue Bezos for defamation and lose, you'll pay his legal fees. That's a powerful deterrent.

Comparative Wealth: Scott vs. Bezos

Let's create a clear comparison table:

| Metric | Mackenzie Scott | Jeff Bezos |

|---|---|---|

| Current Net Worth | ~$32.5 billion | ~$230.2 billion |

| Wealth Source | Divorce settlement, Amazon shares | Amazon ownership (9%), Blue Origin, investments |

| Annual Donations (2025) | $7.1 billion | Minimal (through personal charitable foundation) |

| Total Lifetime Giving | $26.3 billion (since 2019) | ~$1-2 billion (estimated) |

| Primary Focus | Poverty reduction, climate, education, racial equity | Space exploration (Blue Origin), media (Washington Post) |

| Wealth Distribution Strategy | Accelerated giving during lifetime | Traditional wealth accumulation and family legacy |

| Legal Battles (Recent) | None significant | Michael Sánchez defamation case ($190K) |

| Public Perception | Philanthropist, visionary giver | Entrepreneur, space enthusiast, controversial figure |

The contrast is stark. Scott's wealth is approximately 14% of Bezos's wealth, but her annual charitable giving is approximately 10,000 times larger than his in terms of percentage of net worth.

Scott gives away roughly 22% of her remaining wealth annually (using the

The Psychology of Wealth: Why Scott and Bezos Chose Different Paths

This is where it gets philosophical.

Mackenzie Scott was a novelist. Novelists spend their careers understanding human motivation, consequence, and moral complexity. She spent years thinking about what it means to be complicit, responsible, and culpable in a system.

Jeff Bezos was an engineer, then a entrepreneur. Engineers build things. Entrepreneurs scale what works. Neither is inherently better or worse, but they create different psychological frameworks for thinking about wealth.

When Scott inherited her enormous fortune, she asked: What am I obligated to do with this? What kind of person do I want to be?

When Bezos maintained his enormous fortune, he asked: How do I protect what I've built? How do I expand my influence?

These aren't moral judgments (despite how they might sound). They're just different questions. Different frameworks. Different answers.

Psychologically, Scott's approach requires a particular kind of comfort with loss. Giving away $26 billion means accepting that you have less money than you did. That's psychologically difficult for humans, even when it's by choice.

Bezos's approach requires a different comfort: the comfort of perpetual accumulation, perpetual defense, perpetual protection.

Neither is inherently more virtuous. But they produce radically different outcomes for society.

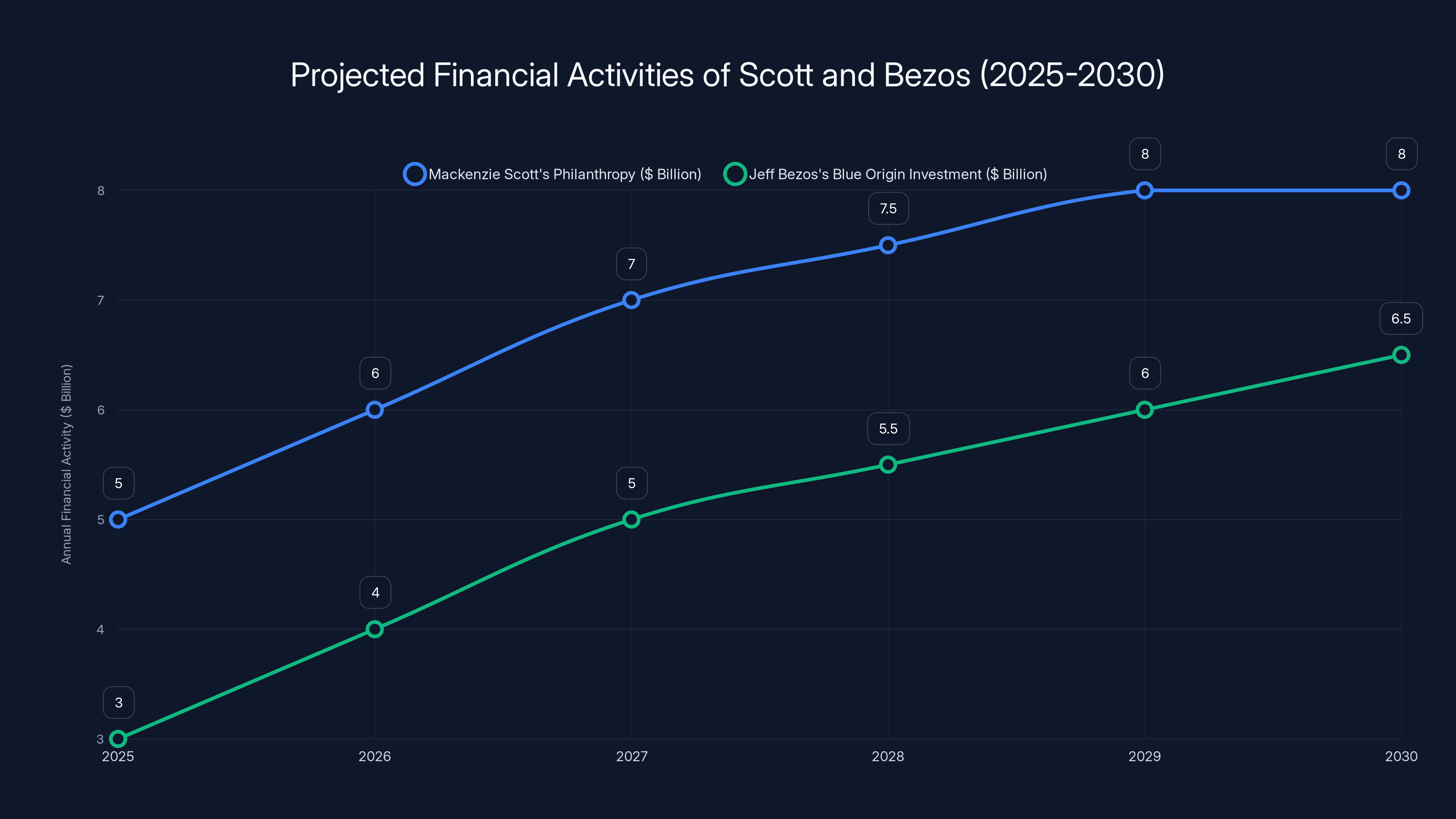

Estimated data shows Mackenzie Scott's philanthropy growing steadily, while Jeff Bezos's investment in Blue Origin increases gradually. Estimated data.

The Broader Context: Billionaire Philanthropy in 2025

Scott's giving doesn't exist in a vacuum. It's happening alongside a broader reckoning with billionaire wealth in America.

The wealth inequality crisis is well-documented. The top 1% now owns more wealth than the middle 60% combined. This concentration of wealth is historically unusual and politically destabilizing.

Billionaire philanthropy is one response to this crisis. It says: the wealthy will voluntarily redistribute their fortunes for the common good.

Scott's approach is the most aggressive version of this response. She's not just establishing a foundation that will exist long after her death. She's giving away money now, to organizations that can deploy it immediately, to address crises that can't wait for generational wealth transfers.

This is different from the traditional billionaire philanthropy model (Gates, Buffett, etc.), which emphasizes long-term foundations and generational wealth transfer.

Scott's approach has implications:

Positive:

- Money reaches communities that need it now, not in 50 years

- Organizations can plan long-term with reliable funding

- The model is transparent and measurable

- It shifts cultural expectations about billionaire responsibility

Challenging:

- It doesn't address systemic wealth inequality (she still has $32.5 billion)

- It requires the billionaire to be motivated by altruism (not everyone is)

- It can't scale to address all problems even if every billionaire followed suit

- It potentially reinforces the idea that individual billionaires should decide how wealth is distributed (rather than democratic institutions)

The Mechanics of Scott's Grant Process

How does someone actually give away $7 billion in a year? It sounds simple in theory. In practice, it requires significant infrastructure.

Scott has assembled teams of advisors, researchers, and program officers who identify organizations aligned with her strategic goals. These teams:

- Research organizations working on her priority areas

- Evaluate their impact, leadership, and financial health

- Network with other funders and community leaders

- Conduct due diligence on grant recipients

- Monitor outcomes after grants are awarded

- Publicize all grants, maintaining radical transparency

This process is similar to how foundation giving typically works, but Scott's scale and speed are unusual. Most foundations take years to award large grants. Scott's process moves faster, identifying and funding organizations within months rather than years.

The grant sizes also vary dramatically. Scott has made gifts ranging from tens of millions to individual grants exceeding $100 million. Each grant is tailored to the organization's capacity and the strategic opportunity.

For example, when Scott gave major grants to HBCUs in 2025, some schools received

These transformative gifts enable schools to:

- Fund new academic programs and research centers

- Increase faculty salaries to attract top talent

- Upgrade facilities and technology infrastructure

- Create endowments for student support and scholarships

- Address deferred maintenance and capital projects

What This Means for Nonprofit Leadership

Scott's giving has transformed the nonprofit sector's expectations around funding and support.

Non-profit leaders are now asking different questions: Should we aim for sustainable revenue streams or transformative grants? Should we focus on incremental improvement or systems change? Should we plan for 5-year cycles or accept that major funding might appear unexpectedly?

The traditional nonprofit model emphasized diversified funding from many sources, long-term sustainability planning, and realistic projections. This model was developed because major funding was unpredictable.

Scott's model introduces the possibility of unpredictable major funding. A well-run organization in one of her priority areas might suddenly receive a $20-50 million grant. This changes the equation.

Nonprofit leaders who've received Scott grants report:

- Dramatically expanded program capacity: They could hire staff, open new locations, and scale operations faster than planned

- Ability to take risks: With major funding secured, organizations could experiment with new approaches

- Staff retention improvements: Increased funding allowed higher salaries and better working conditions

- Strategic flexibility: Organizations could pivot toward highest-impact work rather than following funding availability

But it also created challenges:

- Pressure to scale quickly: How do you hire hundreds of staff and deploy millions in funding while maintaining organizational culture?

- Sustainability questions: What happens when major grants end? Can an organization return to previous funding levels?

- Attention from other donors: Receiving a Scott grant can attract media attention and expectation, which isn't always positive

Jeff Bezos's net worth is over 7 times that of Mackenzie Scott, yet while Bezos disputes

The Tax Implications and Policy Questions

Here's a complex issue that doesn't get enough attention: tax implications of Scott's giving.

When Scott donates money to 501(c)(3) organizations, she receives significant tax deductions. In 2025, her

This is perfectly legal. Charitable deductions are a core feature of the US tax code. But it raises policy questions:

Is it appropriate that a billionaire can essentially direct how billions of dollars flow through the nonprofit sector, while receiving tax benefits for doing so?

Should there be limits on charitable deductions for ultra-wealthy individuals?

Does this system give billionaires too much control over social priorities?

These are legitimate policy questions without easy answers. Scott herself has acknowledged the tension. In her statements about giving, she's emphasized that her choices reflect her particular values, but that doesn't mean those values should dominate society's priorities.

"My opinions are just one voice," she's essentially said. But one voice with $7 billion in annual giving power is inevitably louder than most.

Bezos's Blue Origin Investment vs. Scott's Charitable Giving

Let's compare how Bezos and Scott deploy capital.

Bezos has invested roughly $10 billion into Blue Origin over the past 15 years. This is his primary legacy project aside from Amazon. Blue Origin is developing rocket technology, spaceship capabilities, and the infrastructure for commercial space travel and space-based manufacturing.

The goal is significant: reduce the cost of space access so dramatically that space becomes economically viable for satellite deployment, manufacturing, tourism, and eventually, human settlement.

Is this valuable? Absolutely. The technology that Blue Origin is developing could have profound implications for energy, manufacturing, and human civilization's long-term future.

But compare the timescale and certainty:

Blue Origin:

- 15-year investment: $10 billion

- Uncertain outcomes: Space industry is developing; success is not guaranteed

- Timeline: Decades before major societal impact

- Control: Bezos maintains ownership and strategic direction

Scott's Giving:

- 6-year giving: $26.3 billion

- Measurable outcomes: Supporting existing organizations addressing current crises

- Timeline: Impact begins immediately

- Control: Shared among thousands of organizations and communities

Neither approach is inherently better. But they reflect different visions of the future.

Bezos is investing in humanity's long-term future (space). Scott is investing in humanity's present (poverty, climate, education, inequality).

Both matter. But the time horizons are radically different.

The Media Narrative: How These Stories Get Told

Here's something worth noting: Scott's giving barely makes mainstream news. When $7.1 billion in donations are announced, it often receives a few paragraphs in business sections. Celebrity gossip gets more coverage.

Meanwhile, Bezos's legal battle with Michael Sánchez receives far more scrutiny because it involves celebrity drama, allegations of affairs, and litigation.

This reflects our media ecosystem's biases. We're drawn to conflict, scandal, and personal drama more than we're drawn to systemic giving and poverty reduction.

Scott has acknowledged this. She's spoken about how the media coverage of philanthropy often focuses on the billionaire doing the giving rather than the communities receiving support. She's tried to shift that narrative by emphasizing the work of the nonprofit organizations themselves.

But structural media incentives work against her. A story about a nonprofit solving homelessness is less engaging than a story about billionaire drama.

Future Projections: What's Next for Scott and Bezos?

Based on current trajectories, here are realistic projections:

Mackenzie Scott (2025-2030):

- Will likely continue giving away $4-8 billion annually

- May shift toward climate solutions and long-term environmental funding

- Could potentially distribute the majority of her wealth by age 65-70

- Might establish permanent funding mechanisms to continue giving after her lifetime

- Will likely become a defining philanthropic figure of the 21st century

Jeff Bezos (2025-2030):

- Will likely continue investing in Blue Origin (billions annually)

- May face additional litigation from various parties (his wealth attracts legal challenges)

- Could potentially shift toward higher-profile philanthropy (especially if facing political pressure)

- Will likely remain the world's wealthiest person, barring significant market changes

- May face increased scrutiny over wealth inequality and social responsibility

These projections are based on historical patterns and stated intentions, but wealth dynamics can change rapidly based on stock market performance, unexpected litigation, or personal circumstances.

The Broader Lesson: Wealth, Responsibility, and Choice

What does the Scott-Bezos contrast tell us?

Ultimately, it reveals that wealth itself is morally neutral. It's what you do with it that matters.

Two people with similar origins (both married to early Amazon, both benefiting from its explosive growth) made dramatically different choices about their wealth.

One person chose accelerated redistribution based on the belief that billionaires have too much concentrated power and that funds can generate more value deployed immediately than accumulated.

The other person chose wealth preservation and strategic investment based on long-term vision and personal control.

Neither choice is objectively "correct." But they have profoundly different implications for society.

If all billionaires adopted Scott's model, wealth inequality would decrease significantly. But this assumes that voluntary wealth redistribution is sustainable without policy changes.

If all billionaires adopted Bezos's model, wealth concentration would accelerate. But this assumes that innovation and long-term investment only happen when individuals maintain control.

The real question isn't which billionaire is right. It's what policy framework should govern how extreme wealth functions in a democratic society.

Should billionaires exist? Should they be taxed differently? Should their philanthropy be mandated or voluntary? Should they have power over nonprofit priorities?

These are political and philosophical questions that societies need to answer through democratic processes, not through billionaire choices.

Scott's giving doesn't solve these questions. But it does model what one billionaire chose to do when facing the reality of extreme wealth.

FAQ

How much money has Mackenzie Scott donated in total?

Mackenzie Scott has donated approximately

Where does Mackenzie Scott's money come from?

Scott's wealth originated from her marriage to Jeff Bezos and the appreciation of Amazon stock during their time together. When they divorced in 2019, Scott received approximately 25% of their joint holdings, which translated to roughly **

What organizations does Mackenzie Scott fund?

Scott focuses her giving on organizations addressing poverty, inequality, education, climate change, and community development. In 2025, she emphasized donations to historically Black colleges and universities (HBCUs), food security organizations, climate solutions nonprofits, gender equity programs, and community development financial institutions. She publishes a detailed list of all grant recipients on her official website, making her giving entirely transparent. Each organization that receives funding varies widely in size, from small local nonprofits to major universities and national organizations.

Why did Mackenzie Scott and Jeff Bezos divorce?

Mackenzie Scott and Jeff Bezos divorced in 2019 after 25 years of marriage. While the specific reasons for their separation were not publicly detailed, Scott later married journalist Lauren Sánchez in 2022. The divorce settlement was one of the most consequential financial transactions in history, with Scott receiving approximately $35.6 billion in Amazon stock and other assets. After the divorce, Scott maintained her Amazon shares while Bezos retained the majority stake, and their paths diverged dramatically in terms of wealth management strategies.

What is Jeff Bezos's net worth compared to Mackenzie Scott's?

Jeff Bezos's net worth is approximately

Why is Bezos in a legal battle with Lauren Sánchez's brother?

Jeff Bezos and Lauren Sánchez are in a legal dispute with Michael Sánchez over defamation claims related to the alleged leak of private communications about Bezos and Sánchez's affair. Michael Sánchez originally sued for defamation after being implicated in the leak, but the Los Angeles County Superior Court ruled in Bezos's favor, finding that Bezos's statements were substantially true. As a result of the court ruling, Bezos's legal team has demanded that Sánchez pay approximately

How much is Mackenzie Scott giving away per year?

Mackenzie Scott's annual giving has varied significantly:

What is Mackenzie Scott's investment strategy?

Mackenzie Scott has indicated that she's moving more of her wealth into investments that align with her philanthropic values. Rather than simply maintaining traditional financial portfolios, she's directing capital toward impact investments—businesses and funds that generate both financial returns and measurable social or environmental benefits. This includes investments in community development financial institutions, renewable energy companies, and other entities aligned with poverty reduction, climate solutions, and equity goals. This integrated approach combines traditional charity with strategic capital deployment to influence broader market dynamics.

How does Mackenzie Scott's giving compare to other billionaire philanthropists?

Mackenzie Scott's giving rate (approximately 22% of net worth annually) is substantially higher than other major philanthropists. Bill Gates, for example, has committed to increasing his annual giving but started from a much lower baseline. Warren Buffett committed to give away 99% of his wealth eventually, but over a longer timeframe. Scott's approach is distinctive because she's actively giving away a large percentage of her wealth now, rather than planning for eventual distribution after death. This makes her one of the fastest-wealth-redistributing billionaires in history, measured by percentage of net worth deployed annually.

Conclusion: What This Reveals About Wealth in America

The story of Mackenzie Scott's $7.1 billion in donations and Jeff Bezos's legal battles over attorney fees tells us something crucial about America in 2025: we've entered an era where the choices wealthy individuals make about their money matter profoundly.

Scott's decision to accelerate wealth redistribution isn't just about compassion, though it might include that. It's also a philosophical statement about what happens when you recognize that you have far more money than you could ever spend, and that hoarding it creates social dysfunction.

Bezos's legal strategy isn't just about defending against defamation, though the court case was resolved in his favor. It's also about maintaining the structures of control and power that vast wealth provides. When you have unlimited resources, you can fight indefinitely. Eventually, your opponent runs out of money or will. You don't.

There's no moral equivalency between these choices. One person chose to give away billions. One chose to fight a legal battle that cost six figures. But morality isn't really the right framework here. Economics and power are.

Scott's giving is remarkable precisely because it's voluntary. American law doesn't require her to give away money. Nothing forces her hand. She chose to do this because she decided that's who she wants to be.

Bezos's litigation is equally voluntary. He could choose to forgive the legal fees, to settle the case, to move on. He chose not to. He chose to pursue maximum recovery because that's how he sees the world: as a series of wins and losses, and he prefers wins.

What's interesting is that neither person is uniquely motivated by the circumstances. Millions of other people, in their position, might make completely different choices. Mackenzie Scott could have decided to keep her wealth, build an empire, dominate industries. Jeff Bezos could have decided to give it all away, reshape society through philanthropy.

But they didn't.

So here we are. One former spouse redistributing at historic rates. One current couple litigating over whether the other party pays their legal bills.

It's a perfect metaphor for America at this moment: some people are choosing to give, others are choosing to fight, and the rest of us are trying to figure out what it all means.

![Mackenzie Scott's $7.1B Donation & Bezos Legal Battle [2025]](https://runable.blog/blog/mackenzie-scott-s-7-1b-donation-bezos-legal-battle-2025/image-1-1765657708914.jpg)